The implementation of new international taxation rules, such as taxation on giant global companies that offer cross-border services, is expected to lag behind the initial goal of next year.

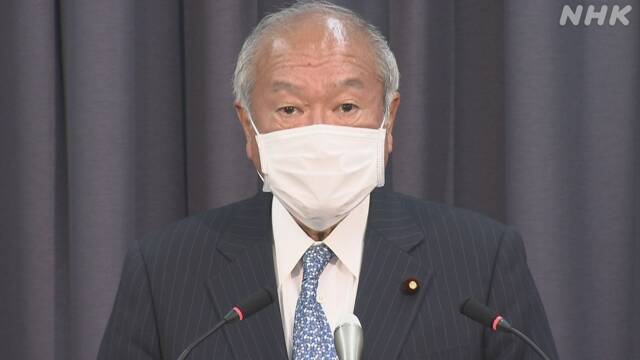

Regarding this, Minister of Finance Suzuki expressed his intention to continue working with each country to implement it as soon as possible.

More than 130 countries and regions, including the member countries of the OECD (Organization for Economic Co-operation and Development), announced in October last year that they would be able to tax huge global companies represented by "GAFA" according to their business models. After agreeing on the new international taxation rules that were included and signing the treaty during this time, we aimed to implement it from next year.

Regarding this, in the summary document released by Indonesia, the presidency, after the closing of the G20 = Finance Ministers and Central Bank Governors' Meeting of 20 major countries this month, each country was asked to sign a multilateral treaty by the first half of next year. The implementation of the new rule is expected to be delayed by about one year from the original schedule.

Regarding the prospect of delay in implementation, Minister of Finance Suzuki said at a press conference after the Cabinet meeting on the 19th, "Japan will continue to actively contribute to international discussions toward early implementation." He expressed his intention to continue to work with each country as Japan so that the new rules can be implemented as soon as possible.