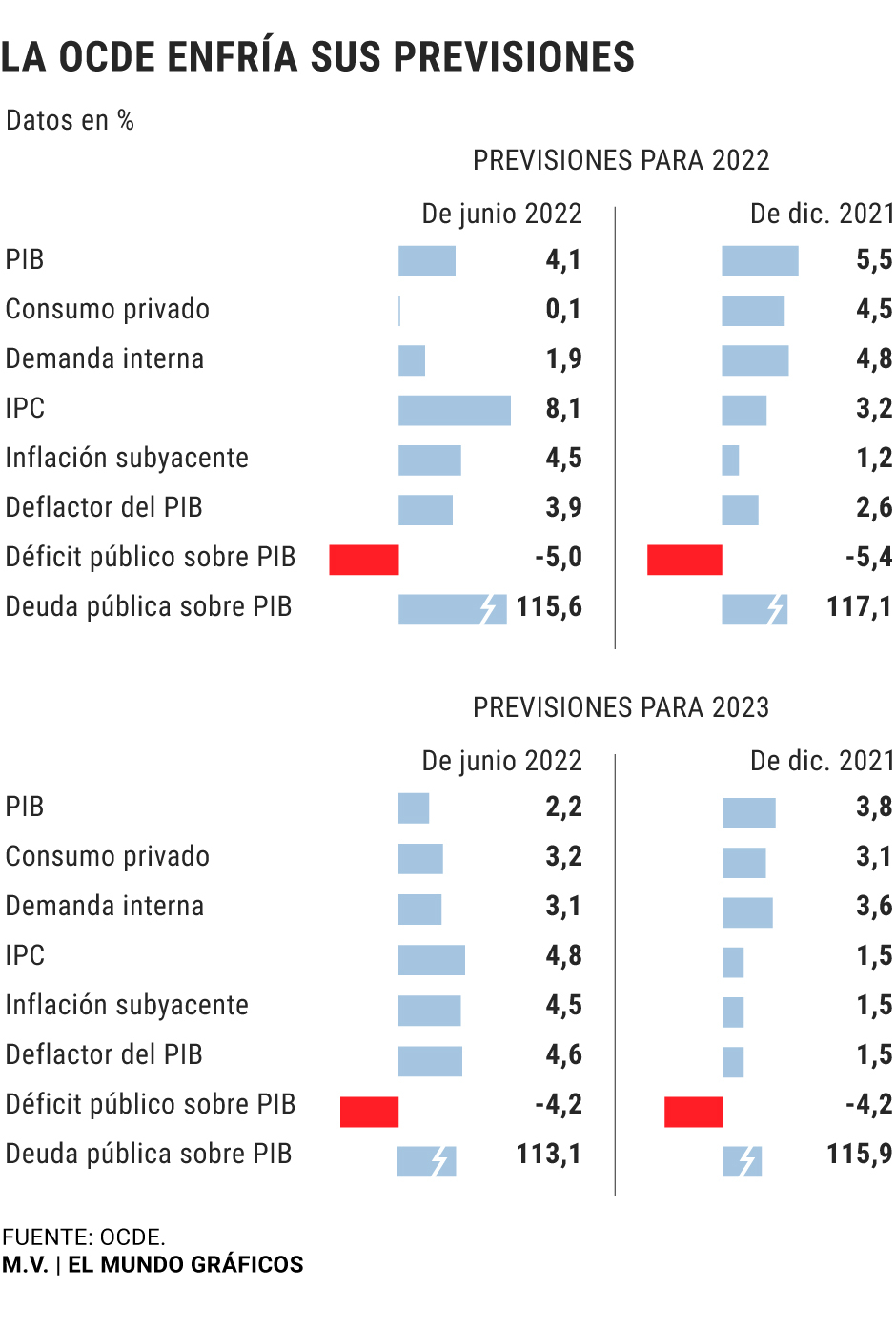

The OECD lowers its growth forecast for Spain by 1.4 points and raises its average inflation forecast by 5 points

Inflation in Spain was going to drop to around 2% in 2023,

which was going to place the country as one of the European Union states with the lowest price increases next year.

This was predicted by the Government, the European Commission, the IMF and the Bank of Spain, but that was

before the EU approved economic sanctions

against Russia.

Now, the

OECD

warns that

the CPI will grow an average of 4.9% next year

, triple what was forecast in December and the highest rise among the EU powers.

"

The war in Ukraine has dispelled hopes

that the

inflationary surge

experienced by much of the world economy in 2021 and early 2022

will abate rapidly

. The additional boost to food and energy prices and the worsening of problems of the supply chain imply that

consumer price

inflation

will peak later

and

at higher levels

than expected," warns the OECD in its latest economic projections report, published this Wednesday.

Prices will rise again in Spain by another 4.9%

next year, an increase that will be added to the one already registered this year -8.1% on average- and that will further impoverish families and make companies less competitive .

In other countries the increase in prices will be somewhat more moderate: in

France

they will rise by

4.5%

;

in

Germany

,

4.7%

;

in

Italy

,

3.8%

;

in

Portugal

,

4%

;

in

Greece

,

3.4%

, and on average in the

Eurozone

as a whole,

4.6%

.

The new OECD inflation forecast triples

what they had in December, when they expected inflation to rise by

1.5% next year in Spain,

and doubles what the rest of the organizations had presented for Spain: the

European Commission

forecast in May that inflation would drop to

1.8%

in 2023;

the

Bank of Spain

in its macroeconomic projections placed it at

2%

and the

IMF

had even placed it at

1.3%.

Other study services such as

Funcas

had projected an average price rise of

3.6%

for next year;

CaixaBank Research

was betting on

2.2%

;

the

Chamber of Commerce

pointed to

3%;

CEOE

, at

2.1%

;

and

Santander

, at

2.5%

.

All very far from the new OECD forecast.

This estimate also clashes head-on with the

official figures

presented by the Government in its 2022-2025 Stability Program, since while the Executive foresaw that the

GDP deflator

(an indicator used to measure the evolution of prices that takes into account all products of the economy and not only those of the consumer basket, such as the CPI)

would rise by 2%

in 2023, the

OECD

itself forecasts that the

deflator

will rise by

4.6%

next year.

For this year, the Government expected the deflator to rise by

4%

on average, a figure in which it coincides with the OECD, which puts it at

3.9%.

The problem of expectations

Inflation

is

a word that appears

860 times

in the 231-page document presented yesterday by this institution and it is its main concern, since it is precisely what will cause a

collapse in domestic demand and consumption

in many countries and a sharp slowdown in increase.

In

Spain

, private consumption will only grow one tenth this year, which has led the OECD to lower

GDP

growth to

4.1%

, compared to the 5.5% it was considering in December.

"

The global economy will weaken sharply.

We estimate global growth to be

3%

in 2022 - up from 4% we projected last December - and 2% in 2023.

Inflation projections now stand at almost 9%

in OECD countries in 2022,

double

than what we previously projected.

High inflation around the world is eroding real disposable income and household living standards, and in turn consumption.

The uncertainty deters business investment and threatens to curb supply for years to come.

At the same time, China's covid-zero policy continues to weigh on global prospects, dampening domestic growth and disrupting global supply chains."

Although they admit that inflation will help reduce the weight of the debt -and also of the public debt-, it also

erodes income, savings and purchasing power

, and can affect the profits of companies and the

ability to invest and create job.

“

Inflation

is a burden that

needs to be shared fairly

between people and businesses, between profits and wages. Governments also have a role to play by targeting support for the most vulnerable to offset rising food inflation. and energy", they claim.

The

OECD

has been the

first body

to forecast such high inflation for next year, which poses a risk in the face of agents'

expectations

, since if the idea that prices will rise sharply next year is consolidated that will condition the behavior of individuals and companies.

To avoid

second-round effects

, expectations are key, since if a

company

assumes that next year the price of its intermediate goods will rise again by an average of 5%, it will have

more incentives to increase final prices

than if it thinks that prices will moderate.

The same thing happens in the labor market: if an

employee

believes that next year prices will continue to rise, he will have

more reasons to ask for a salary increase.

The main reason is in the war and, more specifically, in the

sanctions

approved against Russia: "although alternative supplies can be found on world markets at higher prices and shortages are avoided, as assumed in the baseline projections

, The embargo is expected to push up inflation

and weaken growth, especially in

Europe

."

They further warn that "

upcoming

EU embargoes on

coal

and

seaborne oil imports

from Russia are likely to drive

global energy

prices higher over the next year, keeping

headline inflation higher for more time".

Conforms to The Trust Project criteria

Know more

Russia

Petroleum

GDP

Ukraine

IMF

European Comission

European Union