Graphic report Fever for buying a house or prelude to a new bubble: similarities and differences

Accessing the purchase of a home is not easy in Spain if you do not have, in general, 20% of the final price of the house.

But the difficulties do not end there, because once acquired, paying the mortgage

requires more and more effort

, especially in provinces such as the

Balearic Islands, Malaga or Madrid

, where households have to allocate much more than the recommended 35% of their disposable income to face to monthly installments.

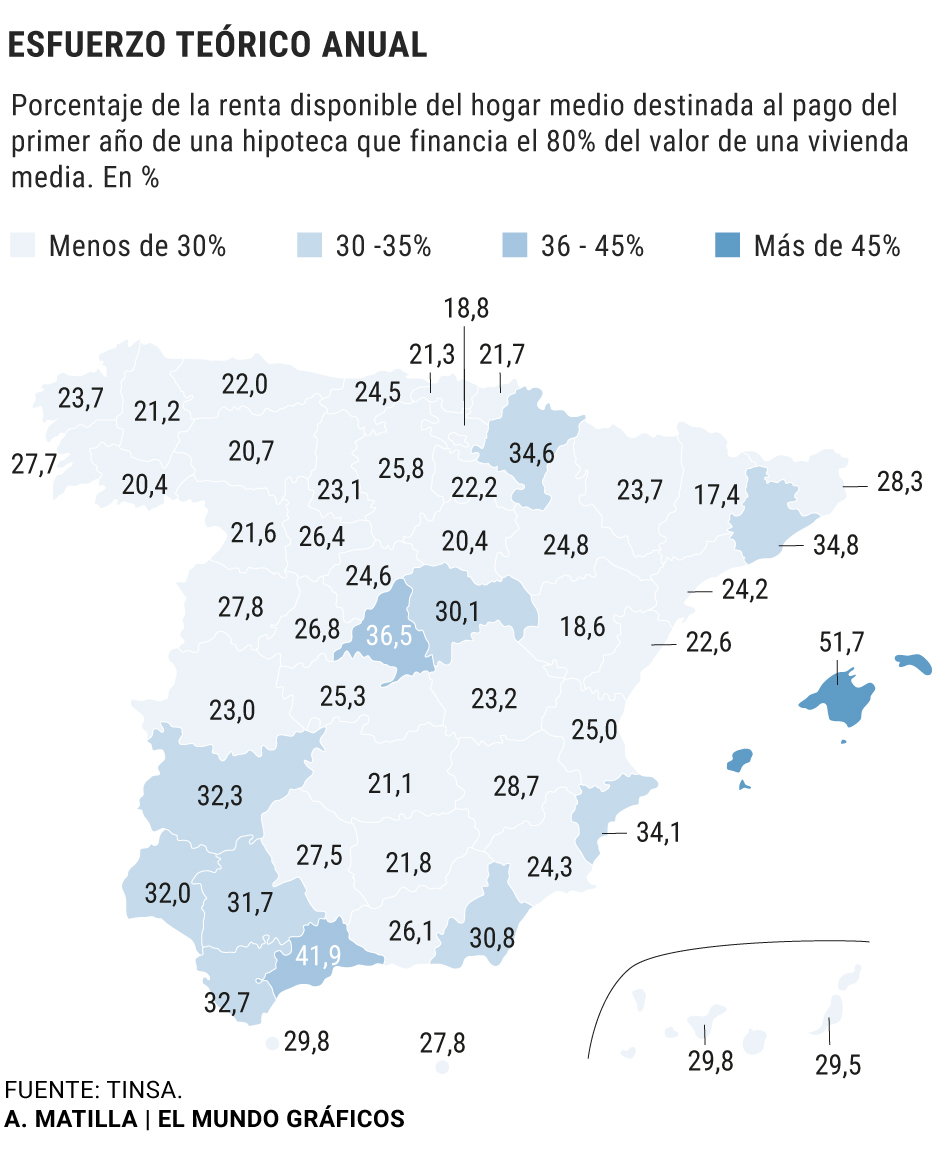

The effort in this context tries to measure how accessible it is for an average household to acquire a first home in the different areas of the national territory.

According to the analysis carried out by the appraiser

Tinsa , Spaniards allocated

an average of 30.7% of their disposable income

in the first quarter of the year

to the payment of the first annual installment of a mortgage that covers 80% of the value of an average home at current prices.

The recommended maximum limit is 35%, something that was widely exceeded in Spain in the real estate bubble prior to 2008. The effort indicator is one of the most closely watched when assessing whether a market is at risk of a bubble or no and, in fact, to properly speak of a bubble, the rate dedicated to paying the mortgage must remain continuously above the aforementioned 35%.

This is not currently the case at the national level -

30.7%-

, but it is in some cities and provinces, and the tension located in them can entail specific risks, while at the same time making it more difficult, if possible, for citizens to access a house owned.

"There are specific areas that reveal a tension closely linked to the dynamics of the local market, given that they are places with little space available and in which there is a sustained and consistent demand," explains

Cristina Arias

, director of the Tinsa Research Service.

This is the case of the province of the

Balearic Islands

, where the payment of a mortgage installment means for

families 51.7% of the average income

available in their home;

or

Malaga

, where it rises to 41.9%, or

Madrid

, where it stands at 36.5%.

In the Balearic Islands, the average mortgage payment calculated by Tinsa stands

at 909 euros per month

, ahead of the 812 euros paid in Madrid, the 749 in the province of Barcelona or the 706 euros per month in Malaga.

"In the Balearic Islands and Malaga there is an asymmetry between the income level of the local population and the foreign population that pushes prices up," says Arias about the pressure in both provinces.

"In these areas, the proportion of purchases by foreigners is one of the highest in Spain, and in both there are luxury segments that differ significantly from the typical multi-family home, with more adjusted prices, that residents usually demand. Thus, by a segmented analysis by type of dwelling,

the situation is not as critical as

initially suggested by the theoretical data on aggregate effort", he points out.

Among the six large provincial capitals,

Barcelona

(45.7% theoretical effort rate),

Madrid

(41.9%) and

Malaga

(41.9%) are the most stressed markets, with peaks of up to 62% effort theoretical in the Barcelona district of

Ciutat Vella

, or with 55.5% in the

Centro

district and 52.8% in

Arganzuela

, both in Madrid.

"In the case of the provinces of the Balearic Islands and Malaga, as well as in several districts of Madrid and Barcelona, there is a lot of dynamism and it is maintained continuously over time.

The competition for space

means that the demand that ends up acquiring the homes has a a profile that is far from the average household or, in the case of non-resident foreigners, from a profile that does not belong to the national labor market and whose income therefore does not appear in national statistics", Cristina Arias contextualizes.

Madrid and Barcelona

"As for the cities of Madrid and Barcelona, they are hubs of business activity where there is

a lot of competition for space

, both from companies and employees and from urban tourism. Once again, this drives prices up and in many cases there is an

expulsion of part of the local demand towards the periphery

, where prices are not so stressed", says the director of Studies at Tinsa.

In the capital, up to 18 districts exceed the level of

"reasonable accessibility"

, that is, the aforementioned 35%;

two -Chamartín and Barajas- brush against it and only one -Moncloa-Aravaca- is clearly below it.

Of all of them, a total of four are above the level that Tinsa calls

"critical accessibility",

that is, above 45%.

In

Barcelona,

the balance is even tighter.

Up to nine districts jump the barrier of "reasonable accessibility" and of these, seven, also exceed "critical accessibility";

only one,

Sarrià-Sant Gervasi,

is at levels below 35% of the recommended effort.

According to data from the National Institute of Statistics, the average mortgage in Spain stands at 137,921 euros.

Each month, the payment of the mortgage installment supposes an average disbursement of 592 euros, in an environment of low interest rates and stable average terms that could change in the coming months due to the uncontrollable increase in inflation.

Conforms to The Trust Project criteria

Know more

living place