ELSA MARTIN

@elsa_millan

Madrid

Updated Tuesday, March 15, 2022-14:38

Share on Facebook

Share on Twitter

send by email

See 1 comment

Taxes: Treasury enters 250 million more per month due to the rise in fuels

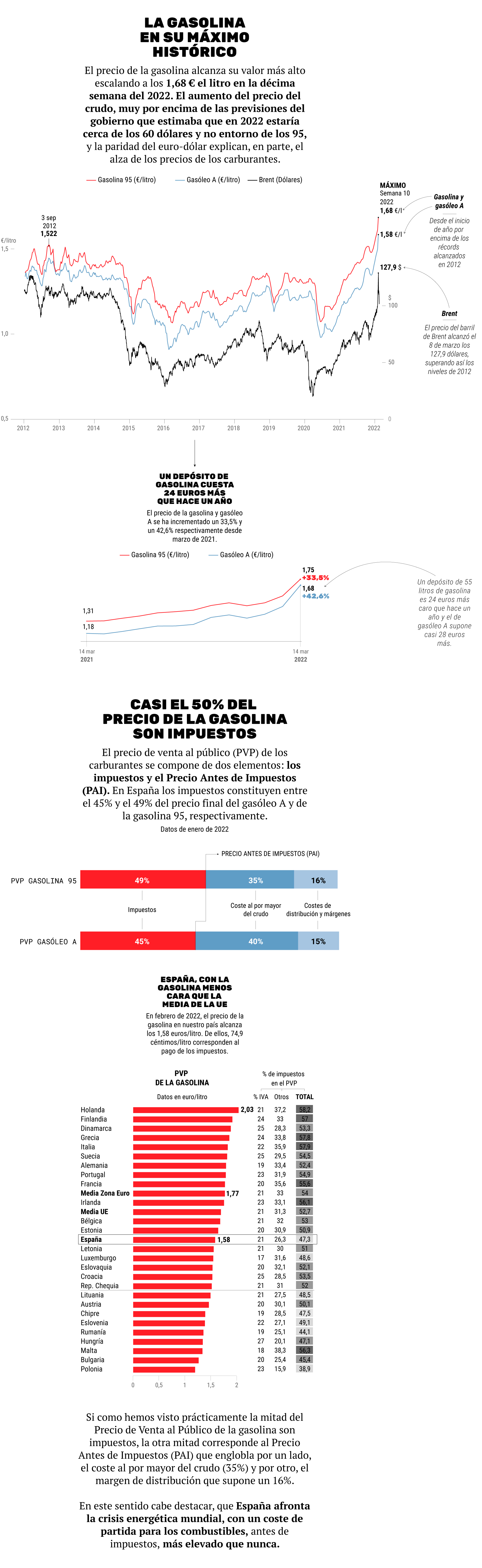

The price of gasoline in Spain reaches its historical maximum reaching 1.68 euros per liter,

in the tenth week of 2022.

Since the beginning of the year, the cost of this fuel has been increasing weekly and is far from the record reached in September 2012 when a liter cost €1,522.

For its part,

diesel

stood at

€1.58/l, also above the maximum of 2012.

All this occurred while the price of

a barrel of Brent,

a reference for setting the price of oil in Europe, reached its maximum touching 127.9 dollars a barrel on March 8.

To try to answer the question of how much the increase or decrease in the price of a barrel of Brent has an impact on the consumer's pocket, it should be noted that

the Retail Price (RRP)

of fuels

is determined

by different components;

On the one hand

, taxes,

which account for half the price

, and on the other, the Price Before Taxes (PAI)

, which includes the wholesale cost of crude oil and distribution costs and margins.

Of these components,

the international price of crude oil accounts for 35% of the Retail Price

, so the rise or fall of a barrel of Brent will affect the final price in that proportion.

In this aspect, the refineries carry out contracts for the acquisition of crude oil to process immediately or in the short-medium term.

In the first case, the price of Brent would have an automatic impact, but in the second case, the impact of the rise in Brent would not be so direct on the final price of fuels, since the refineries could have stockpiled the oil when the price of barrel was smaller.

On top of the international price of crude oil, there are

taxes

(VAT and special tax on hydrocarbons)

that account for practically 50% of the final price of filling a tank and the remaining 16% is marked by the gross distribution margin,

which by the way , in 2020 it marked its historical maximum, making the product even more expensive.

In this way, according to the AOP (Spanish Association of Petroleum Product Operators), if a government decides to raise or lower the taxes levied on gasoline or diesel A, the price of fuel could be directly more affected by this action than by tensions in international prices.

Source:

CNMC (National Markets and Competition Commission), AOP ((Spanish Association of Petroleum Product Operators), Investing, Ministry for Ecological Transition and the Demographic Challenge.

Infographic:

Elsa Martin

Art direction:

María González Manteca.

Conforms to The Trust Project criteria

Know more

Petroleum

Europe

Gasoline

Diesel

EnergyThe EU is now open to untying the price of gas from electricity and will approve measures in two weeks

MotorAutomatic petrol stations: lower costs and savings of up to 20 euros per deposit

Podcast What measures can the Government take to lower gasoline or electricity?

See links of interest

Ukraine Russia Direct

Last News

cheap gas stations

Default Russia

When does the 2021 Income start?

Income 2021

Work calendar 2022

Economy Podcast

Lazio - Venice

Majorca - Real Madrid

Crystal Palace-Manchester City

Indian Wells: Rafael Nadal - Daniel Evans, live