My bank returned it to electronic payment and smart wallets

Checks traded in the market to the lowest level in 6 years

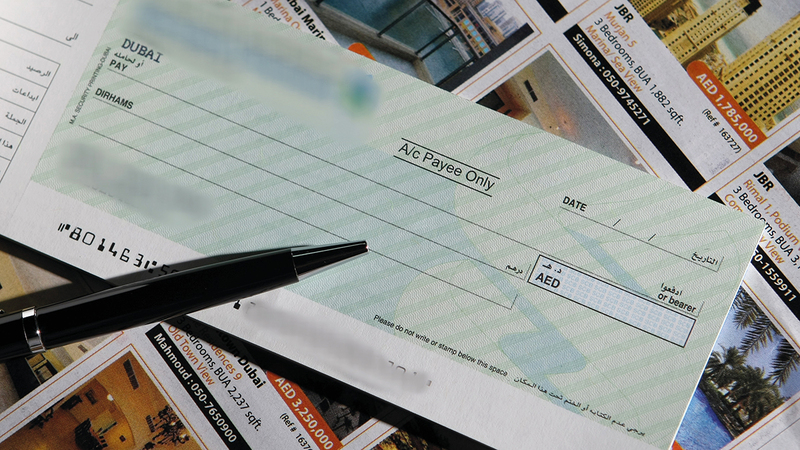

The total cleared checks amounted to 19.5 million checks at the end of last November.

archival

Ahmed Youssef: “The use of checks has decreased a lot at the present time, and it is now limited to future transactions.”

picture

The number of checks that were handled last year recorded its lowest level in six years, specifically since 2016, according to an analysis of the latest data issued by the Central Bank conducted by "Emirates Today".

The data indicated that the total checks cleared through the Central Bank system, using their optical images, amounted to 19.5 million checks at the end of last November, compared to 21.2 million checks at the end of 2020, compared to 25.8 million checks at the end of 2019, and 26.9 million checks at the end of 2018. 28.8 million checks at the end of 2017, and 29.9 million checks at the end of 2016.

The banking expert, Ahmed Youssef, said: “The Central Bank, in cooperation with banks operating in the country, provided the possibility of electronic transfer of funds, as well as rapid payment through applications and smart wallets,” noting that “the use of checks has decreased a lot at the present time, and is now limited to future transactions. As for any other payments or obligations, they are paid by direct transfer or through the direct debit system, which has been introduced by the Central Bank since 2013 and has become a lot less need for resorting to writing checks, where the deduction is made directly from the customer’s account.

Youssef indicated that "the technical infrastructure of the UAE is constantly evolving, and with it the payment methods, as the UAE leads many relevant indicators, and there will be greater qualitative shifts in this direction, thanks to the (blockchain) applications that the UAE seeks to benefit from in various aspects of life. ».

He added, "The Corona pandemic has accelerated the pace of reliance on digital payment, and a large percentage of companies have developed their systems and are using it to pay their obligations faster than writing checks and carrying cash," noting that "the UAE now has three digital banks, and this number is expected to increase, It focuses on supporting small and medium-sized companies, which means that reliance on checks and paper transactions will continue to decline in the coming years.”

The UAE ranks first regionally in the volume of digital payments, thanks to the high rates of automation of financial and banking operations and remittances in the country, as well as the widespread use of platforms and payment cards in the government sector, and in commercial and consumer operations by citizens, residents and visitors in the country.

According to a study issued by "MasterCard", about three out of every four consumers in the UAE (73%) shop online more than they did before the pandemic, as consumer goods, health care, clothing and banking services achieved the highest rise in online activity.

Follow our latest local and sports news and the latest political and economic developments via Google news