IPO企业大面积中止审核的情形再度出现。

1月26日晚间,深交所创业板48家IPO企业集体中止审核,这48家企业或是其保荐人为中德证券,或是其会计师为信永中和会计师事务所(特殊普通合伙),或是其律师为北京市金杜律师事务所。

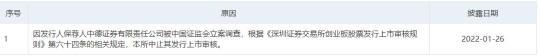

公开披露显示:上述发行人因保荐人中德证券/发行人律师北京市金杜律师事务所/发行人申报会计师信永中和会计师事务所(特殊普通合伙)被证监会立案调查,根据深交所创业板股票发行上市审核规则64条规定,深交所中止其发行上市审核。

除了创业板外,同日,科创板12家IPO企业中止审核,原因也是聘请的相关证券服务机构被证监会立案调查,根据科创板股票发行上市审核规则64条第一款第二项规定,上交所中止其发行上市审核程序。

而这三家中介机构的交集点,就是2015年-2016年曾共同服务过乐视网。

乐视冲击波

2021年4月20日,证监会披露《行政处罚决定书》,对乐视网2007年至2016年连续十年财务造假,致使2010年报送和披露的IPO申报材料、2010年至2016年年报存在虚假记载的行为,未依法披露关联交易、对外担保的行为,以及对贾跃亭、贾某芳履行承诺的披露存在虚假记载、重大遗漏的行为;对2016年乐视网非公开发行欺诈发行行为,作出相应处罚。其中,对乐视网合计罚款2.4亿元,对贾跃亭合计罚款2.41亿元。

1月18日晚间,山西证券率先公告称,控股子公司中德证券收到证监会立案告知书,因在乐视网2016年非公开发行股票项目中,保荐业务涉嫌违法违规,根据《证券法》《行政处罚法》等法律法规,证监会决定对中德证券立案。

根据上述行政处罚决定,乐视网2016年非公开发行股票行为构成欺诈发行。在此期间,除了中德证券外,北京市金杜律师事务所担任此次非公开发行的专项法律顾问,而信永中和则担任2015年-2016年年报的审计机构。

Earlier, the market also reported that King & Wood Mallesons and ShineWing had filed an investigation. Until yesterday, the IPO companies suspended the review on a large scale, and it was confirmed.

Can wait, can be replaced

According to the "Shenzhen Stock Exchange GEM Share Issuance and Listing Review Rules", there are 7 major situations in the IPO review process. Issuers, sponsors and securities service agencies should promptly inform the exchange that the exchange will suspend the issuance and listing review, including: The issuer's sponsor or signature sponsor representative, securities service institution or relevant signatories are suspected of violating laws and regulations due to initial public offering and listing, issuance of securities by listed companies, mergers and acquisitions, or other businesses that are suspected of violating laws and regulations and have a significant impact on the market, The case is under investigation by the China Securities Regulatory Commission, or is being investigated by the judicial authorities, and the case has not yet been closed.

At the same time, the newly declared IPO projects of the above-mentioned intermediaries will also be affected to a certain extent.

Taking the ChiNext Board as an example, according to the “Shenzhen Stock Exchange ChiNext Board Share Issuance and Listing Review Rules”, sponsors, securities service institutions and their related personnel are identified as unsuitable candidates due to securities violations, business activities are restricted, and business activities are restricted within a certain period of time. , will be subject to relevant measures such as not accepting the relevant documents issued by it; or due to suspected violations of laws and regulations in IPO and listing, securities issuance by listed companies, mergers and acquisitions, or suspected violations of laws and regulations in other businesses that have a significant impact on the market. If the case is filed for investigation and investigation, and the case has not been concluded, the Exchange will not accept the issuer's issuance and listing application documents.

In addition to the Growth Enterprise Market and the Science and Technology Innovation Board, there are currently more than 30 IPO companies in the three intermediaries on the Shanghai Stock Exchange and Shenzhen Main Board, and 8 IPO companies from the three intermediaries in the Beijing Stock Exchange.

Since 2020, there have been two large-scale IPO suspensions in the whole market due to being involved in the investigation of intermediary service agencies. During the wave of suspensions, IPO companies may resume listing after the relevant intermediary agencies are investigated and the relevant circumstances are eliminated. audit; or directly replace the intermediary agency.