Social

Security

does not pay the bills with self-

employed workers

.

What he has received so far with his contributions is only enough to pay half of what he spends on public pensions for this group, one of the reasons why the Ministry is now working with the associations on a

reform of the system.

The Social Security budget data confirm the

hole

, which exceeds

10,000 million euros each year

. According to the budgets of this administration for the year 2022,

income from social contributions

of self-employed workers in the country will amount to

12,017 million euros

this year , but Social Security will have to assume

disbursements of 22,442 million euros

in the payment of benefits for this group.

The

resulting

deficit , of

10,425 million

, will be mitigated in part with

transfers from the State,

recurring each year and which in 2022 will

amount to 4,875 million euros,

with which

the final gap remains at 5,468 million.

The

gap between income and expenses

is much

higher

for the self-employed than for the

salaried

: the latter will report income via social contributions to Social Security for 114,306 million euros, according to calculations by the Ministry of José Luis Escrivá, while spending on pensions for retirees of the General Regime will be 135,598 million. If we add the 19,477 million that Social Security will receive from the State and the 734 million that it will enter for other concepts,

the deficit of this regime will be 1,081 million,

well below that of the self-employed.

This gap occurs mainly because

the majority of self-employed workers have chosen to contribute for the minimum contribution base

, which considerably reduces income and aggravates the difficulties of the system in paying the pensions of self-employed workers who are now retired.

To alleviate it and also ensure that today's self-employed have better protection the day they retire, the Ministry wants to

reform the quota system

to lower the contribution of the self-employed who have lower net income (less than 900 euros) and raise considerably the contribution of those who enter more than 1,300 euros per month.

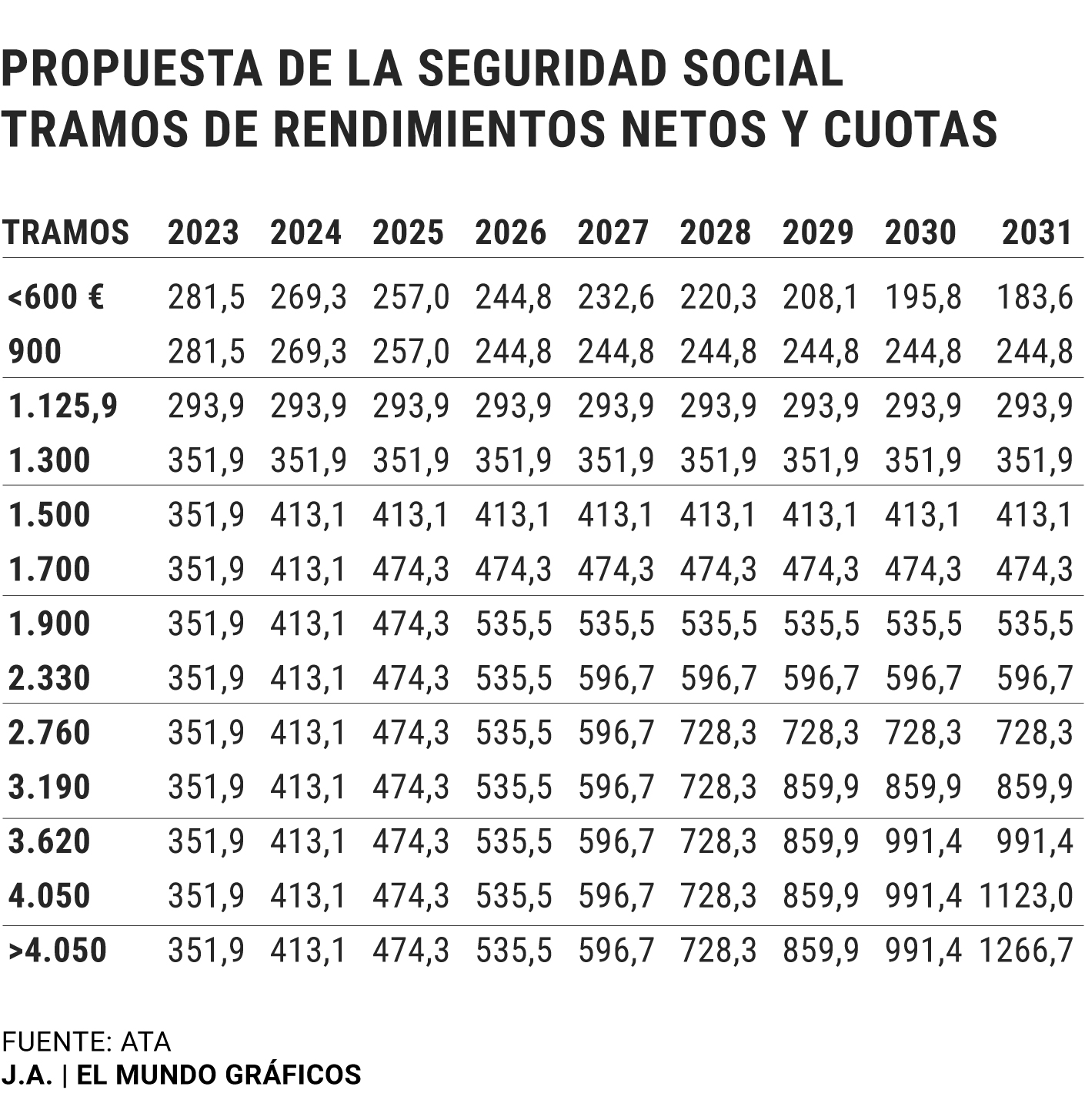

If the proposed reform, which delimits

13 different sections

, goes ahead and comes into force from 2023, it will report

additional annual income to Social Security of about 2,000 million euros

, as calculated by the Union of Professionals and Self-Employed Workers (

UPTA

, the second most representative association in the sector) for El Mundo.

Autonomous sections 2022

Minister Escrivá already announced when he presented his pension reform that this change in the RETA model would barely

contribute a few tenths of savings to Social Security

-specifically, two-, which

will not be enough

to close the hole of 10,000 million .

This large deficit is likely to increase even more in the coming years, as

the self-employed of the baby boomer generation retire

, hence Social Security needs extraordinary income from 2023.

Although a higher contribution from the self-employed will imply higher benefits in the future,

the impact on the accounts will be deferred

over time since the system is distributed based on intergenerational solidarity (with the contributions of today's self-employed, pensions are paid of today's self-employed retirees, not their pensions of tomorrow).

The proposal, in any case, is not definitive since it

is being debated with the main self-employed associations

(ATA, UPTA and UATAE), which have very different positions.

Some of the ideas that these associations have put on the table, such as that of including the workers assigned to

the artist's statute

in the self-employment regime , proposed by

UPTA

, would serve to fatten up Social Security income even more, since although Very low contributions are requested for them, around

80,000 people would be added to the group.

Conforms to The Trust Project criteria

Know more

Social Security

self-employed

economy

Jose Luis Escriva

Public deficit

Self-EmployedEscrivá's proposal confronts self-employed associations, which show their differences at the table

EmploymentThe private sector still has 100,000 fewer workers than before the crisis

Social Security The Government has only spent 1,730 million euros on the Minimum Income of the 3,000 budgeted for 2021

See links of interest

Last News

Work calendar 2022

Home THE WORLD today

Economy Podcast

How to do

Check Christmas Lottery 2021

Check Child's Lottery

Coronavirus

Celta de Vigo - Osasuna

Real Sociedad - Atletico Madrid

Barcelona - Vallecano Ray

Valencia CF - Seville