Recently, a big financial V wrote on the platform that a star fund manager has emptied the new energy vehicle market in 2021, resulting in performance far below expectations. The company plans to hire an additional fund manager to jointly manage it. Expressed a sigh and felt that the fund should look at long-term investment.

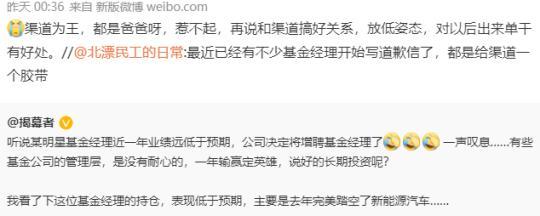

Another financial blogger then forwarded it and said that in order to explain to the channel, a fund manager has recently planned to write an apology letter.

Although no obvious announcement has been seen for the time being, this operation is not uncommon in the fund circle. Wu Chuanyan of Hongde Fund has experienced it, and some private equity people say that it is just to find someone to take the blame.

The ordeal of star fund managers 2021

In 2021, A-shares will "get new energy vehicles", Cui Chenlong of Qianhai Kaiyuan has completed the advanced advancement of tens of billions of fund managers and won the "double material" championship, "Mesozoic" such as Baoying Fund Chen Jinwei and Golden Eagle Fund Han Guangzhe Known for outstanding performance.

At the same time, the products of E Fund Zhang Kun’s products fell by nearly 30%; Xiao Nan’s products generally fell by 12%; Southern Fund Shi Bo’s new funds fell by 18% during the year; Invesco Great Wall Liu Yanchun’s products fell by 10% to 22%; Penghua Fund Wang Zonghe managed more than 10 products, with an average decline of 14%; most products of China Europe Fund Gelan fell 6%; Industrial Securities Global Xie Zhiyu and GF Fund Liu Gesong's funds rose slightly on average by 2.4% and 3.2%.

As of January 13, 2022, the products of these fund managers have not yet issued an announcement of additional employment, but this method is not uncommon in the circle.

On August 28, 2021, Hongde Zhuoyuan added a new fund manager, Yu Haocheng, to jointly manage the fund with Wu Chuanyan.

On August 30, Wu Chuanyan repeatedly asked the general manager for "why was the decision-making power closed for transactions", "Do you want to repeat the mistakes of Hongde Yutai", "Add a fund manager, do you need to discuss with the original fund manager?" and so on, and the response of Hongde Fund and Wu Chuanyan the next day confirmed the incident.

Choice shows that Wu Chuanyan is an investment veteran with more than 20 years of experience. The best return during his tenure is 201.9%. As of the end of the third quarter of 2021, the scale of products under management exceeds 30 billion yuan. In 2021, only one fund will rise slightly by 0.49%, and all the rest fell, with an average decline of 12%.

After this incident, Hongde Fund, as a representative of the "personal department" public offering, has also been questioned on its internal management. Some insiders said that the "personal department" label is like a double-edged sword. The company's decision-making power is centralized and fast, but there are also The lack of checks and balances and the reliance on core figures will put more emphasis on investment, research and channels. However, in this industry that requires patience, some "personal" company bosses do not see improvement in performance for half a year or a year, and their path may change in disguise.

Public offerings write letters, private placements prefer to apologize

"'Give an account to the channel' is essentially 'give an account to the investor'." A private equity fund researcher told reporters that whether it is a public offering or a private placement, this problem will always be faced. If you are a private placement, if you make a lot of profits for the company in the early stage, there is a problem. If you lose your annual performance, your boss may fire you directly, or to put it bluntly, find someone to take the blame.

A person from a public fund in South China told reporters that the company he works for will give the fund manager a three-year assessment dimension, but there will be a small summary every quarter. If the logic is self-consistent, even if the market is not here at the time, the company allows the fund manager to insist own style.

Regarding explanations to channels and investors, since 2021, the "Letter to Investors" has become the main way for public and private funds to "massage" investors' hearts, including Invesco Great Wall, Ping An Fund, Cinda Australia Bank , China Europe Fund, etc., and Hui'an Fund directly apologized.

This operation is still in use to this day. In the beginning of 2022, there will be a continuous decline, and the net value of funds will generally retreat sharply. The above-mentioned Weibo mentioned that "many fund managers have begun to write letters of apology recently". The reporter found on the Internet, Since the beginning of this year, Ping An Fund, ICBC Credit Suisse and Quam Fund have publicly released "Letters to Investors" with similar content.

Some investors bluntly said that "whoever invented the fault will apologize if the performance fails for a period of time." Fund companies should first manage products with due diligence, not just to collect management fees. Let investors and fund managers communicate more effectively, understand the investment logic of fund managers, and give fund managers more time and tolerance.

Different from the mildness of the "Letter to Investors" of the public offering, there have been a number of private equity public apologies in recent days.

For example, Yu Haifeng, the founder of tens of billions of private equity Shenzhi Assets, said through his personal account that products that have been in operation for one year are generally so-so.

But relative to its (public offering) peers, it was the worst since public performance in 2012.

To all investors and channel friends, I would like to say from the bottom of my heart: Ashamed!

The executives of the 100 billion quantified private equity giant Magic Fang apologized to the investors through WeChat Moments, saying that they have not run well in recent months. Don't do it, don't slap your face even if you do it.

Drift vs Persevere

In fact, A shares have obvious industry rotation characteristics, and the market style keeps switching between different industries.

The industry that made the most money this year may also lose the most next year.

At this time, fund managers are likely to give up the investment areas they are good at in pursuit of short-term performance, and pursue market hot spots, resulting in a drift of fund style.

It is not difficult to find that many fund managers who are stepping on new energy in 2021 are industry veterans, managing a scale of 10 billion or 100 billion. Although the drawdown is large, from the perspective of long-term heavy holdings, they stick to their investment philosophy. Do not drift.

A public fundraiser reminded that if the fund often drifts to different fields, it will be very risky, because fund managers who can continue to grasp the theme of industry rotation are very rare in the market. If the fund performance is caused by style drift Large fluctuations, you need to consider switching to those fund managers who have a stable style and can stick to their "circle of competence".

In 2021, public funds will flock to the new energy track, and CATL is only one step away from replacing Kweichow Moutai as the "first brother". For the whole year, Kweichow Moutai will only increase by 3.57%, and CATL will increase by 67.55%.

The extreme market has attracted the attention of regulators, and in mid-September, the regulatory authorities paid special attention to some fund products whose styles deviate, and asked to focus on whether the positions were in line with the fund contract.

Relevant fund managers are also adjusting their positions in fund products.

In the second quarterly report of 2021 before the regulatory oral guidance, ICBC Cultural and Sports Industry Stocks A and C held a total of 2.5456 million shares in Ningde Times, holding a stock market value of 1.361 billion yuan; China-Europe Internet Pioneer Mixed A and C held a total of 955,700 shares, The stock market value of holdings is 511 million yuan; ICBC New Financial Stock A holds 570,000 shares of CATL, with a stock market value of 305 million yuan.

The same is true for other funds such as Baoying Internet Shanghai-Hong Kong-Shenzhen Mixed, Tianhong Internet Mixed, Southern Education Stock, Bosera Internet Theme Flexible Allocation Mixed.