The three key words of "safeguarding safety, preventing risks, and promoting openness" are "spoilers". The focus of foreign exchange management work next year

Our reporter Liu Qi

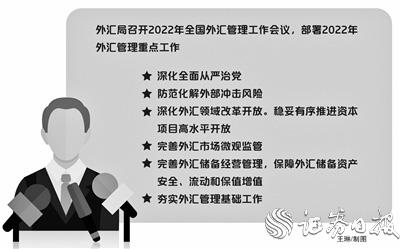

A few days ago, the State Administration of Foreign Exchange (hereinafter referred to as the "Foreign Exchange Administration") held the 2022 National Foreign Exchange Administration Work Conference.

The meeting pointed out that in 2021, many achievements have been made in foreign exchange management, the level of cross-border trade and investment liberalization and facilitation has continued to improve, the prevention and control of cross-border capital flow risks have achieved positive results, the level of foreign exchange reserve management has been steadily improved, and the party has been strictly governed. Advance in depth.

At the same time, the meeting delineated six key tasks for foreign exchange management in 2022, including deepening comprehensive and strict governance of the party, preventing and resolving external shock risks, deepening the reform and opening up of the foreign exchange field, improving the micro-regulation of the foreign exchange market, improving the management of foreign exchange reserves, and consolidating foreign exchange management basic work.

"Securities Daily" reporters combed and found that "safeguarding", "preventing risks" and "promoting openness" have become the focus of the meeting. These three key words also "spoiler" the focus of foreign exchange management next year.

Keep it safe:

Ensure the safety of foreign exchange reserve assets

When summarizing the foreign exchange management work in 2021, the meeting stated that the level of foreign exchange reserve management has been steadily improving, and the scale of foreign exchange reserves has stabilized at around US$3.2 trillion.

According to official reserve assets data released by the Foreign Exchange Administration, in 9 of the first 11 months of this year, the scale of foreign exchange reserves exceeded US$3.2 trillion.

The months with less than US$3.2 trillion were March and April, respectively, and the scale of foreign exchange reserves was US$3,170.029 billion and US$31,98.18 billion respectively.

From the perspective of recent months, the scale of foreign exchange reserves has continued to rise. From September to November, they were respectively US$320.626 billion, US$3217.614 billion, and US$32223.386 billion.

"Factors affecting foreign exchange reserves can be divided into two categories: one is transaction factors, including bank settlement and sale of foreign exchange, foreign capital allocation of RMB assets, etc.; the other is non-trading factors, including exchange rates, asset prices, etc." Deputy Director of CITIC Securities Research Institute Mingming said in an interview with a reporter from the Securities Daily that the fundamental reason for my country's foreign exchange reserves to remain stable this year is that foreign trade remains prosperous and the capital market continues to flow in foreign capital.

On the one hand, the high trade surplus brought about by the strong performance of foreign trade has led to the inflow of foreign exchange funds; on the other hand, the attractiveness of RMB assets continues to increase, and the net inflow of foreign capital in the equity bond market will help increase the scale of foreign reserves.

From the perspective of non-trading factors, the U.S. dollar index is volatile this year. Foreign exchange reserves are denominated in U.S. dollars, and the amount of non- U.S. currencies converted into U.S. dollars will decrease. Under the combined effect of asset price changes and other factors, my country’s foreign exchange reserves have remained stable this year. From an absolute level, it has expanded compared to 2020.

The meeting made it clear that next year "improve the management of foreign exchange reserves. Ensure the safety, flow, and value preservation and appreciation of foreign exchange reserve assets."

Looking forward to next year, Wang Youxin, a senior researcher at the Bank of China Research Institute, predicts that the scale of foreign exchange reserves will remain stable in 2022, and positive factors from trade surplus and securities investment will continue to play a supporting role.

At the same time, he told the "Securities Daily" reporter that as the Fed’s monetary policy normalization process accelerates, the scale of cross-border capital inflows may decrease, and the U.S. dollar index is likely to continue to appreciate. After non-U.S. currencies are converted into U.S. dollars, they will face valuation losses. U.S. stock prices It may fall, and the yield of major currency treasury bonds will rise, which will have a certain impact on the investment income of foreign exchange reserves.

Mingming also believes that the size of our foreign reserves may continue to maintain a relatively stable trend next year.

In the future, the new crown pneumonia epidemic will still be the biggest uncertainty affecting the economic recovery process of various economies around the world, and my country's "dynamic zeroing" policy will help the domestic epidemic to be controlled as a whole, and foreign trade is expected to maintain resilience.

With the accelerated implementation of wide credit, it will promote the continued positive trend of the macro economy next year, and the general trend of foreign capital inflows will remain unchanged.

However, the growth rate of current account and financial account inflows may slow down.

From the perspective of exchange rates, the dollar index is likely to maintain a strong trend in the first half of next year, and maintain a shock pattern in the later period.

Risk prevention:

Optimize foreign exchange services for SMEs

The meeting held that since this year, the prevention and control of cross-border capital flow risks have achieved positive results.

These include strengthening macro-prudential management and anticipation management, and guiding companies to use exchange rate hedging tools more widely.

In the management and development of the foreign exchange market, meeting the real economy's hedging needs is a very important task.

According to data previously released by Wang Chunying, deputy director and spokesperson of the State Administration of Foreign Exchange, from January to September this year, the transaction volume of foreign exchange derivatives such as corporate forwards and options was close to 900 billion U.S. dollars, an increase of 80% year-on-year, compared with the same period of foreign exchange settlement and sales. The growth rate was 56 percentage points higher, and the hedging ratio reached 22.1%, an increase of 7.9 percentage points year-on-year, showing a significant increase in corporate risk aversion awareness and risk-neutral business philosophy.

For next year’s deployment, the meeting specifically emphasized “focusing on small and medium-sized import and export enterprises to optimize foreign exchange services and guide enterprises to better manage exchange rate risks”.

On December 13, when the party group of the SAFE conveyed the study and implementation of the spirit of the Central Economic Work Conference, it was proposed to "guide market entities to establish the concept of'exchange risk neutrality' and promote the wider use of exchange rate hedging tools" as the focus of next year. One of his jobs.

Regarding the key optimization of foreign exchange services for small and medium-sized import and export enterprises proposed by the meeting, he clearly believes that since mid-September this year, in the context of the strengthening of the US dollar index, the RMB has also appreciated strongly, which to a certain extent has brought benefits to domestic export enterprises, especially small and medium-sized enterprises. pressure.

The pressure comes from the weakened export competitive advantage on the one hand, and the exchange loss caused by the appreciation of the renminbi on the other.

In comparison, the foreign exchange losses suffered by large foreign trade companies are relatively low, while the exchange losses suffered by small and medium-sized enterprises are relatively large.

The main reason is that many small and medium-sized enterprises have not yet established an effective mechanism to hedge foreign exchange risks, so they need to focus on optimization.

"SMEs are an important carrier of export trade. Due to their small scale, limited capital, small profit margins, high substitutability of produced products, and lack of pricing power, they are more affected by exchange rate fluctuations." Wang Youxin believes that SMEs may consider adopting hedging. The method of maintaining value, or agreeing on an exchange rate compensation mechanism when the contract is signed, requiring additional compensation or repricing when the exchange rate fluctuates beyond a certain range.

In addition, RMB pricing can be adopted to fundamentally reduce the impact of exchange rate fluctuations on corporate product pricing and financial costs.

Promote opening up:

There are three major starting points for capital account opening

In recent years, the steady and orderly promotion of capital account opening has always been the focus of the foreign exchange administration.

The meeting made it clear that this will also be one of the key tasks for next year.

At the same time, the meeting proposed to "expand the pilot project of the integrated domestic and foreign currency fund pool of multinational companies, promote the cross-border investment pilot of private equity investment funds, and promote the reform of foreign debt facilitation", which further pointed out the direction for related work.

In March of this year, the central bank and the foreign exchange bureau jointly announced that they decided to launch the first batch of pilot projects for the integrated domestic and foreign currency fund pool business of multinational companies in Shenzhen and Beijing to further facilitate the coordinated use of cross-border funds of multinational companies and corporate groups.

The main contents include unifying domestic and foreign currency policies, implementing two-way macro-prudential management, further facilitating the transfer and use of funds, realizing willingness to purchase foreign exchange within a certain limit, and strengthening supervision during and after the event.

In the opinion of analysts, the pilot project of integrated domestic and foreign currency fund pools for multinational companies is conducive to improving the flexibility and convenience of cross-border capital flows for multinational companies.

Regarding the pilot cross-border investment of private equity investment funds, in May 2020, the Central Bank, Foreign Exchange Bureau and other four agencies jointly issued the "Opinions on Financial Support for the Construction of the Guangdong-Hong Kong-Macao Greater Bay Area" clearly stated that Hong Kong and Macao institutional investors will be allowed to pass qualified overseas Limited partners (QFLP) participate in the investment of private equity investment funds and venture capital enterprises (funds) in the Guangdong-Hong Kong-Macao Greater Bay Area, and orderly promote the pilot projects of qualified domestic limited partners (QDLP) and qualified domestic investment enterprises (QDIE) to support private equity in the Mainland Overseas investment by equity investment funds.

The facilitation of foreign debt aims to encourage innovation and support the healthy development of small, medium and micro high-tech enterprises.

In 2018, the State Administration of Foreign Exchange launched a pilot foreign debt facilitation experiment in the Zhongguancun National Independent Innovation Demonstration Zone in Beijing, allowing small, medium and micro high-tech enterprises that meet certain conditions to independently borrow foreign debt within a certain amount.

This pilot policy satisfies the overseas financing needs of some small, medium and micro high-tech enterprises in Zhongguancun and reduces their financial costs.

In March 2020, in order to further facilitate small, medium and micro high-tech enterprises to make full use of the two domestic and overseas markets and two resources, the State Administration of Foreign Exchange decided to expand the scope of the above-mentioned foreign debt facilitation pilot program to Shanghai (a pilot free trade zone) and Hubei (free trade). Pilot area and Wuhan East Lake New Technology Development Zone), Guangdong and Shenzhen (Guangdong-Hong Kong-Macao Greater Bay Area) and other provinces and cities.

At the same time, further improve the level of foreign debt facilitation in Haidian Park, Zhongguancun Science City, Beijing.

Wang Youxin said that the three aspects put forward at the meeting will be an important starting point for the next step to promote high-level opening of capital projects.

It is expected that more related facilitation measures will be launched next year, which will help companies optimize asset and liability allocation, deepen and expand global investment opportunities, and grasp investment and financing opportunities under changes in domestic and foreign exchange rates, interest rates, and financial asset prices.

(Securities Daily)