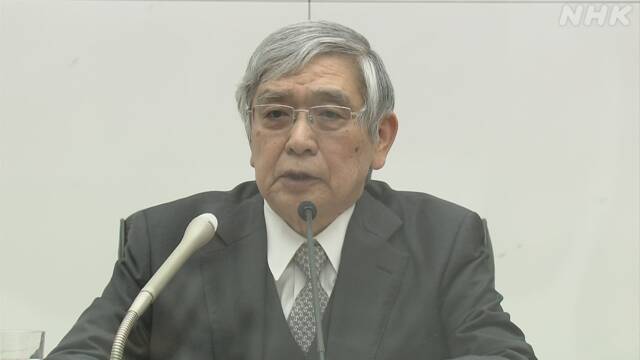

At this meeting, the Bank of Japan's Governor Kuroda explained why he decided to reduce the funding support measures for the new corona for large companies while extending it for small and medium-sized enterprises. , Some small and medium-sized enterprises such as interpersonal services have been delayed in improving their cash flow. Based on this situation, they decided to extend it from the viewpoint of taking all possible measures. Recently, it is uncertain that a new mutant strain called Omicron strain will occur. The high-quality situation continues, and launching an extension at the earliest possible time within the year will lead to a sense of security for SMEs and the financial institutions that support them. "

Regarding the fact that the central banks of Europe and the United States are moving toward a break from the unusual monetary policy that has been promoted by the corona, "Inflation is progressing in Europe and the United States, and monetary tightening and monetary easing measures are being normalized. In the case of Japan, the rise in prices is only about 0%, and there is certainly a difference in policy stance. "

On top of that, Governor Kuroda said, "But it is not a situation where it will have a big negative effect on the Japanese economy through the deterioration of the terms of trade." The depreciation of the yen has a positive effect on the Japanese economy. I showed the recognition that I am doing it.

He also emphasized the stance of persistently continuing the necessary monetary easing, saying, "It is desirable that both wages and prices converge at a rate of increase of 2%, not just that prices should rise."