for failing to achieve adequate compliance with anti-money laundering

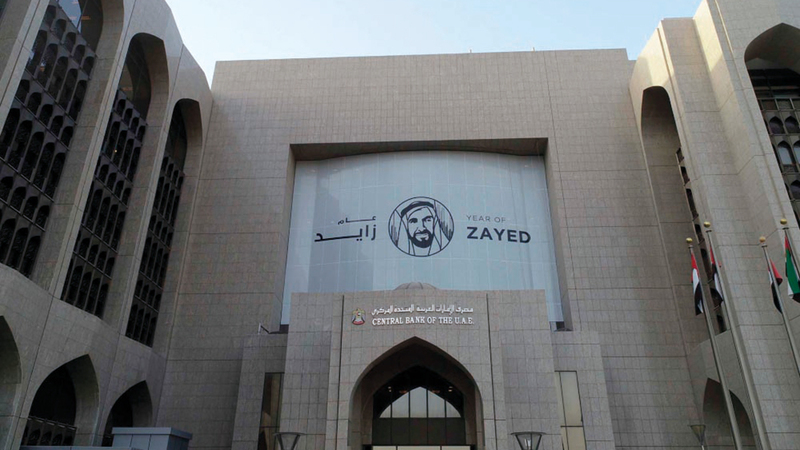

The Central Bank imposes supervisory measures and financial penalties on a bank in the country

The Central Bank imposed a financial penalty on the bank of 19.5 million dirhams.

archival

The Central Bank imposed administrative procedures, followed by a financial penalty, on a bank operating in the country, pursuant to the provisions of Article (14) of Federal Decree-Law No. (20) of 2018 regarding countering money laundering, combating terrorist financing and financing illegal organizations, and the relevant articles and decisions issued by the Council Ministers and the Board of Directors of the Central Bank.

In a statement yesterday, the Central Bank stated that it had taken a two-step approach in the process of enforcing administrative measures and financial punishment, as it imposed on the fourth of August 2021, supervisory measures on the bank, obligating it to appoint a consultant to take urgent necessary measures to address and correct deficiencies in the approved framework. To comply with the bank’s anti-money laundering and sanctions requirements, indicating that the supervisory procedures are still ongoing, and it will continue to coordinate with the bank to complete the process of addressing and correcting the mentioned deficiencies.

The Central Bank added that on the fourth of last November, it imposed a financial penalty of 19 million and 500 thousand dirhams, due to the bank’s failure to achieve appropriate levels of compliance with the frameworks for combating money laundering and penalties for a long period of time, indicating that the concerned bank has the right to file an appeal against the sanctions. imposed financial.

The Central Bank pointed out that all banks operating in the UAE are obligated to achieve appropriate levels of compliance with standards for combating money laundering and combating the financing of terrorism, indicating that they have been given sufficient time to address any deficiencies.

Therefore, in the event that the deficiencies are not corrected, then financial penalties will be imposed by the Central Bank, and it will continue to work with all financial institutions licensed in the state to achieve and maintain high levels of compliance with the requirements to combat money laundering and combat the financing of terrorism, and it will continue to impose more. from administrative and/or financial penalties by law, in the event of non-compliance.

Follow our latest local and sports news and the latest political and economic developments via Google news