Mutual funds are about to end a record year as a result of a perfect storm for the sector that has resulted in an additional

23,691 million euros

in net subscriptions through November.

The increase in

savings

accumulated during the pandemic, uncertainty about the economic recovery and the unstoppable increase in inflation, which

reduces purchasing power

and cancels the returns of other options, have encouraged the transfer of money from Spanish investors to this type of vehicle that little by little gain ground among their preferences.

This is clear from the November balance published by

Inverco

, the sector's employer's association, which includes a new historical maximum of the accumulated assets in funds with a total volume of

assets of 315,236 million euros

.

That is, 3,000 million euros more than in October (+ 1%) and

40,457 million above the end of 2020

(14.7% growth in the year).

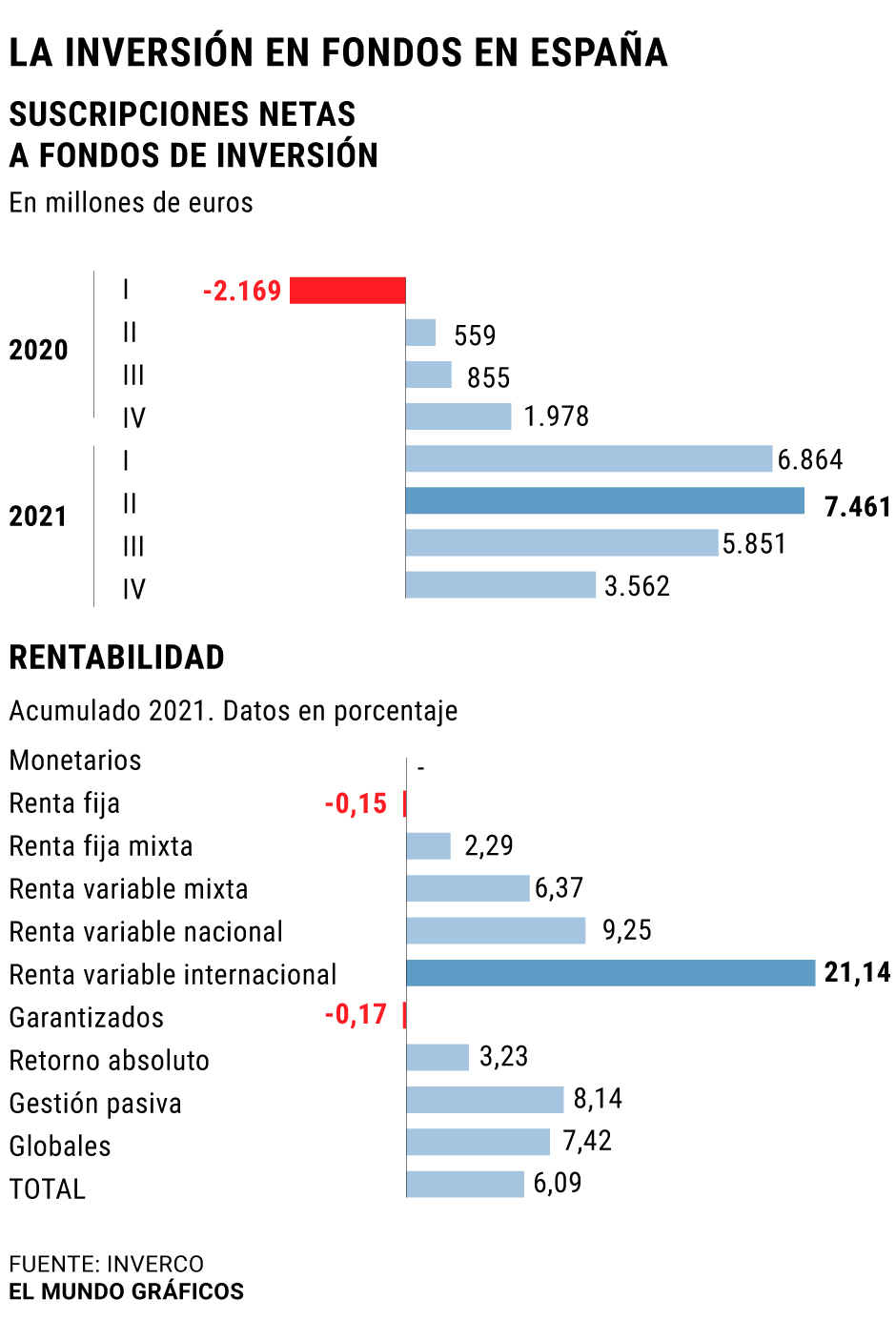

Of those more than 40,000 million, 23,691 million correspond to new inflows and the rest is the result of the performance of the markets and the revaluation of shares and other assets. "For yet another month, the preference of the national saver for this collective investment instrument has generated positive flows towards investment funds in an environment, especially in the last days of the month, of some uncertainty regarding the appearance of the new variant of the virus ", point from the organization.

The profitability accumulated by the funds registered in Spain are one of its main attractions compared to other investment options. On average, until November, they have yielded 6.09%, although equity funds are well above that percentage due to the good performance of the stock markets during most of the year. Specifically, international equity funds have left a return of 21.14% between January and November; those of national variable income, 9.25%, and those of mixed variable income, 6.37%. "Only the longer duration fixed income categories register negative returns," they point out from Inverco. In this case, -0.15% in fixed income funds and -0.17% in guaranteed funds.

The interest of Spaniards in investment funds has skyrocketed as a result of the coronavirus pandemic, in a trend parallel to the increase in savings that occurred during the months of confinement. "40% of Spaniards save through funds, which sets a record and places them as the third investment option, behind deposits (86%) and pension plans (54%)", as as stated in the latest Barometer of Savings from the Inverco Observatory, recently published. The report also includes that 44% of families increased their savings levels since confinement.

According to their conclusions, the profile of the fund saver in Spain corresponds to a man over 50 years old, with a moderate investment profile (56%), who invests thinking in the long term (more than 3 years) and has his investment divided into two or three funds from the same manager.

Regarding the motivations for betting on this type of vehicle, 36% recognize that they choose them to face unforeseen events;

26% for your capital to grow, without a specific purpose, and 25% to supplement your public retirement.

What you value most about them is safety, even ahead of profitability.

77% of investors in Funds plan to maintain or increase their savings in this product and 11% to hire new vehicles.

More than half (54%) hire in the office, 19% do so with their financial advisor and 15% through the web.

According to the criteria of The Trust Project

Know more

economy

savings and consumption

Savings and Consumption Mercadona no longer supports discount coupons in its supermarkets

Savings and Consumption The profitability of Spanish deposits falls by 98% in the last decade

Savings and Consumption Real estate agency? Online?

or traditional: which is more convenient?

See links of interest

Last News

2022 business calendar

Home THE WORLD today

Holidays 2021

Podcast Economia

How to do

Zalgiris Kaunas - Bitci Baskonia

Real Madrid - Maccabi Fox Tel Aviv