ALEJANDRA OLCESE

@AlejandraOlcese

ELSA MARTÍN

@elsa_millan

Updated Tuesday, November 302021-02: 00

Share on Facebook

Share on Twitter

Send by email

Comment

The

excessive rise in prices

(in November they have grown by 5.6%, a record since 1992) is a

negative

phenomenon

for the pockets of families

, which to date have reduced about 9,000 million euros of power purchasing; but it is

positive

from the point of view of

public

collection

, since the income of the Tax Agency so far this year exceeds by 8,300 million those obtained in the first ten months of 2019, the last year before the pandemic.

This is so because the rise in prices fattens the monetary bases and

feeds the collection

; but the public sector also suffers the consequences of rampant inflation on the

spending

side

. Specifically, the rise in prices will force the

revaluation of pensions by 2.5% in 2022

, which represents an increase in spending of more than 3,500 million euros, and to pay a compensatory 'pay' to pensioners for the deviation of 2021 , which, according to calculations by Minister José Luis Escrivá, will require a disbursement of more than 2,000 million additional. In total, more than 5,500 million additional euros for the CPI.

The

salaries of public employees

will not rise in 2022 according to the inflation average this year, but the Government did approve in the General State Budget project an

increase of 2%

precisely to protect civil servants from the loss of purchasing power.

This will add another

600 million

to spending next year, compared to 2021.

Both increases seek to

shield pensioners and officials

from the

decline in purchasing power

that families are suffering in Spain due to the rise in prices and which, according to Funcas,

exceeds 9,000 million euros this year.

Faced with this loss, the

collection of the Tax Agency

has been boosted by price increases and at the end of October was

4.5% higher

than in the first ten months of 2019. Inflation in recent months has contributed to this difference widening, because in September it was 3.1%. This means that

the Executive has 8,300 million more

than then, despite the fact that activity or production (GDP) remains below the pre-pandemic level and will not recover until 2023, according to the European Commission.

"Apart from the recovery in activity that is being witnessed in recent months (in the third quarter, total sales of large companies and corporate SMEs grew, in real terms, by 6%),

the increase in collection is also fueled by due to price increases

", admits the Tax Agency in its latest collection report, published this Monday.

Strike to the renters and relief to those who have debts

This means that households not only have to assume

higher prices in the supermarket

, for example, but also

pay more in VAT

as this is an indirect tax.

The

rental

will be another of the vital areas in which they will face an increase in costs, since most of the review clauses are in accordance with the IPC.

As an example, the average rental price in

Madrid

city stands at 14.8 euros per square meter in October, according to Idealista, which means that a rise with the average CPI (2.5%) would raise it to 15.17 euros.

A 90-meter home

would go from 1,332 euros to 1,365 euros, 33 euros more every month,

396 euros more a year because of inflation.

In

Soria

, where the average price per square meter is 6.7 euros, a 2.5% rise would make a 90-square-meter apartment more expensive by 15 euros per month, up to 618 euros.

A year, the increase will mean

180 euros more for rent.

On the other hand,

companies and households that are in debt

will benefit from the rise in prices

, since inflation eases the burden of debt.

This is so because if you owe 10 euros and prices go up, when you return those 10 euros they will no longer have the same purchasing power that they had when you contracted your debt.

And vice versa.

At the end of the second quarter (latest data available), the

consolidated debt

(loans and debt) of households and companies amounted to

1.67 trillion euros (144.2% of GDP),

according to the latest data available from the

Bank of Spain

.

For all the indebted (including the public sector), the rise in prices is beneficial from this point of view.

However, inflation is negative for those who have their money paralyzed in a bank account or deposit, since

the rise in prices erodes savings

: as time passes and prices rise, each time we will be able to buy less with that capital.

Unions ask for pay rises

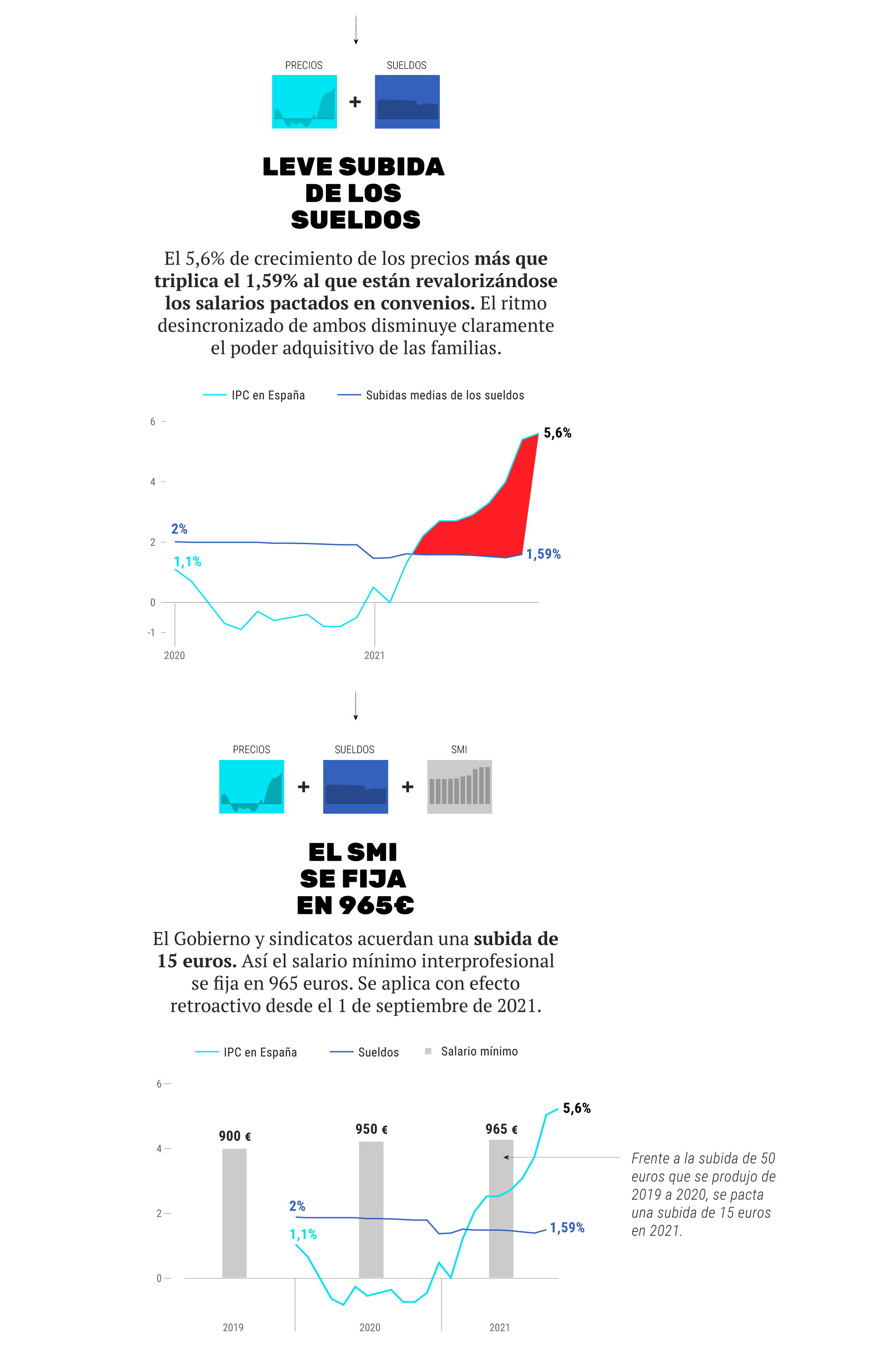

As every time a skyrocketing inflation figure is known, the

unions are demanding salary increases

in the private sector to prevent workers from suffering a loss of purchasing power.

"UGT considers that the advance CPI data corresponding to November follow the line of the loss of purchasing power of wages, something that has a negative impact on the consumption capacity of families, weakening the foundations that sustain the economic reactivation and the creation of of employment. These data, with a price index of 5.6% (two tenths more than in October), imply a

continuous worsening of the quality of life of the working class

, especially those in a vulnerable situation " , they lamented this Monday.

Therefore, they ask that the

salaries negotiated by agreement

pick up this rise - to date they have

risen on average by 1.55%

- and that the Government now work on a new increase in the

Minimum Interprofessional Salary

(SMI) for 2022, since the increase of the 1.6% approved for this year with retroactive effect from September is "very insufficient".

The Second Vice President and Minister of Labor,

Yolanda Díaz

, also said this Monday that it is necessary to "

talk about decent and decent wages

" beyond the minimum wage and not only in Spain but throughout the European Union, despite warnings from different institutions (such as the European Central Bank or the Bank of Spain) that ask that wages not rise in line with inflation to

avoid second-round effects.

Spain leads the Index of Misery in Europe

The rise in prices in recent months and the persistence of the unemployment rate have placed Spain as a leader in Europe in

the Misery Index

devised by the American economist

Arthur Okun,

which measures the economic suffering suffered by society as a result of the lack or fall of income due to unemployment and an increasingly high cost of living.

This index, which is prepared by adding the

unemployment rate

and the

inflation rate

, places

Spain

in the

first place in Europe

, with 20.2 points (unemployment rate of 14.6% and CPI of 5.6%), followed by Greece, Lithuania, Estonia, Latvia, Italy and Sweden, according to the latest data published by the OECD.

All these countries have a Misery Index

higher than the average

for the European Union, which stands at 11.5 points.

On the opposite side of the table are

the Netherlands

(6.52 points: 3.1% unemployment rate and 3.4% inflation), Slovenia (3.9% unemployment and 3% inflation), Denmark ( 4.6% unemployment and price increases of 2.9%) and Portugal (unemployment of 6.4% and inflation of 1.8%).

According to the criteria of The Trust Project

Know more

economy

GDP

UGT

State's general budgets

Taxes

HBPR

MacroeconomicsBrussels cold water jug: growth forecast for Spain sinks 1.6 points this year

The PNV threatens the business of 15,000 winegrowers from the Rioja appellation: "They want to break a successful model"

Pension reform Escrivá raises the rise in contributions to 0.6% to collect 21,000 million and does not convince either employers or unions

See links of interest

Last News

2022 business calendar

Home THE WORLD TODAY

Holidays 2021

Podcast Economia

How to do

Spain - Georgia, live

Osasuna - Elche

Eibar - Girona