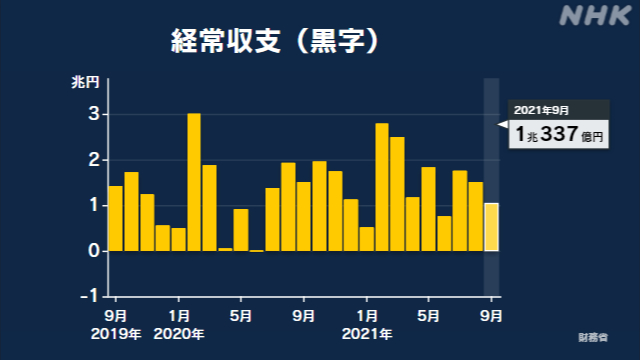

The current account balance in September, which shows how much Japan earned through trade and investment with foreign countries, was in the black at 1,033.7 billion yen.

However, as the value of imports increased significantly due to the rise in crude oil prices and the "trade balance" became a deficit, the amount of surplus fell below the same month last year for the second consecutive month.

According to the balance of payments statistics released by the Ministry of Finance, Japan's current account surplus in September was 1,033.7 billion yen, but the surplus amount was 467.6 billion yen from the same month last year, or 31.1%. It has decreased and has fallen below the same month last year for the second straight month.

This is because while the import value increased significantly due to the rise in crude oil prices, the export of automobiles decreased due to the difficulty in procuring parts due to the spread of infection in Southeast Asia, and the "trade balance", which is the export minus imports, was 229.9 billion. The main reason was that the yen was in the red.

In addition, the “primary income balance”, which includes dividends such as securities investment and interest received by Japanese companies from overseas subsidiaries, increased to a surplus of 1,753.2 billion yen due to the rise in stock prices and other factors. I did.

In addition, the current account balance for the first half of this year from April to September, which was announced at the same time, was a surplus of 8.12 trillion yen.

In addition to an increase in exports due to the recovery of overseas economies, the “primary income balance” increased, and the surplus amount increased by 2,280.1 billion yen, or 39.8%, compared to the same period last year.