Taxation Treasury rules out including the Basque Country and Navarra in the tax harmonization that it wants to apply in Madrid

Taxes Treasury orders a second reform of Societies to collect up to 15,000 million more from companies

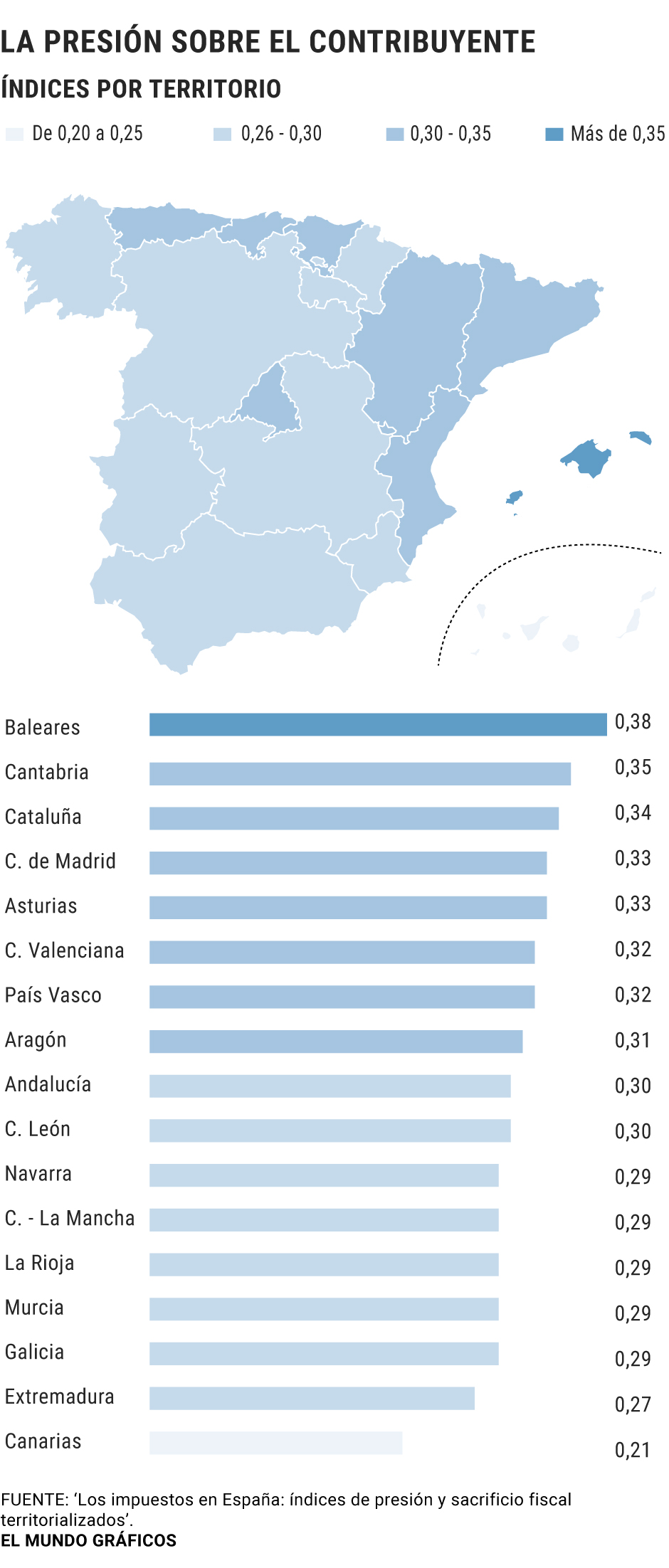

The Government, headed by the Minister of Finance María Jesús Montero, wants to carry out a fiscal harmonization to tackle, mainly, the

fiscal

dumping

that in its opinion incurs in the Community of Madrid. The region has even come to be classified as a kind of tax haven within Spain. But the reality is that the Madrid community is the fourth with a higher adjusted tax burden, only behind the Balearic Islands, Cantabria and Catalonia.

Next are

Asturias, Valencian Community or Aragon

, regions all governed by the PSOE, as well as the Basque Country. And among the communities with less pressure are the Canary Islands, Extremadura, Galicia and the Region of Murcia. In an intermediate zone, therefore, there are La Rioja, Castilla-La Mancha, Navarra or Castilla y León, as well as Andalusia.

All of this is evidenced by the document

Taxes in Spain: territorialized pressure and sacrifice indices

to which EL MUNDO has had access and which is prepared by

José Félix Sanz, Santiago Álvarez and Desiderio Romero

, three of Spain's leading experts in the tax field . So much so that Sanz is a professor at the Complutense University and between 2000 and 2004 he was deputy director general of Tax Studies at the Institute of Fiscal Studies, a body that depends on the Ministry of Finance; Desiderio Romero is a professor of Applied Economics at the Rey Juan Carlos University; and Santiago Álvarez holds the position of Professor of Public Finance and the Spanish Tax System at the University of Oviedo.

The tax burden included in this document is the same index used by the Treasury to maintain that Spain is "seven or eight points" below the European average.

That is, there is room to raise taxes by up to 90,000 million euros, and what the tax reform that the Executive plans to carry out is precisely to reduce that difference.

Those responsible for the work, however, also perform an additional calculation based on Bird's tax sacrifice index.

"This index", they explain,

"weights the tax burden, measured with respect to GDP net of taxes, in relative terms of GDP per capita

."

And it is added: "Its calculation is considered a more appropriate indicator than the tax burden to measure the fiscal effort required of taxpayers in relation to their economic capacity."

Applying this index, the situation in Madrid would vary significantly and it would no longer be among the top positions. But even then, it would not be among the regions that require less sacrifice from their taxpayers, the first three positions being occupied, in this order, by the

Canary Islands, Navarra and the Basque Country

. Then there is Madrid, while in the other part of the table, that is, among the communities that demand a greater tax sacrifice from their taxpayers, Cantabria and the Balearic Islands remain, and Andalusia would be added.

In Sanz's own opinion, the tax burden is an "easy calculation."

"Popularity does not imply robustness, the tax pressure index is an imprecise index, not very informative and of very limited utility to carry out fiscal policy prescriptions", he adds.

The fiscal effort, on the other hand, takes into account "revenue and GDP, also taking into account the population size and per capita income."

But the truth is that the Government, and the very economists who make up the group of experts chosen by Montero for the great tax reform that he aspires, are always based on the tax burden.

And going to that reference, that is, using the same criteria as the Executive, the result is the one already indicated:

Madrid is the fourth region with the highest adjusted fiscal pressure

.

No harmonization

In any case, and back to the "robust" slaughter index, it is highly significant that the Treasury is not going to include in its fiscal harmonization two of the three communities that present a lower tax requirement: the Basque Country and Navarra. Despite the evidence in the document and the fact that these regions could also be accused of incurring in alleged

fiscal

dumping

, as Montero does with Madrid, his Ministry has ruled out including them in the process.

“

Legally it would not be possible because they have their own tax system

.

What could be tried is to reach agreements, but it cannot be imposed ”, they justify in the Treasury, as this newspaper published this week.

And in this they also fully coincide with Calviño, who also maintains that it is necessary to review the taxation of the communities of common regime, but not of those of the foral regime: that is, that of all regions, except those of the Basque Country and Navarra.

According to the criteria of The Trust Project

Know more

Taxes

Valencian CommunityValencia will tax large holders of empty flats with a surcharge of at least 30% of the IBI

PoliticsCastilla-La Mancha abolishes the license fee for hunting and fishing

PoliticsAndalucía offers the "best tax regime" in Spain for the heirs

See links of interest

La Palma volcano

Last News

Holidays 2021

2022 business calendar

Home THE WORLD TODAY

Podcast Economia

How to do

Torino - Genoa

Baskonia - AS Monaco

1. FSV Mainz 05 - FC Augsburg

Sampdoria - Spezia

Barça - Zenit Saint Petersburg