The hot spot behind the trillion-dollar transaction accelerates the rotation of the five major sectors, which can increase sharply and become popular

Editor's note: Recently, trillion yuan of daily turnover in the A-share market has become the norm.

From the perspective of Shenwan's secondary industry, the average daily turnover since the rebound on July 28 so far has increased by more than 50% compared to the average daily turnover since the second half of the year, and the growth rate of the sector outperforms the Shanghai Composite Index, and the latest dynamic P/E ratio is higher than A The sectors with the median price-earnings ratio of the stock market are gas, infrastructure, livestock and poultry breeding, high and low pressure equipment, and coal mining.

Today, this newspaper will sort out and analyze the investment opportunities of the above five sectors and their leading stocks for readers.

Gas sector

Over 90% of stocks with active trading have achieved gains since July 28

Our reporter Wu Shan, trainee reporter Chu Lijun

Since the second half of the year, the A-share market has bottomed out. The Shanghai Stock Exchange Index hit a year low of 3,32.72 points on July 28 and oscillated and strengthened. At the same time, the combined daily turnover of the two cities continued to exceed 1 trillion yuan.

Further analysis found that the gas sector has recently been active in transactions. Since July 28, the average daily turnover of the gas sector during the period was 2.483 billion yuan, an increase of 136.56% from the average daily turnover of 1.049 billion yuan since the second half of the year as of July 27. Ranked first among Shenwan's second-tier industries in terms of average daily turnover increase during the period.

In terms of individual stocks, judging from the growth rate of average daily turnover since July 28 over the average daily turnover since the second half of the year as of July 27, 23 stocks have achieved growth in average daily turnover during the period. Among them, Shenzhen Gas and Shenzhen Gas The growth rate of average daily turnover of Shaanxi Natural Gas during the period was 119.00% and 105.31%, respectively. The growth rate of the average daily turnover of five stocks including Datong Gas, New Natural Gas, Zhongtai, Xinjiang Torch, and Foran Energy also increased during the period. Both exceeded 50% and were active.

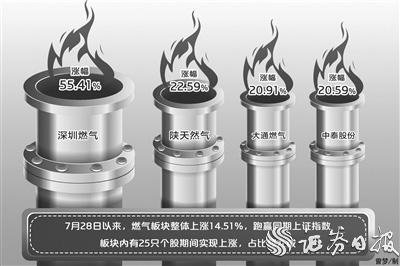

The overall performance of the gas sector is remarkable. Since July 28, the gas sector has risen by 14.51% as a whole, outperforming the Shanghai Stock Exchange Index (up 4%) over the same period.

There are 25 stocks in the sector that achieved gains during the period, accounting for more than 90%. Among them, Shenzhen Gas performed strongly, with a cumulative increase of 55.41% during the period, Shaanxi Natural Gas (22.59%), Chase Gas (20.91%), Zhongtai (20.59%) ) The cumulative gains of the other three stocks during the period also exceeded 20%, and they performed well.

In response to this, Yang Liu, director of the content department of the private equity row network interviewed by a reporter from the Securities Daily, said that the concept of carbon neutrality and the continuous increase in LNG prices have driven the gas sector to strengthen recently. There are two specific reasons. On the one hand, natural gas As a clean energy, it will become an alternative energy source in the industrial sector under the needs of carbon neutrality and environmental protection, which will be beneficial to the industry in the long term; on the other hand, in the process of urbanization, the rate of residential gas usage and consumption will maintain a deterministic growth. situation.

As the temperature drops in the second half of the year, natural gas demand will pick up, which is expected to support the continued rise of natural gas prices.

In an interview with a reporter from Securities Daily, Xinpu Asset Investment Director Mao Junyue said that international energy prices continue to rise, the natural gas boom is high, and the trend of the gas sector is also stronger than the broader market.

With the increase in energy conservation, emission reduction and environmental protection awareness of the whole society, clean and efficient natural gas energy is favored. With the acceleration of corporate natural gas production, it is expected to bring positive effects to listed companies.

In terms of performance, as of the close of August 13th, three gas companies including Datong Gas, Chengdu Gas, and Baichuan Energy announced their semi-annual reports. The net profits of the three companies in the first half of the year have all achieved year-on-year growth.

In addition, there are 9 companies that have disclosed their performance forecasts for the first half of this year, and 6 companies are expected to have a good performance, accounting for 66.67%.

Regarding the development prospects of the natural gas industry, Everbright Securities stated that in the context of the global economic recovery and carbon-neutral energy transition, the international natural gas market continues to rise, cost support is superimposed on the promotion of the "coal-to-gas" policy, and my country's natural gas market is improving for a long time. .

It is worth noting that despite the outstanding performance of the gas sector, the latest dynamic P/E ratio of the gas sector is 22.83 times, which is lower than the median A-share valuation of 41.27 times. The latest dynamic P/E ratio of 18 stocks in the sector is below 22 times, accounting for Than over 60%.

"This year, due to the abnormal climate in the United States and other places, the demand for natural gas power generation has increased and international natural gas prices have been increased. Gas stocks are at a low level, and they are likely to be favored by funds in the recent market high-low switching atmosphere." Jianhong Times Investment Director Zhao Yuanyuan told "Securities" A reporter from the Daily said that it is difficult to judge the continuity of weather-dependent natural gas price increases.

However, some institutions have expressed optimism about investment opportunities in the gas sector. Chunshi Group partner Yang Ruyi said that due to the impact of price increases, the stock market has reacted quickly, and the gas sector has increased significantly since July 28.

With the coming of the heating season in the future, the air quality requirements and carbon neutrality requirements of the Winter Olympics will be superimposed, the use of natural gas will continue to increase, the price of LNG is expected to be supported, and the gas sector will have investment value.

(Securities Daily)