In the second quarter, the land price rose

slightly, and the

regulation increased.

Our reporter Huang Xiaofang

Since the beginning of this year, the policy has continuously strengthened requirements for stabilizing land prices, housing prices, and expectations, so as to promote the steady and healthy development of the real estate market.

The fine control of the land supply side has been strengthened in many places across the country.

The next step is to adjust and improve relevant rules in a targeted manner to help stabilize expectations.

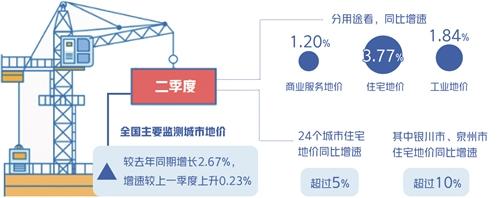

The land price monitoring report of major cities across the country recently released by the China National Land Survey and Planning Institute showed that the overall national land price growth rate rose slightly in the second quarter.

Land prices in major monitored cities across the country increased by 2.67% over the same period last year, and the growth rate was 0.23% higher than the previous quarter.

In terms of usage, commercial service land prices grew by 1.20% year-on-year, residential land prices grew by 3.77% year-on-year, and industrial land prices grew by 1.84% year-on-year.

The increase in residential land prices was significantly higher than that of other land.

As far as individual cities are concerned, residential land prices in 24 cities have increased by more than 5% year-on-year. Among them, residential land prices in Yinchuan and Quanzhou have increased by more than 10% year-on-year, which are in the high-speed operating range.

Since the beginning of this year, the policy side has continuously strengthened the positioning that houses are used for living, not for speculation. It requires stable land prices, stable housing prices, and stable expectations, and promotes the steady and healthy development of the real estate market. It targets real estate corporate financing, school district housing, and second-hand housing. Introduced control measures.

At the same time, a number of cities have launched a centralized land supply model, and the land supply is not limited to housing prices, but also requires land premium rates and housing quality.

For example, on July 30, the city of Hangzhou announced the second centralized transfer of land plots this year. The upper limit of the premium rate was adjusted from 30% to 20%. A total of 31 residential plots were provided, of which 10 plots will be tested for "competitive quality". The premium rate The upper limit is 10%.

Previously, in the first centralized supply of land this year, Beijing introduced a housing sales price guidance mechanism for the first time. Changchun implemented a policy of “limiting land prices and competing for construction”, and Chengdu implemented a policy of “limiting housing prices, determining quality, and competing for land prices”. The fine control of the end is strengthened.

According to expert analysis, this move means that the linkage between land prices and housing prices is further strengthened. In view of the differentiation of the national land market and the rising trend of land prices in some cities, the policy adjustments implemented by cities may increase.

The report shows that the fixed base price index of key cities keeps rising.

In the second quarter, the comprehensive average land price index of key cities with 2000 as the base period was 322, and the average residential land price index reached 412.

In addition, the average land price index for commercial services is 304, and the average industrial land price index is 236.

In terms of residential land prices in the Yangtze River Delta, the Bohai Rim region and the Guangdong-Hong Kong-Macao Greater Bay Area, with the exception of Shenzhen and Yantai, the quarter-on-quarter negative growth in residential land prices, and the quarter-on-quarter positive growth in residential land prices in all cities in the three key regions.

However, the growth rate of residential land prices in the three key areas has slowed for the first time since the second quarter of 2020.

The quarter-on-quarter growth rate of residential land prices in Beijing and Shanghai declined, while the quarter-on-quarter growth rate of residential land prices in Guangzhou and Shenzhen increased.

Among them, the land price in Shenzhen has experienced negative growth for two consecutive quarters, but the growth rate this quarter has increased compared with the previous quarter.

The report shows that the second quarter mainly monitors the negative growth in the supply of urban commercial services, residential and industrial and mining warehousing land, and the proportion of residential land supply has declined.

In the second quarter, the supply area of land for construction in 105 major monitored cities across the country was 58,200 hectares, an increase of 3.24% month-on-month and a year-on-year decrease of 10.36%.

Among them, 3,200 hectares of commercial service land, 11,300 hectares of residential land, 14,600 hectares of industrial and mining storage land, and 29,100 hectares of other land for transportation and water conservancy infrastructure.

The relevant person in charge of the Land Price Institute of the China National Land Survey and Planning Institute stated that the central government adhered to the overall tone of "housing, housing and not speculation" in the second quarter, continuously improving the policy toolbox, stringent real estate financial risk identification and regulatory policies, and overall tightening of funds for development enterprises.

In terms of policy, the policy of affordable rental housing will be set, and the development of affordable rental housing will be promoted in terms of taxation policies and supply channels.

At the same time, regulation and control policies in many places have increased, and market regulation has been increased in terms of the scope of purchase restrictions, land use and affordable housing supply, and loan supervision.

He said that it is expected that in the third quarter, land prices in major monitored cities across the country will maintain a steady upward trend, and there will still be greater regulatory pressures in some areas with higher enthusiasm.

In the next step, we must pay close attention to the impact and effects of policies and measures such as the centralized supply of residential land on the real estate market, and adjust and improve relevant rules in a targeted manner to help stabilize expectations.

At the same time, the supply of land for affordable rental housing should be increased reasonably and appropriately.

Huang Xiaofang