36.2 trillion yuan of green bonds raised in the bond market during the year

Host Tian Peng: Since the beginning of this year, thanks to various measures to promote the development of the bond market, the financing function of my country's bond market has been significantly enhanced, helping enterprises to resolve financing difficulties and serve the development of the real economy.

In addition, foreign institutions are enthusiastic about investing in RMB bonds, and long-term investment and diversified asset allocation may become its development trend.

Today this newspaper started to interpret this.

Our reporter Bao Xing'an

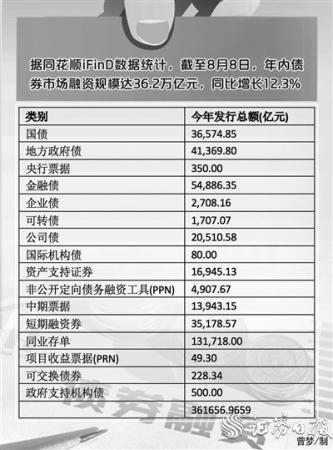

Since the beginning of this year, my country's bond market financing function has been significantly enhanced. According to statistics from Flush Shun iFinD, as of August 8, the bond market financing scale during the year reached 36.2 trillion yuan, a year-on-year increase of 12.3%.

Experts believe that while the bond market has grown steadily in scale, it has injected "live water" into high-quality economic development.

Multiple measures to promote the development of the bond market

Pan Helin, Executive Dean of the Institute of Digital Economy, Zhongnan University of Economics and Law, told the Securities Daily reporter that since the beginning of this year, there have been four main reasons for the increase in the scale of bond market financing: The inclusion of China's bond investment in the international bond investment index has significantly strengthened the liquidity of the bond market; the second is to broaden the liquidity channels of the bond market by improving the bond trading system and mechanism, such as improving derivatives and market regulations to promote liquidity channels in the bond market Increase; third, a prudent monetary policy is conducive to reducing capital costs and increasing investor risk appetite, thereby increasing investment demand in the bond market; fourth, pension and social security funds have increased the proportion of bond financing, actively intervening in the bond market, and providing liquidity Sexually possible.

Since the beginning of this year, my country has launched a series of measures to continue to promote the reform and development of the bond market, including improving the corporate bond information disclosure system and the supporting system for the reform of the corporate bond registration system, optimizing exchange bond trading rules, and effectively improving the operational efficiency of the bond market.

For example, on August 6, the People’s Bank of China, the National Development and Reform Commission, the Ministry of Finance, the China Banking and Insurance Regulatory Commission and the China Securities Regulatory Commission jointly issued the "Notice on Promoting the Healthy Development of the Bond Market Credit Rating Industry", requesting to effectively improve the quality of credit ratings and support the bond market Stable and healthy development, and promote credit rating agencies to effectively play the role of "gatekeeper" in the bond market.

Since the beginning of this year, the scale of national debt issuance is 3,654.785 billion yuan, a year-on-year increase of 0.2%; the scale of local government bond issuance is 4136.98 billion yuan, a year-on-year increase of 3.8%; the scale of central bank bill issuance is 35 billion yuan, a year-on-year decrease of 2.8%; the scale of financial bond issuance is RMB 5,488,635 million, an increase of 8.1% year-on-year; the scale of corporate bond issuance was RMB 205.1058 billion, an increase of 6.3% year-on-year; the scale of corporate bond issuance was RMB 270.816 billion, an increase of 26.3% year-on-year; the scale of convertible bonds was RMB 170.707 billion, an increase of 27.9 year-on-year %; Exchangeable bond issuance scale was 22.834 billion yuan, a year-on-year decrease of 32.3%; asset-backed securities wassuance scale was 1,694,513 million yuan, a year-on-year increase of 49.6%; non-public directional debt financing instrument (PPN) issuance scale was 490.767 billion yuan, a year-on-year increase 5.1%; the issuance scale of medium-term notes was 1,394.315 billion yuan, a year-on-year decrease of 10.5%; the issuance scale of short-term financing bills was 3,517,857 million yuan, a year-on-year decrease of 4.6%; the issuance scale of interbank certificates of deposit was 13,171.8 billion yuan, a year-on-year increase of 28.6%; project income notes ( The issuance scale of PRN) was 4.93 billion yuan, a year-on-year increase of 310.8%; the scale of international agency bond issuance was 8 billion yuan, a year-on-year decrease of 27.3%; the scale of government-supported agency bond issuance was 50 billion yuan, a year-on-year decrease of 16.7%.

Guo Yiming, director of investment consultants at Jufeng Investment Consulting, told a reporter from the Securities Daily that in recent years, my country’s bond market has been rich in types and more reasonable in structure, and corporate financing channels have been expanded, especially in the repeated new crown pneumonia epidemic and the overall economic recovery. Solving the financing difficulties of enterprises, improving the ability to serve the real economy, and injecting "live water" into the real economy.

“In the future, the importance of bond financing will increase significantly. As a direct financing method, bond financing will replace part of indirect financing and become one of the main sources of financing for Chinese companies. Bond financing supports the development of the real economy, especially for economic recovery. Made a major contribution.” Pan Helin said.

Green bonds heat up

The new version of the "Catalogue of Green Bond Supported Projects (2021 Edition)" implemented on July 1, unified the definition standards for green projects by the relevant management departments of green bonds for the first time. Including the scope of support, guiding more funds to support green industries and green projects, investors' attention to green bonds has rapidly increased, providing more high-quality financial support for the green transformation of my country's economic and social development.

Data shows that as of August 8, the scale of green bond issuance has reached 311.69 billion yuan this year. Among them, carbon neutral bonds, as a sub-variety of green debt financing instruments, have rapidly increased their market size.

Since the issuance of the first batch of carbon neutral bonds in February this year, a total of 140 carbon neutral bonds have been issued, with a scale of 137.86 billion yuan.

The main varieties include medium-term notes, ultra-short-term financing bills, corporate bonds and corporate asset-backed securities, etc., with a rich variety.

Guo Yiming said that compared with other green bond varieties, carbon neutral bonds have the characteristics of more focused fund use, quantifiable environmental benefits, and more detailed information disclosure. They can more effectively guide funds to support the development of green industries and accelerate the And the achievement of the goal.

Looking forward to the second half of the year, Pan Helin said that the scale of bond financing will further increase. Compared with indirect bank credit financing, bond financing has less macroeconomic systemic risks.

Compared with equity investment in the stock market, bond financing risks are lower and investment arrangements are easier.

"As the economy continues to recover, bond market reforms and continuous innovation continue, the scale of bond financing will continue to expand steadily this year, promoting high-quality economic development." Guo Yiming said.

(Securities Daily)