In the previous week, U.S. stocks also plummeted due to concerns about the Fed’s turn to the Eagles, but the S&P 500 Index hit a record high on June 25.

A shares also broke through 3,600 points again, and the northbound funds flowed into 14.1 billion yuan on June 25.

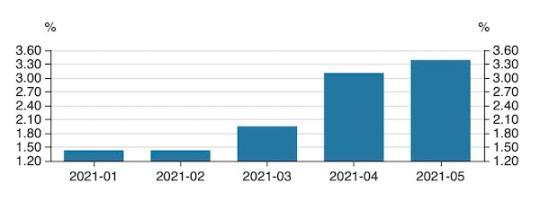

At the same time, the inflation data that has continuously hit the market in the past two months has not slowed down.

The U.S. May core PCE price index announced on the evening of June 25 rose 3.4% year-on-year. This Fed’s most favored indicator recorded the largest increase in nearly 30 years.

Although China announced a larger year-on-year increase in May PPI, its transmission to CPI is limited.

Why the market, especially the U.S. stocks, is now ignoring inflation data and setting new highs repeatedly?

How do international investors view the trend of the Chinese market in the future?

U.S. core PCE is now peaking signs

CBN previously reported that the market began to digest the Fed’s hawkish interest rate hike expectations in the past week, risk sentiment improved, and U.S. stocks broke through historical highs again after the plunge.

On June 17, after the Fed's meeting on interest rates, the dot plot showed that there were two interest rate hikes before the end of 2023, and the median value of the last meeting was zero.

More critically, the outside world expects the possibility of the Fed to raise interest rates in 2022 is on the rise.

Fed Chairman Powell successfully calmed the market in subsequent congressional hearings.

He reiterated the view that "inflation is temporary", saying that he will not preemptively raise interest rates because of inflation concerns, implying that he will remain patient in exiting QE and raising interest rates.

The inflation data released on June 25 seemed to show signs that inflation was beginning to peak.

The US PCE in May rose 3.9% year-on-year, expected 3.9%, and the previous value was 3.6%; the core PCE price index in May rose 3.4% year-on-year, expected 3.4%, and the previous value 3.1%.

Although inflation exceeded the previous value but in line with expectations, US stocks continued to rise sharply and hit a record high.

The reason for this is that the "segmented data" allows the market to see that "inflation is temporary", which strengthens the belief that easing will continue.

Personal expenditure data showed that the month-on-month growth in May was almost zero.

Specifically, in May, U.S. personal service spending increased by 74.3 billion U.S. dollars, but commodity spending fell by 71.5 billion U.S. dollars, that is, net expenditure only increased by 2.9 billion U.S. dollars, relative to the US economy with a volume of more than 20 trillion U.S. dollars. , Minimal.

If you look at the actual personal consumption expenditure, it also fell by 0.4% year-on-year, which is more than expected and the previous value.

As a result, from the perspective of actual personal consumption expenditure, the actual PCE seems to have peaked.

At the same time, personal income is also deteriorating.

After last month's revenue plummeted by 13.1% month-on-month, May continued to fall by 2% month-on-month.

In March, the U.S. government issued a subsidy of US$1,400 per capita. As a result, data volatility in the following months increased. In April, the data plummeted by 13.1% from the previous month. The May data continued to deteriorate because the employment situation was less than expected. As the government's welfare policy fades out, it will naturally be reflected in a decline in personal income, which may also drag down the core PCE data.

In the previous hearing, Powell said in answering questions from members that 5% inflation is unacceptable.

This actually defines the conditions under which inflation triggers the Fed's tightening.

The overall CPI of the United States rose 5% year-on-year in May, and the core CPI increased 3.8% year-on-year. What Powell said should be the Fed’s most popular inflation indicator—core PCE.

Even if US inflation will remain high in the future, it is still very difficult to exceed 5%.

Earlier, the market was overly concerned about inflation data, but the Fed cares most about employment-there are still 15 million Americans receiving unemployment benefits and nearly 10 million job vacancies.

As Powell said, the path to employment recovery is certain (the jobs are ready), but the timing is difficult to judge (I don’t know when Americans are willing to come out).

Therefore, now the Fed must suppress inflation expectations and wait for the economy to gradually recover, rather than really speeding up the tightening of the currency.

Situ Jie, a senior US stock trader, told reporters that traders have also undergone a psychological change.

At first, the market worried that the Fed would tighten rapidly, believing that it would raise interest rates four times in the next two years.

After a while, the market began to accept that the Fed would really maintain a low interest rate level for a long time, so it began to buy short-term debt and sell long-term debt, and the yield curve steepened again.

At the same time, the market is beginning to worry about inflation, and funds may re-enter a large amount of commodities, TIPS (inflation-linked bonds) and value stocks that can better hedge against inflation.

The infrastructure stimulus also further stimulated US stocks.

On June 25, the two parties in the United States reached an infrastructure construction agreement, which not only increased government spending but also did not increase taxes.

"How can the stock market not like to increase government spending without increasing taxes? In this case, increasing spending is equivalent to stronger economic stimulus. The S&P 500 Index hit a record high at around 4273.2 on Thursday, the next resistance level. Around 4329.6 points, and then the uptrend line around 4380 points." City Index senior analyst Matt Simpson told China Business News.

Foreign capital overweights the value of A-shares and the booming industry

As far as A shares are concerned, the sharp rebound in the semiconductor and new energy sectors undoubtedly boosted market sentiment throughout June.

In the past week, as global risk sentiment improved and commodities rebounded, the cyclical sector also rebounded, pushing the market to rise.

In the past week, the net inflow of northbound funds was 20.97 billion yuan; the two financing funds were active. As of June 24, the scale of the two financings increased by 17.966 billion yuan compared with the previous week.

The industries where the Northbound funds increased significantly during the week were electrical equipment, building materials, mechanical equipment, transportation and electronics.

Among them, the stocks that have increased their positions by a large margin are Huaibei Mining, Sophia, Jingda, Sinotrans, and Tongcheng New Materials.

Compared with the United States, China does not have obvious overall inflationary pressures, but more localized upstream price pressures. Recently, with the overall decline in commodity prices, the outside world expects that the PPI will peak and fall in the second half of the year.

"China is structural inflation. The overall inflation level calculated by combining CPI and PPI is not too high, and there is not much room for further inflation in the second half of the year. Therefore, the suppression of the stock market will not be too great. Structural inflation in China The characteristics of the stock market determine structural investment opportunities in the stock market. Upstream price-increasing varieties and low-value blue-chip stocks are less useful due to valuation pressures. On the contrary, their earnings rise can also promote stock prices. But those who rely on concept-driven and profitable Industries and companies that are declining and valuations are too high are more affected by inflation, and their stock prices also have a greater downside." Wu Zhaoyin, director of macro strategy at AVIC Trust, told reporters.

As a result, the current foreign investment is focused on non-cyclical value stocks whose valuations are still low or reasonable.

At the same time, booming industries with mid- to long-term certainty such as new energy continue to increase.

Wang Yuxuan, Director of Equity Research at Fullerton China, told reporters that new energy vehicles and photovoltaics are still long-term promising industries.

Previously, there was a sharp correction in the photovoltaic concept, which is closely related to the lack of installed capacity as expected. However, for such long-term topics, foreign investors generally look more at the medium and long-term and will not care too much about fluctuations in several months or even a year.

Since the third quarter may be the turning point of the photovoltaic and new energy vehicle industry chain, institutions may build positions in advance.

For example, China Merchants Securities believes that due to the tight supply of chips and batteries, it should appropriately lower its sales expectations for new energy vehicles in the second quarter, but it is expected that sales will return to an upward trend in the latter part of the third quarter.

In terms of overseas markets, Xinju Information also mentioned to reporters that under the high subsidy of the government in Europe, the major countries' new energy vehicles maintain a high penetration rate, and the new energy vehicle industry is trending faster.

As far as the photovoltaic sector is concerned, domestic module companies have previously been under pressure from upstream price increases. According to the current spot purchase prices of raw materials, modules need to be priced at 1.7 yuan per watt to make a profit. However, there were 1.6 biddings in January and February. If the bid price is below RMB/W, the second-tier component company may not be profitable. But in the near future, the bidding prices of most projects have begun to recover significantly, and the transaction prices of several large projects have reached around 1.7 yuan/watt and above. According to agency estimates, it should still be profitable to install components at 1.8 to 1.9 yuan per watt in most places in China. As the price increase peaks, the subsequent installation speed may recover. (Author: Zhou Ailin)