From October to December 2020, the share of the dollar in Russia's export settlements decreased from 56.6% to 48.3%.

The value became the lowest ever observed.

This is evidenced by the materials of the Central Bank.

According to the Central Bank, Russia is gradually abandoning the American currency in favor of the European one when conducting trade transactions.

So, in the IV quarter of 2020, the use of the euro when paying for Russian goods and services by other countries increased from 24.4% to 36.1% - the highest level in history.

At the same time, even at the beginning of 2013, the share of the dollar in Russia's export settlements exceeded 81%, and transactions in euros accounted for less than 9% of transactions, another 9% - for the ruble.

The de-dollarization in trade observed in recent years is largely due to the desire of the Russian authorities to minimize the impact of geopolitical and sanctions risks.

This point of view in an interview with RT was expressed by Dmitry Babin, an expert on the stock market "BCS World of Investments".

“If you have a dollar account, even in a Russian or European bank, in the end, this amount is in a correspondent bank under the jurisdiction of the United States - that is, in fact, in an American financial institution.

Consequently, if the United States imposes restrictions on settlements in dollars, these funds will be blocked or a ban will be imposed on certain transactions with them.

Therefore, an account in another currency and transactions with it allow avoiding such risks, ”explained Babin.

The Central Bank adheres to a similar strategy in the formation of Russia's gold and foreign exchange reserves.

According to the latest estimates of the Central Bank, from January 2018 to June 2020, the share of the dollar in the international reserves of the regulator more than halved - from 45.8% to 22.2%.

At the same time, the share of the euro increased by almost a third - from 21.7% to 29.5%.

Reuters

© Jo Yong-Hak

The drop in the share of the dollar in Russia's international settlements may also be associated with a decrease in oil and gas sales in 2020.

Olga Belenkaya, head of the macroeconomic analysis department of Finam Group, shared this opinion in a conversation with RT.

From January to December 2020, Russia in monetary terms reduced the export of energy raw materials by 37.5% compared to the same period in 2019.

This is stated in the report of the Federal Customs Service (FCS).

“The decline in the share of Russian oil and gas exports was due to a collapse in global oil demand due to a pandemic and restrictions on hydrocarbon production under the OPEC + agreement.

Meanwhile, it is worth noting that payments for energy resources on the world market are traditionally carried out in dollars, ”explained Belenkaya.

In general, over the last three months of 2020, Russia has noticeably reduced the use of the American currency in the sale of goods and services to the EU countries and the BRICS countries.

At the same time, the most active trade de-dollarization is taking place in relations with China.

So, according to the Central Bank, from October to December, the share of the dollar in payments for Russian exports to China fell more than threefold - from 38.5% to 10.8%.

At the same time, the share of the euro, on the contrary, doubled - from 40.3% to 83.3%.

“The growth in the number of transactions in euros in settlements with China is associated, among other things, with the policy of de-dollarization of Beijing itself, which also seeks to bypass the US sanctions rhetoric.

At the same time, this export direction opens up huge opportunities for Russia, especially taking into account the growing demand for many of our goods in China, ”said Artyom Deev, head of the analytical department at AMarkets, in a conversation with RT.

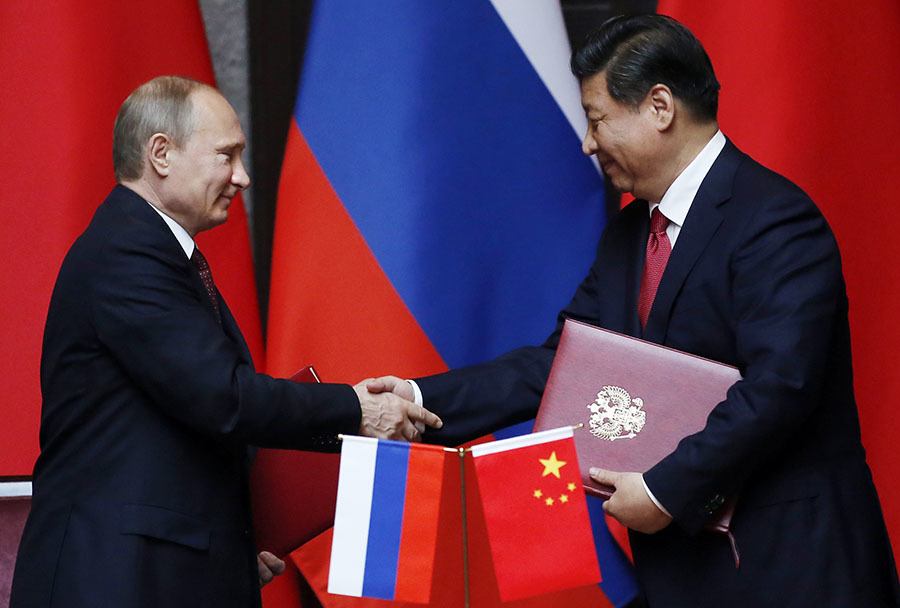

Vladimir Putin and Xi Jinping

Reuters

© Carlos Barria

According to the Federal Customs Service, in 2019 the volume of Russian-Chinese trade grew to a record level and came close to $ 111 billion.In 2020, amid the consequences of the COVID-19 pandemic, the indicator slightly decreased and amounted to about $ 104 billion.

However, already in 2021, mutual trade between the countries began to grow again, and by the end of the first quarter increased by 15.4% in annual terms.

Such statistics are provided by the General Customs Administration of the PRC.

Moreover, according to Artyom Deev, over the next few years, the volume of trade between Russia and China may reach $ 160-170 billion.

“China has become the only country that has fully recovered from the pandemic, and the dynamics of the GDP of the countries of the Asia-Pacific region is ahead of the indicators of the United States and Europe.

The reorientation of trade ties from West to East is not only a political, but also an economically justified step on the part of the Russian government.

In these conditions, a gradual decrease in the share of the dollar in mutual settlements is a necessary insurance against sanctions, ”concluded Deev.