The first batch of 4 infrastructure public offering REITs projects were officially accepted by the Shanghai and Shenzhen Stock Exchanges

In just 2 days, the Shanghai and Shenzhen Stock Exchange formally accepted the first batch of 4 applications for infrastructure public offering REITs.

On April 23, the Shanghai Stock Exchange (hereinafter referred to as the “Shanghai Stock Exchange”) also officially accepted the first batch of 2 infrastructure public offering REITs projects-"Zheshang Securities Shanghai-Hangzhou-Ningbo Expressway Closed Infrastructure Securities Investment Fund", "Guojin Railway Construction" Chongqing Yusui Expressway Closed Infrastructure Securities Investment Fund’s decision to declare.

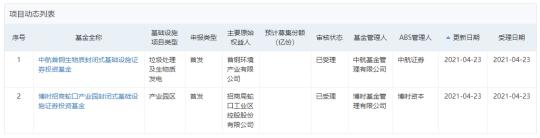

On the same day, the Shenzhen Stock Exchange ("Shenzhen Stock Exchange") also passed the public REITs review business system and officially issued the "AVIC Shougang Biomass Closed Infrastructure Securities Investment Fund" and "Boshi Merchants Shekou Industrial Park Closed Infrastructure Securities Investment Fund" "Notice of acceptance of project application.

The fund prospectus and other relevant documents of the above four projects have been disclosed on the Shanghai and Shenzhen Stock Exchange public offering REITs information platform website.

The above projects were also accepted by the China Securities Regulatory Commission on the same day.

This marks that the Shanghai and Shenzhen Stock Exchange's infrastructure public offering REITs pilot has officially entered the review stage, and the capital market has taken another important step in actively serving the national strategy and the development of the real economy.

Brokerage analysts pointed out that in the long run, the scale of my country's public REITs can reach trillions of yuan in assets.

With the official landing of REITS products, it means that this trillion-level market is about to set sail.

The industries of the 4 projects are all national key fields

Since April 30, 2020, the National Development and Reform Commission and the China Securities Regulatory Commission issued the "Notice on Promoting the Pilot Work of Real Estate Investment Trust Funds (REITs) in the Infrastructure Sector", the prelude to domestic public REITs officially kicked off.

In addition to the 4 projects currently approved, many projects are still being actively "prepared."

An insider in the fund industry told The Paper (www.thepaper.cn) reporter that public REITs products have a trillion-level market space, which is an exciting new field for the industry.

For ordinary investors, publicly offered REITs invest in the development of linked regions and high-quality infrastructure to fight inflation. Under the current environment where market interest rates continue to fall, they are rare high-quality assets and can be traded in the secondary market. Mass investors have opened up a new path of asset allocation.

Specifically, the first two projects of the Shanghai Stock Exchange are all infrastructure projects, both of which are based on expressways. They are another major action for the capital market to serve the integration of the Yangtze River Delta and the development of the Yangtze River Economic Belt.

Among them, the original owner of the Shanghai-Hangzhou-Ningbo REITs is Zhejiang Shanghai-Hangzhou-Ningbo Expressway Co., Ltd., and the basic asset is the Zhejiang section of the Hangzhou-Huizhou Expressway, which is located in the Yangtze River Delta.

The original stakeholders of Chongqing Yusui Expressway REITs are China Railway Construction Chongqing Investment Group Co., Ltd. and Chongqing Expressway Investment Holding Co., Ltd. The basic assets are the Chongqing section of Yusui Expressway, which is located in the Yangtze River Economic Zone.

The first two infrastructure public offering REITs projects of the Shenzhen Stock Exchange are located in the two key integrated development areas of Beijing-Tianjin-Hebei and Guangdong, Hong Kong and Macao, and their industries are all national key areas.

Among them, the "AVIC Shougang Biomass Enclosed Infrastructure Securities Investment Fund" infrastructure project is located in Mentougou District, Beijing. It is a waste treatment and biomass power generation project. The recovered funds of the original equity holders are planned to be invested in new similar infrastructure projects; The "Boshi Merchants Shekou Industrial Park Closed Infrastructure Securities Investment Fund" infrastructure project is located in the Shekou Wanggu Industrial Park, Nanshan District, Shenzhen. The recovered funds from the original stakeholders will be used for 5 industrial park infrastructure projects under construction.

Issue the first written feedback within 30 working days after acceptance

After the project is formally accepted, the Shanghai and Shenzhen Stock Exchange will carry out audit work in accordance with relevant regulations and rules, strictly control the entry of pilot projects, strengthen the audit quality control mechanism, and improve the quality and efficiency of project audits.

According to relevant rules, the Exchange will issue the first written feedback within 30 working days from the date of acceptance; if there is no need to issue feedback, it will notify the fund manager and asset-backed securities manager.

Fund managers and asset-backed securities managers shall reply in writing within 30 working days after receiving written feedback.

After review and inquiry and other links, the exchange will conduct reviews in accordance with the procedures and issue a no-objection letter for the listing of infrastructure funds and infrastructure asset-backed securities or make a decision to terminate the review based on the results of the review.

If a letter of no objection is issued, the Exchange will request the CSRC to perform the registration procedures for the project after completing the relevant review.

The Shanghai Stock Exchange stated that it will refer to the relevant procedures and requirements of the public issuance of securities, adhere to the principle of openness and fairness, based on information disclosure, effectively control the entrance, and in accordance with the requirements of the audit concerns issued in the previous period, the public offering of infrastructure REITs funds and the assets to be invested Support the trading arrangements of securities, infrastructure projects and publicly offered REITs funds, and whether the documents issued by intermediaries comply with relevant regulations and requirements.

The Shenzhen Stock Exchange pointed out that the implementation of the pilot infrastructure public offering REITs will help revitalize the stock assets of the society, promote the improvement of the level of infrastructure operations, and implement high-quality development requirements to build a new development pattern with domestic and international cycles as the main body and mutual promotion of domestic and international double cycles. Has a positive role in promoting.

The Shenzhen Stock Exchange stated that it will follow the decision and deployment of the Party Central Committee and the State Council and the deployment requirements of the Securities Regulatory Commission, based on the new development stage, implement the new development concept, serve the new development pattern, and closely focus on the capital market to comprehensively deepen reforms and serve the Guangdong-Hong Kong-Macao Greater Bay Area, a pilot demonstration zone Build related requirements, steadily advance the work of infrastructure public offering REITs, actively build a featured sector of Shenzhen REITs, strengthen the capital market’s innovative practice of supporting infrastructure investment and financing mechanisms, give full play to the capital market’s function of optimizing resource allocation, and promote the establishment of a system that is in line with international standards System, enhance the capital market's ability to serve the real economy, and better serve the overall economic and social development of the country.

(This article is from The Paper. For more original information, please download the "The Paper" APP)

The Paper, Reporter Ge Jia