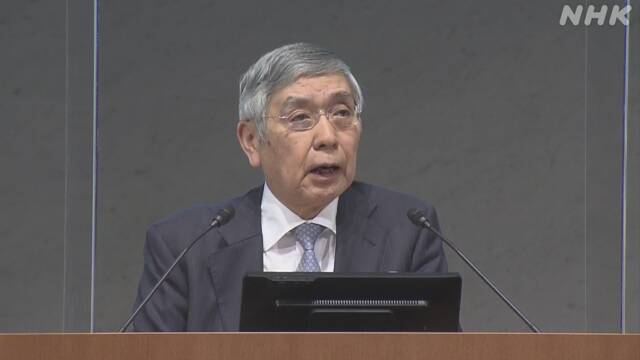

The Bank of Japan's governor, Kuroda, has been in office for 2940 days in 6 days, ranking second in history.

The target price increase rate of 2% has never been achieved, and as the effects of the new coronavirus continue for a long time, it will continue to be an issue whether the target can be achieved while supporting the Japanese economy.

Governor Kuroda of the Bank of Japan took office in March 2013.

He declared that he would achieve the price increase target of 2% in about two years, and immediately after taking office, he launched a large-scale monetary easing measure, which was also described as "Kuroda Bazooka".

After that, in addition to implementing additional easing of "surprise" that surprised the market, in January 2016, we decided to introduce the first "negative interest rate policy" in the history of the Bank of Japan, and continued aggressive monetary easing. However, during this period, the price target has never been achieved.

Furthermore, since last year, the spread of the new coronavirus has put strong downward pressure on the domestic economy and prices.

Last month, the Bank of Japan conducted an "inspection" of monetary easing measures and decided to review various measures in preparation for a prolonged large-scale easing, but it has been pointed out that monetary policy has become more complicated.

Governor Kuroda has been in office for 2940 days in 6 days, and is the second longest in history along with Masamichi Yamagiwa, who was the governor of the Bank of Japan in the 1955's.

As the effects of infectious diseases continue to prolong, the challenge continues to be how to achieve price targets while supporting the Japanese economy and how to show the path to normalization of monetary policy.

Monetary policy after taking office as Governor Kuroda

Governor Kuroda of the Bank of Japan took office in March 2013.

He declared that he would achieve the 2% inflation target in about two years, and launched a large-scale monetary easing policy at the monetary policy decision meeting in April immediately after taking office.

The pillar was to significantly increase the purchase of government bonds and supply a large amount of funds to the market, and it was called "Kuroda Bazooka".

In the financial markets, the yen depreciated and stock prices rose at a stretch, but the following year, the consumption tax hike and the sharp drop in crude oil prices will affect the Japanese economy.

As the inflation rate slowed, the Bank of Japan decided in October 2014 to make additional easing in a surprising manner in the market.

We have further increased the amount of money available in the world and accelerated the pace of purchases of ETFs.

However, the price target could not be achieved even after that, and in January 2016, the Bank of Japan decided to introduce a "negative interest rate policy".

This was the first policy in the history of the Bank of Japan to apply a negative interest rate to a part of the "current deposits" that financial institutions deposit with the Bank of Japan, but there are growing voices that it will have a negative impact on asset management and profits of financial institutions. went.

In September 2016, the Bank of Japan conducted a "comprehensive verification" of monetary easing in order to achieve price targets as soon as possible while considering these "side effects."

We decided to introduce monetary easing measures to keep short-term interest rates negative and keep long-term interest rates at around 0%, and the main axis of monetary policy shifted from "quantity" to "interest rates" again.

Since last year, we have further strengthened monetary easing to support the economies affected by the new coronavirus.

As a result of such large-scale easing, the balance of government bonds held by the Bank of Japan was 545 trillion yen as of the end of December last year, accounting for 44% of the total.

The market capitalization of ETFs held by the Bank of Japan also accounts for approximately 7% of the total shares of companies listed on the First Section of the Tokyo Stock Exchange.

However, according to the latest outlook for the economy and prices announced by the Bank of Japan in January, the inflation rate will remain at + 0.7% in 2022, achieving the target by April 2023, the term of office of Governor Kuroda. Is in an extremely difficult situation.