Property Market Observation|Shenzhen regulates the property market 9 times in six months, and the market will enter a stable period this year

Compared with other first-tier cities, Shenzhen's property market will be the first to rise in 2020 at the beginning of the epidemic.

In the whole year of 2020, a total of 167,000 new and second-hand houses were sold in Shenzhen, of which 141,000 were sold for residential houses, the highest transaction volume in the past five years.

However, while the transaction volume hit a record high, Shenzhen's property market is also undergoing a comprehensive renovation in 2020.

Shenzhen has frequently launched a regulatory mode in the past six months to fully and accurately crack down on speculation in the property market.

In 2020, second-hand housing in Shenzhen will be "boosted up" and new housing will be "hot"

The Shenzhen property market has set off a house-buying boom but it will start in the second half of 2019.

The fuse that made Shenzhen's property market rapidly heat up included Shenzhen's initiation of the construction of the "Pioneer Demonstration Zone" and Shenzhen's adjustment of the identification standards for ordinary commercial housing.

On November 11, 2019, Shenzhen adjusted the standard for identification of ordinary commercial housing: the standard for ordinary housing no longer has price regulations, and houses with a plot ratio above 1.0 and a single set of building area below 144 square meters are ordinary residential buildings. Years can be exempted from VAT.

This is considered by the market as "really paying less."

The price of second-hand housing in Shenzhen was also on the highway at this time.

"The transaction price reached a new high", the sale rate of real estate reached 50%, the landlord's reluctance to sell the market, and the signing until one or two in the morning became the Shenzhen property market described by the intermediary.

At the beginning of 2020, the Shenzhen property market was temporarily suspended under the influence of the new crown pneumonia epidemic, but when the epidemic resumed, the Shenzhen property market took the lead to recover.

In April 2020, Shenzhen's second-hand housing transaction volume returned to above 8,000 units, a record high in 16 months, an increase of 25.9% year-on-year.

At the same time, the problems of owners "holding group price increases" and "inflated listing prices" continue to emerge.

This also caused the Shenzhen Municipal Bureau of Housing and Urban-rural Development to take action in May 2020-to conduct on-site inspections of real estate intermediaries, and remove all listings whose listing prices were significantly higher than the real transaction prices.

The Shenzhen Shell Research Institute pointed out that the second-hand housing recovery in Shenzhen in the first half of 2020 exceeded expectations, but it returned to rationality after the second half of the year.

Data show that after the effective control of the epidemic in March 2020, the property market continued to recover. In July, 13,407 second-hand housing online signings reached a monthly peak; after the introduction of the "715" New Deal, the market returned to rationality again, with an average of about 6,000.

In terms of housing prices, the Shenzhen Shell Research Institute's price precision index showed that the index rose during the period of active market activity from March to July, and the price increase slowed significantly after the New Deal, and it stabilized within 2% from August to December.

However, the upside-down of the prices of second-hand houses and new houses has also given birth to the "new craze" for new houses.

In 2020, Shenzhen's rigid demand for real estate increased, and the government's strict price guidance mechanism and other factors have triggered a new upsurge.

"Buying a house is equivalent to 5 million", "10,000 people robbing a house", and "crowdfunding for new projects" have become hot topics, and many home buyers even "make new projects by name".

The upsurge of new fights continues to this day, but it has attracted government attention.

Recently, the Shenzhen Municipal Housing and Construction Bureau suspended the qualifications for online signing and use of provident fund loans for those involved in fraudulent subscription projects.

At the same time, Shenzhen focuses its profit control on reviewing the qualifications of home buyers. In addition to requiring real estate development companies to uniformly use the "home purchase intention registration system," it also requires real estate companies, real estate brokerage agencies, and relevant commercial banks to provide valid identity certificates for home buyers. Household registration, marital status, and family member certification materials; social insurance or individual tax list materials; income certification, credit report, source of house purchase payment, and bank slips of the past one year or more, etc., are strictly checked.

This makes some "speculators" retreat.

Nine times in six months introduced the property market control policy

The cooling of the Shenzhen property market is closely related to the tightening of the property market.

In July 2020, Shenzhen began to increase its property market regulation to curb overheating of the property market.

One of the policies that caused second-hand housing to return to rationality was the "715" New Deal.

On July 15, 2020, the Shenzhen Municipal Bureau of Housing and Urban-rural Development issued the "Notice on Further Promoting the Stable and Healthy Development of the City’s Real Estate Market", which includes adjusting the purchase limit of commercial housing, improving differentiated housing credit measures, giving full play to the role of tax regulation, and refinement Housing standards, strengthen the management of hot real estate sales, implement the management of online signing of housing mortgage contracts, increase the disclosure of second-hand housing transaction information, and severely crack down on violations of laws and regulations in the real estate market.

Subsequently, Shenzhen frequently opened a regulatory model to fully and accurately crack down on speculation in the property market.

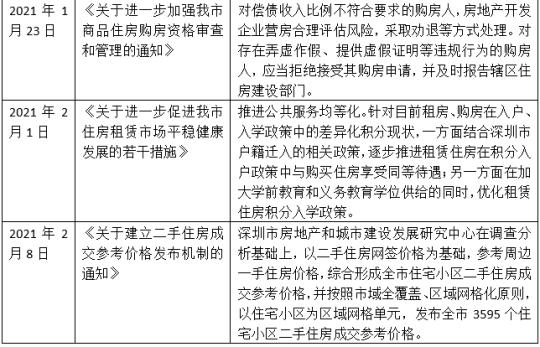

According to incomplete statistics from The Paper (www.thepaper.cn), Shenzhen has issued nine consecutive property market tightening policies in six months.

After the "715" New Deal, on July 30, the Shenzhen Municipal Bureau of Housing and Urban-Rural Development issued the "New Eight" rules for the regulation of the property market, clearly and strictly controlling the listing price of intermediary agencies. Intermediary agencies shall not be allowed if the listing price is significantly higher than the reasonable transaction price of the real estate. Accept and publish to the outside world.

The housing and construction bureaus of all districts should urge intermediary agencies to remove them in a timely manner if the policy has been issued before the introduction.

In addition, on September 10, the People’s Bank of China Shenzhen Central Branch, Shenzhen Housing and Construction Bureau, etc. issued a notice on establishing a marriage information inquiry mechanism to improve housing loan management. Clients’ qualifications for buying houses will be strictly checked and buying houses under false divorce. The plan will no longer be feasible.

On September 17, the Shenzhen Municipal Bureau of Justice issued a notice on soliciting opinions on the "Shenzhen Real Estate Market Regulations (Revised Draft for Comment)."

Among them, the pre-sale policy for commercial housing was adjusted back to the pre-epidemic level, and for the first time requirements for current sales were made. In addition, the Shenzhen competent authority established a reasonable price guidance mechanism for the purchase of stock commercial housing, and regularly released reasonable transaction prices for commercial housing projects in the city.

In October, there was news that some large state-owned banks in Shenzhen tightened mortgage loans to prevent funds from entering the property market in violation of regulations.

At the beginning of 2021, Shenzhen continued its regulatory tightening model, and successively took measures to regulate the market.

At the same time, the control of the second-hand housing market has gradually come into effect.

On February 8, the Shenzhen Municipal Housing and Construction Bureau issued three announcements in a row, announcing the establishment of a second-hand housing transaction reference price release mechanism, and for the first time released the city’s 3595 residential community second-hand housing transaction reference prices.

According to the reference price list, the unit price of the most expensive residential district in Shenzhen was set at 132,000 yuan.

According to the Securities Times, there is a certain gap between the reference price and the market price.

Taking the most expensive communities as an example, the current transaction reference price of Taikoocheng Garden in Nanshan Shekou is 132,000 yuan, but on the Lianjia website, the average price of this community is listed as 205,400 yuan, and 8 sets are listed. In the house, there are 6 units with a unit price of no less than 190,000.

This means that the reference price given by the Shenzhen Bureau of Housing and Urban-rural Development is almost equivalent to 30% off the market price.

According to the interpretation of Wang Feng, a real estate expert of the Ministry of Housing and Urban-Rural Development and Director of the Shenzhen Real Estate and Urban Construction Development Research Center, the reference price of second-hand housing transactions in Shenzhen is released once a year in principle. The mid-price listing price cannot exceed the reference price, and commercial banks will follow the transaction reference price. Grant second-hand housing loans.

Shenzhen's property market "enters a stable period" in 2021

The report of the Shenzhen Shell Research Institute pointed out that the Shenzhen real estate market has experienced an upward period from 2019 to 2020 and is expected to enter a stable period in 2021.

The continued unrelenting of control policies is an important foundation for market stability, and the overall strong demand for home purchases will also support the market's development.

In terms of new housing, supply and demand remained relatively strong.

The increase in the supply of residential land in 2020 and the advancement of old renovation and construction will provide a guarantee for future supply. The "supply year" will continue in 2021, in which the supply of rigidly-needed real estate will occupy a dominant position, and the supply of improvement in some areas will increase.

At the same time, the demand for "new house" still exists. First, buyers naturally favor new houses. Second, the phenomenon of new houses and second-hand upside down still exists in the short-term. Third, new house transactions are more convenient and cheaper than second-hand houses.

For second-hand housing, the market trend is more stable.

The first is the "715 Regulation" and the refinement at the beginning of 2021. The regulation continues to be strict and further restrains some short-term unreasonable demand; the second is the "715 Regulation" second-hand housing market cooling down, the release of housing demand is stable, and development is moving in a rational direction; It is the weakening of demand in high-priced areas, and the increase in the proportion of low- and medium-priced areas and rigid demand housing, which has weakened the hot spots to a certain extent and can effectively curb expectations of price increases.

However, in Shenzhen real estate, the dominant position of the second-hand housing market will not change (that is, about 70%), mainly because the area selection, community selection, and price selection of second-hand housing are more abundant and diversified, which can meet the needs of different buyers. At the same time, the transaction cycle is relatively short, which can meet those urgent housing needs.

(This article is from The Paper. For more original information, please download the "The Paper" APP)

The Paper Journalist Ji Simin Liu Chang Pang Jingtao Tang Yingying