On Tuesday, February 9, world oil prices reached their highest values in more than a year.

Thus, the cost of raw materials of the Brent reference grade on the ICE exchange in London grew by 0.9% - to $ 61.2 per barrel, while the quotations of the American WTI grade rose by 1% - to $ 58.62 per barrel.

The last time similar indicators could be observed back in January 2020.

“The world oil market has all the prerequisites for a return to pre-crisis levels.

For this, prices must firmly consolidate in the range of $ 60-70 per barrel.

So far, the coronavirus pandemic has not gone anywhere and is still putting pressure on quotes, but we believe that by the end of 2021 the market will be able to fully recover from last year's losses, "Natalya Milchakova, deputy head of the Alpari information and analytical center, told RT.

Recall that in 2020, as a result of the introduction of quarantine measures and the massive closure of borders in most states in connection with the pandemic, global fuel consumption began to decline rapidly.

The fall in energy demand led to a decline in oil prices from an average of $ 61.6 per barrel in January to $ 32.2 in March.

Such data are provided by the World Bank.

The actions of the countries participating in the OPEC + deal should have stopped the collapse of oil prices.

It was expected that the states would reduce the production of energy raw materials and thereby balance supply and demand in the global hydrocarbon market.

Meanwhile, in March, following the meeting, the parties could not agree and decided to completely abandon all the obligations assumed.

In April, the situation on the oil market worsened.

In the middle of the month, Brent quotes fell to a minimum in 21 years and fell below $ 16 per barrel at the moment.

In turn, the price of a barrel of WTI for the first time in history fell to negative values and reached minus $ 37.6.

The collapse of the oil market forced oil exporters to return to the negotiating table and resume cooperation.

From May 1 to July 2020, the OPEC + countries began to reduce oil production by a total of 9.7 million barrels per day compared to October 2018.

From August to December, the countries agreed to somewhat ease the restrictions - to 7.7 million barrels, and in January 2021 - to 7.2 million barrels.

Reuters

© Ramzi Boudina / File

Against the background of a decrease in the production of raw materials by the largest exporting countries, average oil prices in the summer of 2020 rose above the psychological mark of $ 40 per barrel, and in January 2021 they exceeded $ 53.

Since February, the OPEC + countries have begun to further reduce production by 1.4 million barrels per day, as a result of which the growth of commodity quotations has accelerated.

“The willingness of a number of OPEC + countries to further restrict production will remain the main factor for oil prices until the end of 2021.

Everything will depend on the agreements of the countries.

If the current restrictions remain in the coming months, the price of Brent will be able to firmly gain a foothold in the range of $ 60-66 per barrel, "said Yevgeny Mironyuk, an analyst at Freedom Finance, in an interview with RT.

Vaccine for the market

In addition to the resumption of the OPEC + deal, oil prices are supported by the recovery in global demand for energy resources.

Back in mid-2020, many states began to gradually lift quarantine restrictions and partially open their borders.

As a result, the number of freight and passenger traffic in the world began to increase, which had a positive effect on fuel consumption.

According to the US Energy Information Administration (EIA), in 2020, global oil demand fell by almost 9% - from 101.2 to 92.2 million barrels per day.

However, according to the organization's forecast, already in 2021 the figure will grow to 97.8 million barrels per day, and in 2022 it will practically return to the pre-crisis level and will amount to 101.1 million barrels per day.

Mass vaccination of the population against coronavirus can accelerate the recovery of global demand for energy resources.

This point of view in a conversation with RT was expressed by the expert of BCS World of Investments Igor Galaktionov.

“We believe that in 2022, global fuel consumption will be able to fully return to pre-pandemic levels.

Vaccination of people from COVID-19 makes it possible to expect such a development of events with greater confidence, since it reduces the likelihood of the introduction of new lockdowns in different parts of the world and thus limits the possibility of new market shocks, "the analyst explained.

Shale Awakening

It is noteworthy that the observed rise in oil prices has led to a gradual revival of shale oil production in the United States.

According to Baker Hughes, since the beginning of 2021, the number of active oil rigs in the States has increased by 32 units to reach 299, the highest since May 2020.

Recall that in 2020, against the background of a sharp collapse in quotations, shale oil production in the United States became unprofitable.

As a result, many US producers of raw materials faced bankruptcy and were forced to leave the market.

However, the rise in prices above $ 50 per barrel again made shale oil production profitable, and drilling activity in the United States began to grow.

“The current prices for WTI crude oil enable many shale producers to rely on high cash flow sufficient to invest in new drilling.

However, the expansion of shale production in the United States may be restrained.

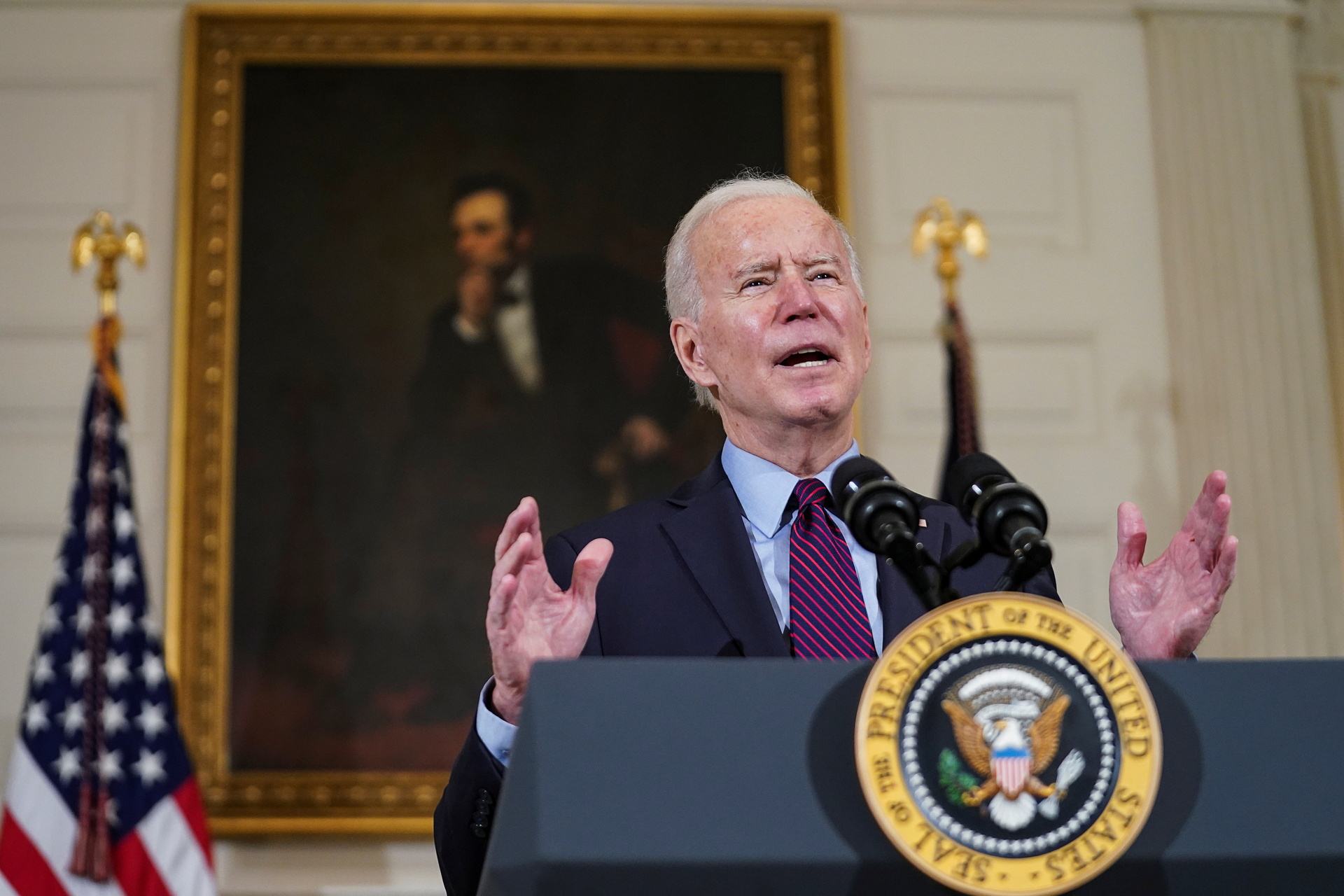

This is largely due to pressure on shale producers from shareholders and Joe Biden's environmental initiatives, ”says Igor Galaktionov.

So, today, oil shale enterprises use their profits not to create new industries, but to pay off debts and pay off funds to investors.

At the same time, the President-elect of the United States ordered to stop issuing permits for the development of shale deposits in federal lands.

Reuters

© Kevin Lamarque

Although many shale producers in the United States prepared ahead of time for a change in production regulation and stocked up on licenses, Joe Biden's innovations could put serious pressure on the industry in the long term.

Viktor Kurilov, an analyst at the Rystad Energy consulting company, told RT about this.

“Now we are not talking about a complete limitation of production, but only about a temporary ban on licensing new areas for drilling.

However, this prohibition was established in order to calculate how much the rental price will be increased as a result of including a tax on carbon dioxide emissions, ”the expert explained.

Ruble support

According to experts, the rise in oil prices should have a positive effect on the state of the Russian economy.

Thus, growing receipts from the sale of energy raw materials will allow to reduce the negative difference between revenues and expenditures of the federal budget faster, Igor Galaktionov believes.

As a result, the financial stability of the country will increase.

Moreover, the government will be able to send additional money to help businesses and the population, the analyst is sure.

“Optimistic forecasts for oil can stimulate the authorities to revise the budget in the direction of increasing government spending.

The authorities will be able to direct more funds to support the economy after the COVID-19 pandemic.

In addition, high oil prices may have a positive impact on the dynamics of the ruble, ”the expert noted.

According to Natalia Milchakova, at current oil prices, in the near future, the dollar and euro rates may gain a foothold near 74 and 88 rubles, respectively.

At the same time, according to Yevgeny Mironyuk, in the absence of geopolitical risks, the dollar may drop to 72 rubles.