Spanish pharmaceutical companies remain immune to the uproar around Covid vaccines and capitalize on supply problems and the row between the big companies in the sector and the European Union.

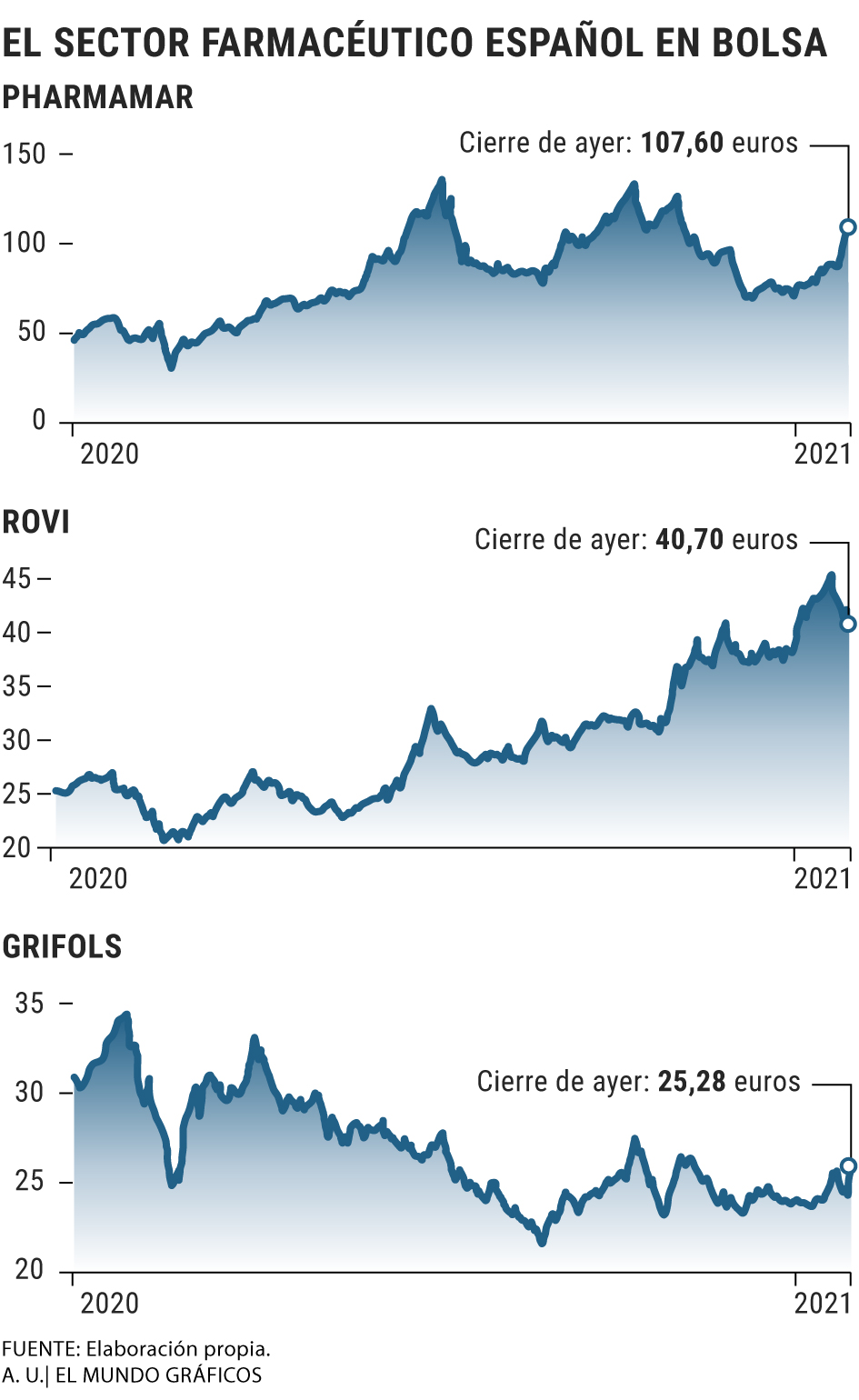

PharmaMar is the most prominent case, with a rise that in this first month of the year already exceeds 50%, but others such as

Grifols, Rovi, Faes or Reig Jofre

also join the stock market rally.

In some cases, such as Rovi, because it is directly involved in the production process of the

v

cradles in alliance with Moderna;

in others, such as that of Grifols or PharmaMar, because difficulties with supply encourage interest in their drugs and treatments.

"They are not affected by what is happening with the distribution because they do not have the development of vaccines," he explains.

Joaquin Robles

, an analyst at investment firm XTB.

In his opinion, investors should

calibrate optimism

compared to stocks such as PharmaMar or Grifols - which accumulates a rise of 5.8% in 2021 - because the increases in recent weeks are not based so much on real and palpable results, but on expectations.

"Hence the volatility in these values"

, aim.

Although all are included under the umbrella of the pharmaceutical sector, each one presents very different characteristics, from the strength of Rovi to the uncertainty of PharmaMar.

"Rovi is benefited by its agreement with Moderna and has a fairly strong growth profile," he says

Antonio Aspas

, manager and partner of

Buy & Hold

.

However, "around PharmaMar there is a lot of noise.

It is an inflated company in its valuation "

.

Each one different

His diagnosis is shared by many investors in the market.

The results of its antiviral Aplidin are not conclusive in the trials that have been carried out so far in humans, although this week the journal

Science

supported its proven effect on animals.

The single publication of the news

spiked the company's shares by 21% on Tuesday

and yesterday they rose again to 107.6 euros.

Almirall's case is different.

The health and economic crisis has hit the

sales of your dermatological products

, especially in the US, where it has a good part of its market.

2020 ended with a 25% decline in the stock market, however, expectations of a recovery have encouraged investors and have caused a 6% revaluation so far this year.

Grifols' strength, for his part, lies in his investigations against the

Cancer

, although it is also trying to take advantage of a possible treatment against Covid-19.

In mid-January, he announced the start of a clinical trial with a new drug that, if positive, would provide immediate immunity against the virus.

His greatest weakness, however, is his

debt

.

Together they capitalize about 18,500 million and despite their positive evolution in those weeks, they do not manage to sneak among the favorites of investor bets.

"For a more defensive portfolio, I would opt for the energy or renewables sector because the exposure of pharmaceutical companies to new drugs makes them very volatile values," says Joaquín Robles, of XTB.

Neither the evolution of its profits in recent years convinces investors and its lack of specialization represents a handicap compared to other profiles such as companies

biotech

.

To continue reading for free

Login Sign Up

Or

subscribe to Premium

and you will have access to all the web content of El Mundo

According to the criteria of The Trust Project

Know more