RAQUEL VILLAÉCIJA

rvillaecija

VÍCTOR MARTÍNEZ

vmartinez_EM

Monday, December 282020-02: 08

Share on Facebook

Share on Twitter

Send by email

Comment

The new year will bring big changes in online shopping.

The entry into force of a new European regulation on electronic payments will force banks and businesses to reinforce the security of all operations, which will make purchases a little more complex as a double verification of the transaction is necessary by mobile phone.

Banks and businesses warn that not all companies have been able to adapt their computer systems to change in the midst of a health pandemic, so they anticipate a high number of incidents during the first weeks of operation.

The financial entities have asked the

Bank of Spain

and the

European Banking Authority (EBA)

to be flexible in the entry into force of the measure and grant an exceptional extension of two months in regard to payments of less than 250 euros.

Financial sources warn of the impact that the entry into force could have in the first days of January, just before the Christmas shopping linked to the Three Kings.

However, the financial authorities reject the new deadlines and point out that an extension of 16 months has already been given for the regulations to come into force.

"There are businesses that have not adapted, and the direct consequence will be a high number of rejections of operations by banks," explains a financial source who has participated in several of the meetings held with the Bank of Spain on this matter in the last weeks.

According to calculations made by the sector, around 20% of businesses have still installed new payment systems, which require verification of transactions through approval through the bank's APP.

In other words, it will no longer be enough to enter the card number and CVV code.

The second fear of the commerce sector is that the lack of practice on the part of users or the incipient state of the new system will translate into an increase in friction in operations, which ultimately implies a strong increase in the rate of shopping abandonment.

"We ask the Bank of Spain for more flexibility so that it does not affect the Christmas trade", they explain in the financial sector.

Sources from the Bank of Spain respond that the institution acts as an interlocutor, but the decisions correspond to the European authorities.

Carlos Torme,

director of expansion of

Aecoc

, warns that the abandonment rate in purchases at the time of payment "is chillingly high" in those businesses that have already implemented the change.

This occurs when the customer abandons the purchase because the payment process becomes cumbersome.

“At that moment, friction occurs in the shopping experience and causes the consumer to abandon the cart.

It is evident that the chain as a whole is not ready for the change ”, he points out.

Merchants and banks agree that the new regulation is very positive because it reinforces security and will reduce fraud in electronic commerce, even if they disagree on the date of entry into force.

Many of these establishments, especially those of medium and small size, have tried to delay as much as possible the update of their systems to prevent it from having an impact just when their physical stores were empty due to the impact of the coronavirus.

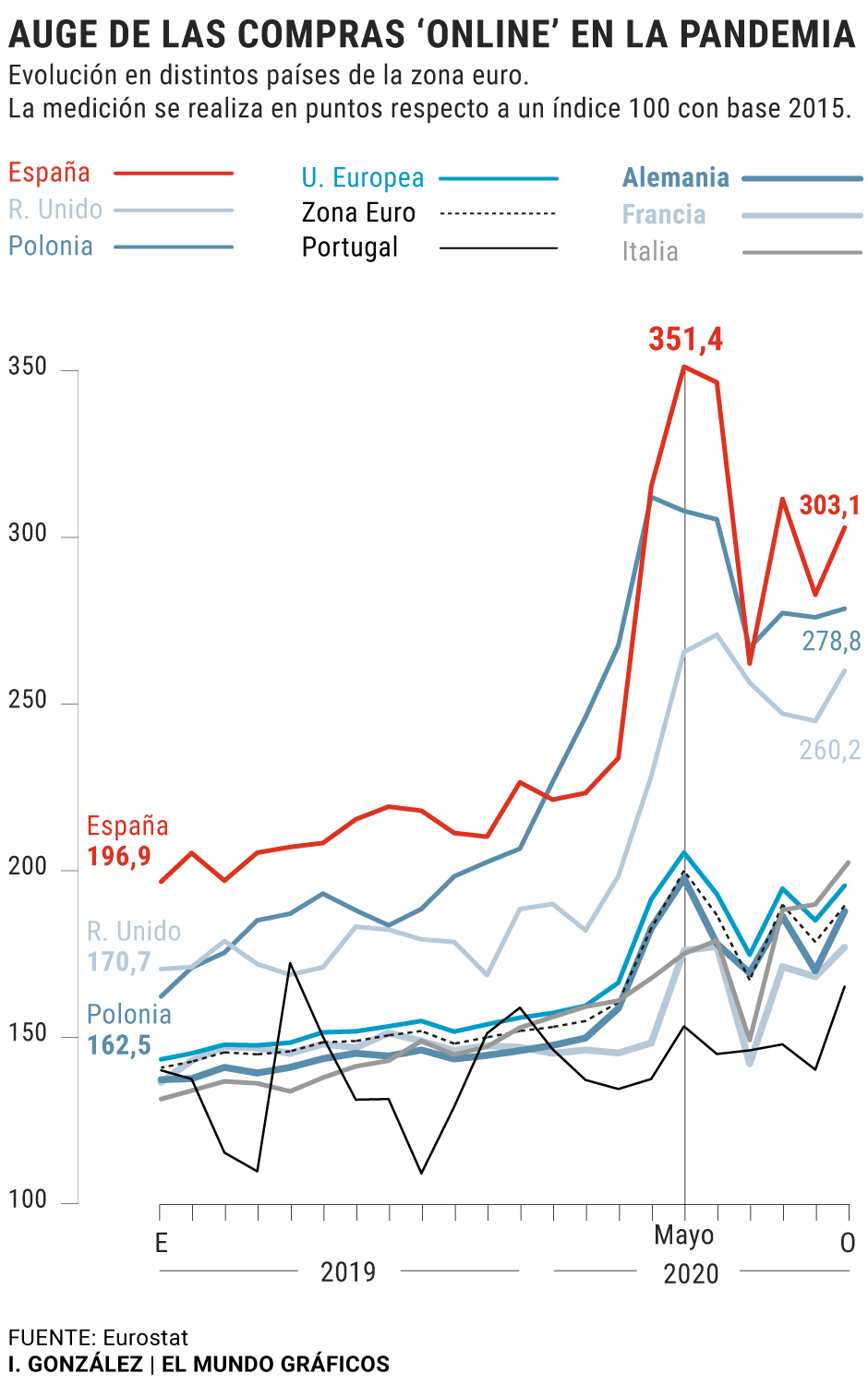

Online shopping boom pandemic

Between 10 and 15% of consumers abandon the purchase under normal conditions, but now the rate "is much higher" and puts at risk between 18,000 and 20,000 million euros of online sales in Spain, according to estimates by the consulting firm

Cmspi.

According to Torme, the trade began to do tests in June "to be able to get to Christmas, which is the period of most purchases, with the operation greased", but with the pandemic "everything has been delayed. Few have been able to to do tests and the results of these have not been good ".

The largest distributors are "those who are best prepared", but "there is a difference between being prepared to comply with the directive and making an optimal implementation of it", that is, that it does not spoil the customer's shopping experience and that the friction rate is the minimum.

Small and medium businesses have more problems, also because "they have had less time to test" and because the large ones achieve exemptions in this authentication process when the information provided between the banks (that of the customer and that of the business) is sufficient.

According to the criteria of The Trust Project

Know more

Spain

EconomyPablo Iglesias supports Díaz in raising the Minimum Wage and demands Sánchez to disavow Calviño

Politics The Provincial Council places the reserve of its contracts for social insertion companies and special centers at 7%

LoteríaONCE: Daily Coupon Draw for Monday, December 21, 2020

See links of interest

Check Christmas Lottery

Club Joventut de Badalona - Hereda San Pablo Burgos

UCAM Murcia - Monbus Obradoiro

Leeds United - Burnley

Iberostar Tenerife - MoraBanc Andorra

Baxi Manresa - Herbalife Gran Canaria