On Thursday, November 5, the global cryptocurrency market showed record growth.

During the trades, the price of bitcoin grew by more than 8% - up to $ 14.9 thousand per coin.

The value was the highest since January 2018.

Other digital assets have shown similar dynamics.

So, for example, Ethereum rose in price by 7% (to $ 411), bitcoin cash - by 6% (to $ 248), and Ripple - by 4% (to $ 0.24).

At the same time, the total capitalization of the electronic money market increased by almost 6% - to $ 421 billion. Such data are provided by the Coinmarketcap portal.

Investors began to actively invest in cryptocurrencies amid the uncertainty surrounding the presidential elections in the United States.

This point of view in a conversation with RT was expressed by the executive director of EXANTE Anatoly Knyazev.

“It is worth noting that bitcoin was gaining strength last week, when securities on world exchanges were getting cheaper.

Probably, by increasing purchases of cryptocurrencies, investors are trying to avoid risks around the dollar and traditional financial instruments.

Players are afraid of possible turmoil and turbulence in the markets if candidates do not admit defeat, ”explained Knyazev.

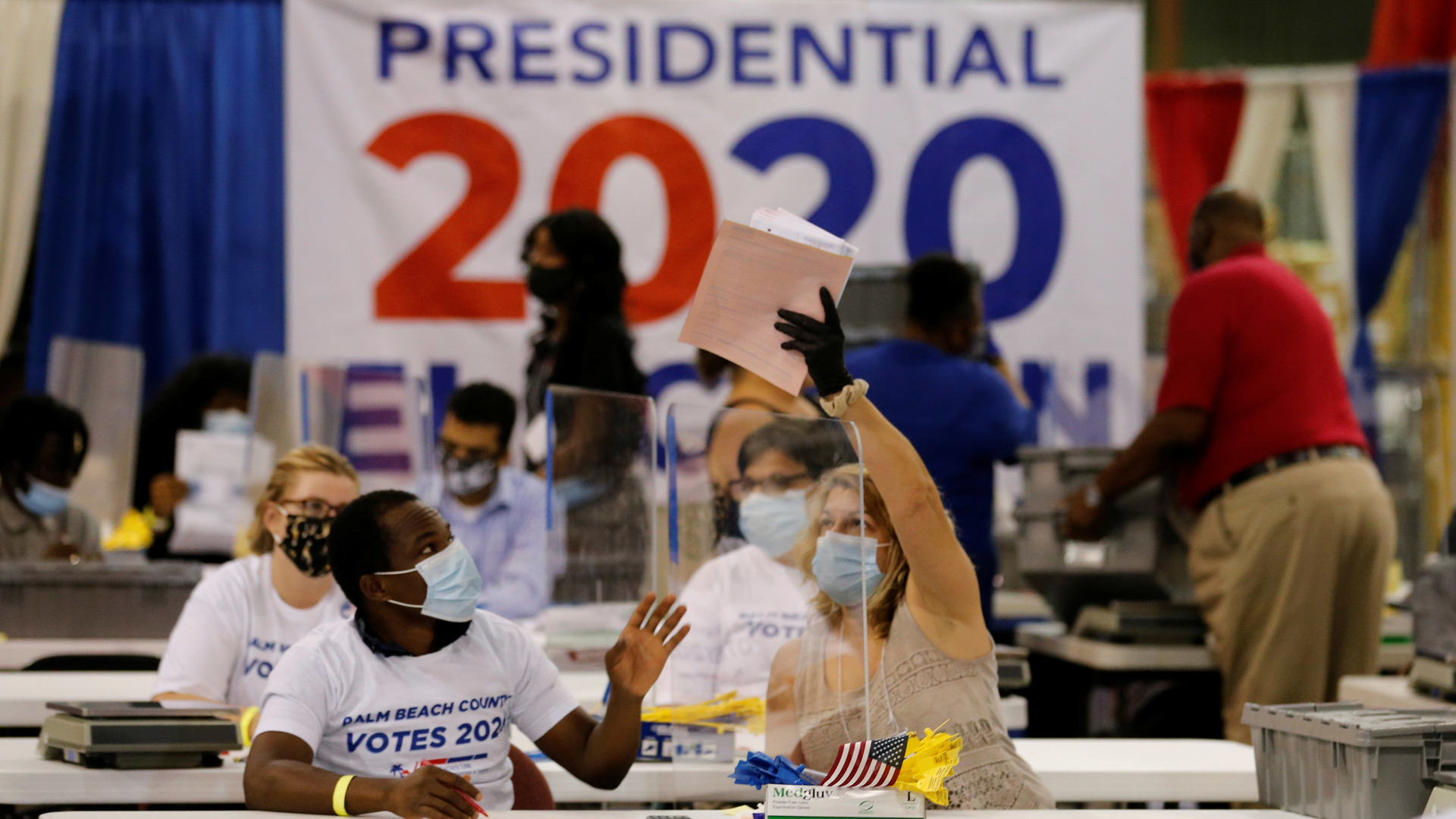

On Tuesday, November 3, a general election was held in the United States.

They elected the president and vice president, 35 senators, all 435 members of the House of Representatives, 13 governors of states and territories, as well as local government representatives.

At the moment, the counting of votes is still going on in the country.

According to the latest data from Fox News, during the presidential race, the incumbent head of the White House, Donald Trump, secured the support of 214 electoral college members, and Joe Biden - 264. To win, a candidate must receive at least 270 votes.

Meanwhile, both candidates for the presidency declared their confidence in their victory in the elections.

Joe Biden's campaign headquarters, without waiting for the official results, created a website about the transfer of power.

In turn, Trump's headquarters are filing lawsuits in the disputed states and demanding the suspension of the counting of votes, as well as the refusal to take into account the "late" ballots.

Reuters

© Joe Skipper

However, regardless of the outcome of the elections, the future US president will have to approve a new stimulus package to restore the economy from the consequences of the coronavirus pandemic.

Such actions of the new head of state may have an additional impact on the value of bitcoin.

Alexander Yanyuk, a CEX.IO Broker finance expert, told RT in an interview about this.

Note that the new measures to support the economy developed by the Trump administration imply budget spending at the level of $ 1.8-1.9 trillion.

In turn, the volume of incentives offered by Joe Biden is $ 2-4.2 trillion.

This is stated in the report of the Committee for the Responsible Federal Budget (CRFB).

Alexander Yanyuk believes that a significant pumping of the economy with money risks leading to a weakening of the dollar.

In this case, the bitcoin rate may additionally grow, the specialist is sure.

“The new package of measures will be adopted in any case.

The question is to what extent.

Interim results show Biden's leadership.

Therefore, traders are already putting into the price of bitcoin a new, more voluminous package of financial assistance to the US economy than the one proposed by the Republicans led by Trump.

However, a smaller amount of aid may lead to a correction of the bitcoin price up to $ 14 thousand, ”Yanyuk stressed.

Meanwhile, the actions of world central banks still play in favor of the cryptocurrency market.

As Oleg Bogdanov, a leading analyst at the QBF Investment Company, explained to RT, since the beginning of 2020, regulators in a number of countries have begun to lower interest rates and pursue super-soft monetary policy to support national economies.

Against this background, inflationary risks began to grow in the world, so investors began to actively invest in precious metals and cryptocurrencies.

“This year, investors have again started looking at bitcoin as an asset to preserve their investments.

Super-soft monetary policy by central banks and zero rates have led to the fact that against the backdrop of a deep economic downturn, everything is growing: from gold and silver to food prices.

Bitcoin is following the same trend, ”Bogdanov added.

In addition, market players continue to respond positively to the decision of the international payment system PayPal to launch a service for the sale, storage and purchase of cryptocurrencies.

The option is expected to be available to US PayPal account holders by early December.

The company's customers from a number of other countries will start using the service only in the first half of 2021 and will be able to pay with electronic coins at 26 million outlets.

"Under these conditions, by the end of 2020, it is quite realistic to reach the $ 16,000 level by bitcoin, but a new historical maximum around $ 20,000 cannot be ruled out. If this record does not happen this year, it is very likely that we will see it next year," Anatoly concluded Knyazev.