- At the beginning of the pandemic, the Russian authorities expected the country's GDP to decline by 5% in 2020, while experts from the International Monetary Fund estimated a likely decline of 6.6%. The economic downturn is now expected to be less severe and close to 4%. What are your predictions on this score?

-

What's interesting is that during the pandemic, Russia turned out to be economically quite stable compared to other emerging markets.

However, we believe that Russia's GDP will decline by about 5% in 2020.

I think for the time being we should be careful about the forecasts of a decrease of 4%, since we still do not have a clear idea of how the situation with the pandemic will develop and how things will be with economic activity by the end of the year.

There is a risk that new difficulties may arise in the coming months due to the second full of pandemic, which some countries have already faced.

We do not know how companies will react in terms of investments, and what new measures of social restrictions the government will have to apply.

- At the same time, many experts believe that the expected decline in Russia's GDP will not be as significant as in a number of other countries. How can this be explained?

- A positive moment for Russia is that the share of the service sector in the country's economy remains much lower than, for example, in Europe.

And we see that the pandemic hit this sector in the first place.

So yes, the Russian economy is in a less difficult position than many European countries.

However, it should be noted that under normal conditions the absence of a strong and developed service sector is rather a minus for the economy.

This state of affairs indicates weak aggregate demand.

However, in the current situation, this has become one of the factors of the stability of the Russian economy, which largely depends on the dynamics of commodity markets.

- What other factors are currently supporting the Russian economy?

- One of the main reasons why the Russian economy turned out to be more stable compared to other emerging markets was the growth of gold and foreign exchange reserves.

They serve as a kind of financial cushion both during and after the crisis.

Interestingly, the central bank, unlike many emerging market economies, was able to reallocate its reserves and reduce its dependence on the dollar even before the pandemic, mainly through the sale of US Treasury bonds.

In many respects, this is why the international reserves of the Central Bank are now extremely high.

If we delve into the statistics, we will see that almost two thirds of Russian international reserves are in gold, euro and Chinese yuan.

All of these assets, especially gold, have risen well in recent months, so in the middle of summer, international reserves reached one of the highest rates on record, exceeding $ 600 billion. This is clearly a very positive moment, and it shows that the Central Bank has done a very good job. before the crisis and copes well with the challenges of the pandemic.

- When do you think the Russian economy will be able to recover from the consequences of the coronavirus?

- As I have already noted, the situation is still uncertain.

But if we proceed from the optimistic scenario, then it may take from two to three years to fully recover the economy from the crisis.

This is a very long process, and we need to be patient, which means that the Central Bank and the government will need to support the economy for a very long time.

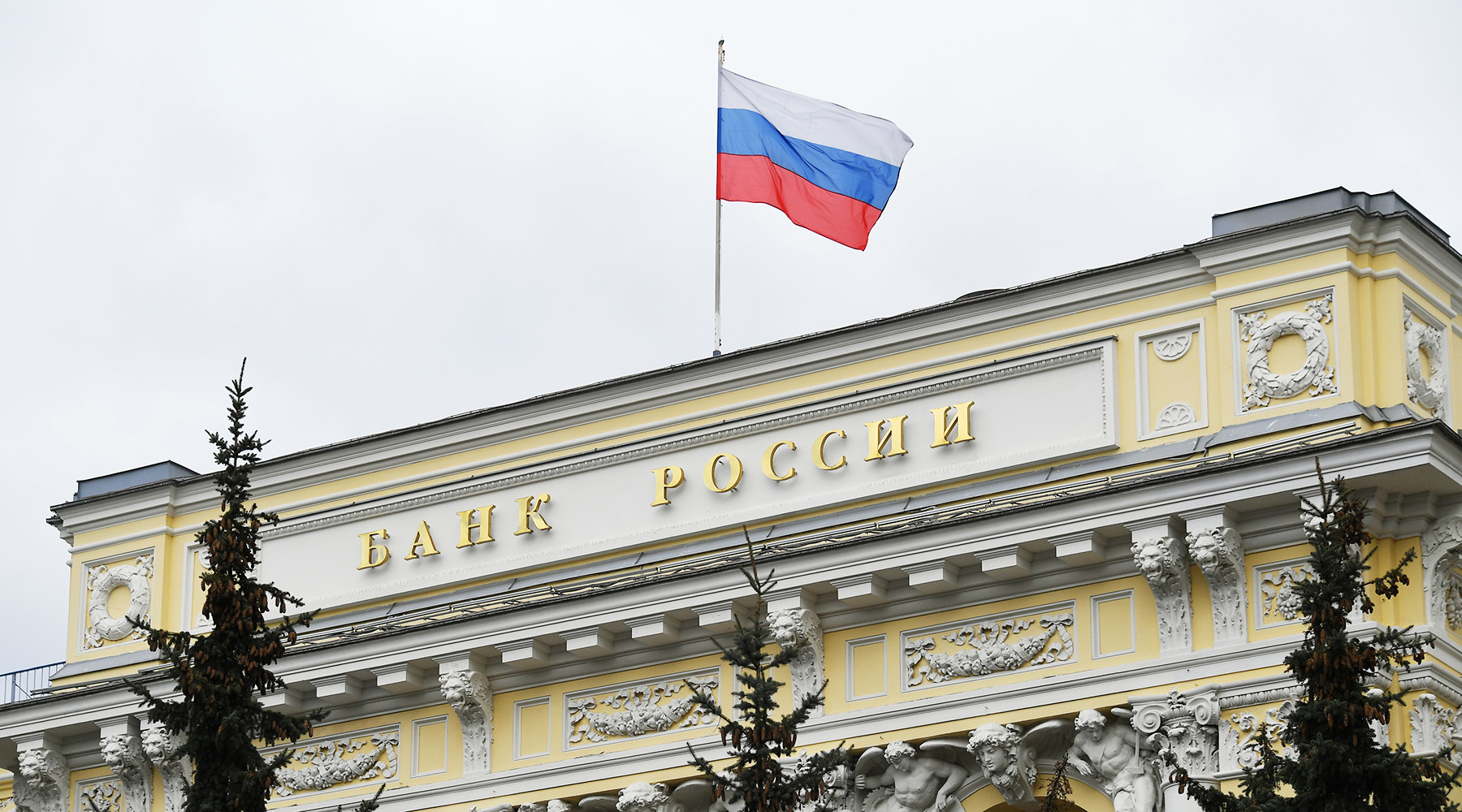

RIA News

© Maxim Blinov

- A serious blow to the economy of Russia and a number of other states was caused by the spring collapse of oil prices. Now quotes have recovered somewhat and are close to $ 40 per barrel. Do you think we should expect the indicator to return to $ 50 per barrel in the near future?

- I don't think this will happen in the near future.

We see that the total demand for hydrocarbons in the world is still rather weak.

However, in our forecasts for the medium and long term, we believe that the price could rise to $ 50 per barrel.

- Against the background of a record collapse in oil prices, Russia also faced a sharp weakening of the ruble. How critical was the depreciation of the national currency for the economy?

-

In previous years we have seen that usually the weakening of the currency became a big problem for the economy, because in most cases it led to higher inflation.

Now the situation is completely different.

Inflation in Russia is still much lower than in most emerging market economies.

As previously calculated by the Central Bank, a 10% decrease in the exchange rate leads to an increase in inflation of less than 1%, which is not so much.

In addition, the depreciation of the ruble contributes to an increase in oil and gas revenues of the Russian budget.

Against this background, we can say that the weakening of the ruble plays into the hands of the economy, but only in the short term.

- Since the beginning of October, some strengthening of the ruble has been outlined on the Russian foreign exchange market. Should we expect this trend to continue in the coming months?

- I think that in the coming months we will continue to observe fluctuations in the foreign exchange market, especially in November, due to the high uncertainty regarding the US presidential election.

In addition, the ruble will continue to remain under pressure against the dollar due to investors' concerns about the introduction of new quarantine restrictions in the world.

- In the context of a pandemic, the International Monetary Fund and a number of other organizations note an unprecedented increase in the global public debt. How can the growth of debt burden threaten the world economy?

-

We believe that public debt in most developed countries is no longer a problem, as central banks such as the European Central Bank, the Federal Reserve, and so on have clearly stated that they will cover the entire amount of public debt arising from the pandemic.

So in the short and medium term, public debt in developed countries, where central banks are strengthening their market positions, is not an issue.

In many emerging markets, central banks also strongly support the need to increase public debt to counter the pandemic.

Russia, in turn, manages its public debt well and I see that the country's public debt is still very attractive to foreign investors.

However, the growth of private debt due to the very difficult economic situation can become a global problem.

We remember that after 2008 the biggest problem was public debt, now it will be private debt, because after the pandemic and global isolation there will be many bankruptcies.