GDP growth in the third quarter may exceed 5%, and China's economic recovery will accelerate

The third quarter macroeconomic "report card" will be unveiled soon. The National Bureau of Statistics will announce the latest economic indicators such as GDP growth, industry, consumption, and investment on October 19.

Judging from the leading indicators PMI, electricity generation and consumption, prices, imports and exports, and financial data that have been released, the economy is showing a strong recovery trend.

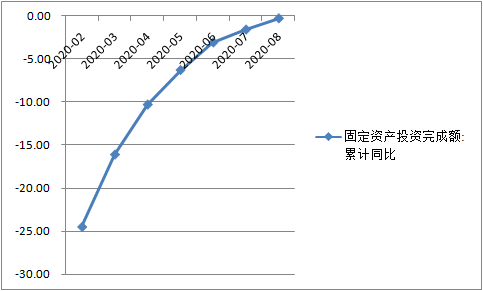

With the accelerated recovery of supply and demand, industrial production will continue to recover in September, consumption will continue to improve, and the cumulative growth rate of fixed asset investment and infrastructure investment is expected to "turn positive".

According to expert analysis, China's macroeconomic prosperity continued to rise on the basis of a "V"-shaped rebound in the second quarter, and GDP growth in the third quarter may exceed 5%.

Looking ahead to the macroeconomic policy in the fourth quarter, the monetary policy will continue to maintain "money stabilization + wide credit", while fiscal policy has sufficient room for force, and fiscal expenditure is expected to maintain double-digit growth.

The current macro-control should pay more attention to increasing residents’ income and improving income distribution to stimulate consumption as an important engine of economic development.

GDP growth rate may exceed 5%

The International Monetary Fund (IMF) recently released the latest issue of the World Economic Outlook.

Compared with its forecast in June, the IMF raised its forecast for China's 2020 economic growth rate by 0.9 percentage points to 1.9%. It is still the only major economy that can achieve positive growth.

Wang Jun, a member of the Academic Committee of the China International Exchange Center, told CBN that the economy continued to recover steadily in the third quarter, and the weak domestic demand has improved, and GDP growth is expected to be around 5.2%.

Wu Chaoming, deputy dean of the Financial Information Research Institute, also believes that domestic economic growth is gradually returning to potential growth driven by accelerated investment and consumption restoration. It is estimated that GDP will grow by about 5.4% in the third quarter and about 6% in the fourth quarter. Approximately an increase of 2.3%.

The results of a survey conducted by the chief economist of China Business News in September showed that the average GDP growth forecast for the third quarter rose sharply from 3.2% in the previous quarter to 5.26%.

At the Chongqing Jiefangbei Forum held on October 15, Yang Weimin, the former deputy director of the Office of the Central Finance and Economics Leading Group, analyzed that China’s rapid economic recovery was due to the fact that the basic conditions for China’s stable economic growth remained unchanged, and the government effectively controlled the epidemic in the short term. Spreading, a stronger hedging policy was introduced, and fiscal and monetary policies were strong.

However, Yang Weimin also pointed out that the current economic recovery is not balanced, the supply side recovers faster than the demand side, investment on the demand side recovers faster than consumption, and the digital financial and information service industries in the tertiary industry are growing faster than others. industry.

The impact of the epidemic is superimposed on some long-term and structural issues, such as the continuous decline in the consumption rate of residents, the sluggish manufacturing and private investment, and the pressure of rising real estate prices, which are all worthy of attention.

A number of economic data exceeded expectations

It is not surprising that GDP growth is expected to accelerate in the third quarter. Judging from the published leading indicators of PMI, electricity generation and consumption, prices, imports and exports, and financial data, the economy is showing a strong recovery.

The PMI in September was 51.5%, an increase of 0.5 percentage point from the previous month, and it has been operating within the 50% range for seven consecutive months.

Physical volume indicators such as electricity generation and consumption, railway freight volume, and crude steel output also continued to improve.

In August, the national industrial power generation above designated size rebounded rapidly, with a year-on-year increase of 6.8%, an increase of 4.9% from the previous month; the cumulative power generation growth rate from January to August turned from negative to positive for the first time, with a year-on-year increase of 0.3%.

In the first eight months, the cumulative electricity consumption growth rate of the whole society also turned from negative to positive for the first time, with a year-on-year increase of 0.5%.

In September, CPI rose 1.7% year-on-year and 0.2% month-on-month; PPI fell 2.1% year-on-year and rose 0.1% month-on-month.

According to analysis by Wang Han, chief economist of Industrial Securities, the means of production in the PPI continue to rebound year-on-year, and if the impact of oil prices is excluded, its rebound will be more obvious, which is consistent with the domestic investment demand still picking up.

Wu Chaoming said that domestic demand restoration, especially the release of infrastructure and real estate investment demand, will support domestic industrial product prices.

However, the peak of the overseas epidemic has not arrived, the global economic recovery is uncertain, and commodity prices lack the basis for a sharp rise. The PPI will be slowly repaired in the next few months.

In terms of financial data, in September, the growth rate of credit, social financing and M2 continued to exceed expectations, and financial support for the real economy continued to increase.

In September, RMB loans increased by 1.9 trillion yuan, a year-on-year increase of 204.7 billion.

In the first three quarters, the cumulative increase in social financing was 29.62 trillion yuan, which was 9.01 trillion yuan more than the same period last year and was close to the annual target of 30 trillion yuan.

At the end of September, M2 increased by 10.9% year-on-year, and rebounded again after two consecutive months of decline; M1 increased by 8.1% year-on-year.

Zeng Gang, deputy director of the National Finance and Development Laboratory, believes that at the end of September, M1 was 4.7 percentage points higher than the same period of the previous year, setting a new high since March 2018, indicating that economic activity has increased significantly and business vitality has increased significantly.

In addition, the total value of my country's import and export of goods trade in the first three quarters was 23.12 trillion yuan, an increase of 0.7% over the same period last year.

The total value of imports and exports, total exports, and total imports in the third quarter all hit a quarterly record high.

In the first eight months, cumulative exports achieved positive growth, and cumulative imports and exports achieved positive growth in the first three quarters.

Increased endogenous momentum for economic recovery

Economic indicators such as industry, consumption, and investment for the third quarter will be released on the 19th.

At present, the production side is strong, and the demand side is picking up steadily.

The year-on-year growth rate of industrial added value in August has exceeded the level of the same period last year.

According to Wu Chaoming’s analysis of CBN, industrial growth in the third quarter may be around 5.4%, overseas economic belt epidemics restarted, and demand rebounded; domestic epidemic prevention and control have made substantial progress, and the service industry and consumption have resumed growth, plus infrastructure and construction projects since the second quarter. The growth rate of real estate investment turned positive, and the interaction between supply and demand drove steady growth on the supply side.

In terms of consumption, the growth rate of total retail sales of consumer goods in August turned positive for the first time this year, and is expected to continue to accelerate in September.

Wang Jun told China Business News that consumption growth in September is expected to reach about 3%.

The auto consumption stimulus policy continued to advance, the superimposed high base effect faded, passenger car approvals and retail sales growth both rose sharply, and the recovery of auto consumption significantly boosted social consumer goods.

In addition, as the epidemic situation further improves, catering consumption continues to rebound, and the film market continues to open up, stimulating the offline consumer market, which has a certain boost to the improvement of social zero growth performance.

In terms of investment, the cumulative growth rate of fixed asset investment in the third quarter is expected to turn positive, real estate investment gradually strengthened, and the growth rate of manufacturing investment and private investment rebounded significantly.

Infrastructure investment will usher in a faster rebound when the southern flood season recedes and the use of fiscal funds accelerates to form physical quantities.

It is worth mentioning that from January to August, private investment fell by 2.8% year-on-year, and the rate of decline narrowed by 2.9 percentage points from January to July. Among them, the rate of decline of private investment in manufacturing and infrastructure decreased by 2.1 and 0.5 percentage points, respectively. The endogenous power gradually recovered.

Meng Wei, a spokesman for the National Development and Reform Commission, said recently that the decline in private investment has significantly narrowed, which is a positive sign.

It will further improve the long-term mechanism for promoting projects to private capital, support private investment in making up for shortcomings and new infrastructure construction, and fully mobilize the enthusiasm of private investment.

Allow the macro leverage ratio to rise gradually

Looking ahead to the macroeconomic policy in the fourth quarter, although the central bank has weakened its counter-cyclical adjustments to hedge against the impact of the epidemic, the possibility of a direct shift in monetary policy during the year is low.

Ruan Jianhong, Director of the Investigation and Statistics Department of the Central Bank, stated on October 14 that the rebound in macro leverage since the beginning of this year is a manifestation of macro policies that support epidemic prevention and control and the recovery of the national economy. A phased increase in macro leverage should be allowed to expand the impact on the real economy. Credit support.

Wen Bin, chief researcher of Minsheng Bank, believes that in the next stage, monetary policy should continue to increase support for the real economy while strengthening risk prevention.

On the one hand, enhance the intensity and effect of structural policies, and provide precise support for weak links in the recovery and development of the real economy, such as manufacturing, small and medium-sized enterprises, etc.; on the other hand, do not engage in “flood flooding” to prevent the influx of funds into the real estate market. Increase the asset price bubble, while continuing to pay close attention to the international economy and the epidemic situation, and be prepared for the sharp appreciation of the renminbi and the possible large fluctuations in cross-border capital.

In terms of fiscal policy, Wu Chaoming believes that there is sufficient room for fiscal development in the fourth quarter, and the focus is on improving the efficiency of capital use and accelerating the formation of physical workloads.

It is expected that with the central budgetary investment, special bonds, special treasury bonds and other funds issued one after another, the start of projects and the availability of funds will continue to improve, and fiscal expenditures in the fourth quarter are expected to maintain double-digit growth.

Wang Jun also said that the GDP growth rate in the fourth quarter is expected to reach 5.5% to 6%, but the pace of recovery has slowed marginally relative to the second and third quarters.

There are some hidden worries and problems in the current economy. For example, the income growth of urban and rural residents is still not as fast as the recovery of economic growth, and the expansion of consumption lacks fundamental support.

He suggested that the current macro-control should shift from the traditional means of expanding investment, stimulating consumption and expanding exports, to focusing more on increasing residents’ income and improving income distribution, so as to stimulate consumption as an important engine of economic development.

Increasing income is the core and foundation of stabilizing consumption and forming a "double cycle".