The State Council issued a document requesting quality improvement. What is the quality of A-share companies?

After the "Opinions of the State Council on Further Improving the Quality of Listed Companies" (hereinafter referred to as the "Opinions") was issued on October 9, the China Securities Regulatory Commission and the Shanghai and Shenzhen Stock Exchanges immediately organized the study and publicly stated that they will resolutely implement them.

The State Council puts forward 17 requirements from the perspective of improving the quality of listed companies, covering six aspects including improving the governance of listed companies, promoting better and stronger listed companies, improving the exit mechanism, solving outstanding problems, increasing illegal costs, and forming work force.

"(The "Opinions") has made systematic and targeted deployment arrangements for improving the quality of listed companies. It is a programmatic document to promote the high-quality development of listed companies for a period of time. The top priority of comprehensively deepening the reform of the capital market, adhere to the general tone of seeking progress while maintaining stability, and earnestly grasp the implementation of the "Opinions" under the unified command and coordination of the Financial Commission of the State Council.

For all parties concerned about the development of the A-share market, the release of the "Opinions" is not unexpected.

Since last year alone, LeTV, which has been issued a huge ticket of 240 million, Kangmei Pharmaceutical which was transferred to the judiciary, and Zhangzidao which was transferred to the public security, are breathtakingly rampant in violation of laws and regulations.

However, it is worth noting that the deployment of decision-makers to promote the high-quality development of listed companies has already begun before this.

In November 2019, after the China Securities Regulatory Commission formulated the Action Plan for Promoting the Improvement of the Quality of Listed Companies, various reforms and rules were introduced at a high density, and the exchange established a special working group to fully promote the improvement of the quality of listed companies.

Management quality: growth in differentiation, but the alarm has not been lifted

Listed companies have always been called the "heavy weapon of the country" of the real economy and the "important carrier" of two-wheel drive development.

At present, there are more than 4,000 listed companies in Shanghai and Shenzhen, covering key leading companies in various industries and companies with strong core competitiveness in subdivisions.

However, as stated in the "Opinions", "currently, problems such as irregular operation and governance of listed companies and poor development quality are still prominent."

In the first three quarters of 2020, affected by the new crown pneumonia epidemic, all types of companies, including listed companies, have encountered severe challenges, and the production and operation of a large number of companies have been affected.

Observe the performance growth of A-share companies based on the 2019 annual report data, which is more representative.

According to data from the Shanghai Stock Exchange, in 2019, more than 1,500 companies on the Shanghai Stock Exchange’s main board achieved annual operating income of 37.21 trillion yuan, a year-on-year increase of 9%, accounting for nearly 40% of the country’s total GDP; a total of 3.19 trillion yuan in net profit, a year-on-year increase 9%, net profit after deducting non-profits was 2.97 trillion yuan, an increase of 8% year-on-year.

Blue-chip performance of the broader market was outstanding.

SSE 50 achieved operating income of 19.19 trillion yuan and net profit of 2.17 trillion yuan, an increase of 9% and 11% year-on-year respectively, accounting for 52% of the Shanghai stock market’s overall operating income and 68% of overall profit.

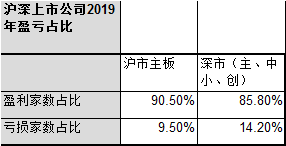

Of course, not all of the more than 1,500 companies are profitable, and some companies have difficulties and risks in their operations.

In 2019, 141 companies on the main board of the Shanghai Stock Exchange suffered losses, basically the same as in 2018.

From the perspective of the overall loss, the loss in 2019 was about 117.8 billion yuan, which was basically the same as in 2018.

In terms of pledge and goodwill risks, as of the end of 2019, there were 1,170 companies pledged on the main board of the Shanghai Stock Exchange, a net decrease of 203 from the beginning of the year, and 143 companies with more than 80% pledged by controlling shareholders, a net decrease of 51 from the beginning of the year.

In 2019, the Shanghai Stock Exchange's main board company's goodwill balance was 535.5 billion yuan, and a total of 18.5 billion yuan of goodwill impairment reserves were made, which was significantly lower than in 2018.

At present, the Shanghai Stock Exchange main board pledge and goodwill risks have been released to a certain extent, but from a structural point of view, the high pledge risk of some private enterprises still continues. The goodwill of some early "three high" restructuring companies remains high, and the follow-up still needs to be closely monitored.

Shenzhen companies present similar characteristics.

According to data from the Shenzhen Stock Exchange, the total operating income of Shenzhen companies in 2019 was 13.3 trillion yuan, a year-on-year increase of 10.2%; of which, the main board, small and medium-sized boards and ChiNext were 6.5 trillion yuan, 5.2 trillion yuan and 1.6 trillion yuan, respectively. Increases of 9.7%, 10.3% and 11.7% were significantly higher than the 3.8% revenue growth of industrial enterprises above designated size.

In terms of profitability, 60% of the companies increased year-on-year, and the main board, small and medium-sized board and ChiNext achieved net profits of 356.51 billion yuan, 223.57 billion yuan and 51.92 billion yuan, respectively, up 1.1%, 2.4% and 29.1% year-on-year.

In terms of goodwill, the total impairment of goodwill dropped significantly year-on-year. As of the end of 2019, the book value of goodwill of Shenzhen companies was 721.68 billion yuan, accounting for 7.2% of the current total operating income.

However, under the influence of external uncertainty, the huge loss of "face-changing" caused by this still requires vigilance.

In addition, the compliance risks of a few companies have become prominent when the economy is down.

In Shenzhen, 99 companies have suffered losses for two consecutive years, and 8 companies have suffered losses for three consecutive years.

As of the end of April 2020, 134 companies have been issued non-standard audit opinions.

In the general environment of economic downturn, listed companies are generally under greater operating pressure, and illegal activities such as financial fraud, illegal letter disclosure, and illegal occupation of funds may increase.

Credit quality: The game mechanism is prominent, but fraud and loss of control are still prominent

Financial data can be described as the most important information in the information that a listed company needs to disclose.

In recent years, the number of "non-standard" reports issued by listed companies has gradually increased.

On the one hand, it shows that the role of "gatekeeper" of intermediary agencies is gradually playing a role, but on the other hand, it also shows that the issue of information disclosure by listed companies deserves attention.

The previously released "Report on Accounting Supervision of Annual Reports of Listed Companies in 2019" (hereinafter referred to as the "Report") previously issued by the China Securities Regulatory Commission shows that in 2019, 274 companies in the Shanghai and Shenzhen markets were issued non-standard audit opinions on their annual financial reports.

Among them, 45 were unable to express their opinions, 126 had qualified opinions, 102 had unqualified opinions with explanatory notes, and one was issued a negative opinion.

In the previous year, the aforementioned figures were 219, 38, 82, 99 and 0 companies.

The "Report" shows that the overall quality of the implementation of corporate accounting standards and financial information disclosure rules by listed companies is relatively good, but some listed companies still have problems with inadequate understanding and implementation of the standards.

Conventional problems include improper classification of financial assets, equity investments, etc., unreasonable judgments on the timing of income recognition and the scope of consolidated statements, improper fair value measurement and asset impairment estimation, and incorrect presentation of asset-liability liquidity and cash flow. Inadequate disclosure of major transactions and events, etc.

The China Securities Regulatory Commission disclosed in early August that in the first half of 2020, there were 165 new illegal cases of various types in the capital market, 59 suspected securities crime cases and clues were transferred to the public security organs, and 98 administrative penalty decisions were made, with a total fine of 3.839 billion yuan. .

Financial fraud cases bear the brunt.

In the first half of the year, the China Securities Regulatory Commission filed investigations into 35 listed companies including Yihua Life, Yudiamond, and VV for suspected violations of information disclosure, and imposed administrative penalties on 43 cases of false statements.

For example, Tang Wanxin and others manipulated Steyr’s fictitious technology transfer to inflated profits of 280 million yuan; Oriental Jinyu’s fictitious jade rough sales increased inflated profits of 350 million yuan; Changyuan Group used its commissioned agency sales business to recognize revenue in advance; The performance of the restructuring promised to put "toxic" assets into Ningbo Dongli, fictitious overseas business and other inflated profits of 430 million yuan.

The number of cases in which major shareholders and actual controllers occupy funds, illegal guarantees, and harm the interests of listed companies and small and medium shareholders is also quite alarming.

In the first half of this year alone, the China Securities Regulatory Commission filed and investigated 24 cases of failure to disclose such material information in accordance with regulations, and some cases involved vicious transfer of interests.

For example, Xinguang Yuancheng provided 1.4 billion yuan in funds to major shareholders under the guise of payment of equity, debt transfers, etc., but failed to truthfully disclose; Yinhe Biosciences provided guarantees for external loans of major shareholders and other related parties for 15 times and failed to truthfully disclose a total of 1.54 billion yuan; Control Interaction, the actual controller of Yufu shares borrowed externally in the name of the listed company, borrowed from the bank with the bank deposit of the listed company as a pledge, and transferred the funds to the account controlled by the major shareholder.

Related entities of listed companies violate the law, often accompanied by the absence of "gatekeepers" in intermediaries.

In the first half of this year, the China Securities Regulatory Commission conducted "double investigations in one case" on six accounting firms.

In the first six months, a total of 10 new intermediary violation cases were added, including 8 audit institutions, 1 sponsor institution, and 1 appraisal firm.

The investigation found that even some auditing agencies cooperated with listed companies to forge bank deposits and inquiries.

"On April 7, April 15, and May 4, the Financial Committee of the State Council convened three consecutive meetings, all of which proposed to resolutely combat fraud in the capital market." Yan Qingmin, the vice chairman of the China Securities Regulatory Commission, was in the China Association of Listed Companies 2020 in June this year. It was stated at the annual meeting that listed companies have problems such as insufficient awareness of integrity, insufficient corporate governance effectiveness, and absence of public company responsibility obligations.

He said: "A company that is dishonest cannot gain a foothold in the market. What the company has accumulated is not wealth but disaster."

The executive meeting of the State Council held on September 23 specifically made arrangements for improving the quality of listed companies and put forward three "requirements", including first, improving the rules of the listed company governance system, second, promoting listed companies to become better and stronger, and third, exerting the joint efforts of departments Strengthen supervision.

The "Opinions" released in full this time further put forward comprehensive and specific requirements.

The China Securities Regulatory Commission stated on October 9 that it will improve the system of rules and regulations that promote the high-quality development of listed companies, unswervingly promote the comprehensive deepening of the reform and opening of the capital market, and increase key reforms.

At the same time, efforts are made to strengthen cooperation with local governments, relevant ministries and commissions, and continuously optimize the policy environment and ecological system, strive to form a new pattern of improving the quality of listed companies, and jointly promote the high-quality development of listed companies.