GEM registration system full moon: stocks increased to 33, with a market value of over 375 billion

Since August 24, the first batch of companies that reformed and piloted the registration system for the Growth Enterprise Market were listed for trading. By September 24, the registration system for the Growth Enterprise Market has been in operation for one month.

Within one month, the number of listed stocks under the registration system has increased from the first batch of 18 to the current 33. The 33 stocks have increased by an average of 200.47% compared to the issue price, and the total market value has reached 375 billion yuan.

According to industry insiders, the market performance of the GEM registration system in the first month is worthy of recognition, and there have also been some events exceeding market expectations. In the future, the reforms need to be further promoted through the continuous improvement of the system and the strengthening of supervision.

An average increase of 200% from the issue price, with a total market value of 375 billion

After the implementation of the registration system, the pace of listing of new shares on the ChiNext has accelerated significantly.

On August 24, the first batch of 18 stocks were listed on the GEM reform and pilot registration system. After that, 3 stocks were listed on September 1, September 10, September 16, September 17, and September 24 respectively. , So far, the number of GEM registered stocks has reached 33.

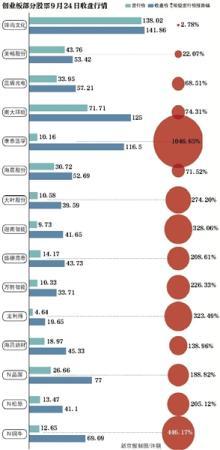

On September 24, 33 stocks rose an average of 26.07%.

Among them, the three new stocks listed on the same day, Tongniu Information, Songyuan shares, and Pinwo Foods, rose the most by 446.17%, 205.12%, and 188.82% respectively.

A total of 22 stocks rose, Jinchun shares 20% daily limit; 11 stocks fell, of which Carbide and Kangtai Medical fell more than 10%.

As of the close of the market on September 24, 33 stocks have increased by an average of 200.47% from their issue prices, and a total of 23 stocks have increased by more than 100% from their issue prices.

Among them, Kangtai Medical had the highest increase, reaching 1046.65%.

Kangtai Medical was one of the first listed stocks on August 24. Its issue price was 10.16 yuan per share, and it closed at 116.5 yuan on September 24. The stock price has risen 10 times in one month.

In addition, in addition to the new shares that were just listed yesterday, the companies that have seen higher price increases compared to the issue price include Kappel, which rose by 507.24%; Huiyun Titanium, which was listed on September 17, rose by 411.81%; Canaan Smart and Longlead respectively Increased 328.06%, 323.49%.

The smallest increase in the issue price was Fengshang Culture, which was also one of the first listed stocks, rising only 2.78% in one month.

Among the registered stocks on the GEM, a total of 8 100-yuan stocks were born, of which Fengshang Culture had the highest stock price, reaching 141.86 yuan per share, ranking 15th among all stocks on the GEM; followed by Anker Innovation, 138.88 yuan /Share, ranking 17th among all stocks on the GEM; third is Nanda Environment, with RMB 125 per share, ranking 21st among all stocks on the GEM.

From the perspective of total market value, as of the close of September 24, the total market value of 33 stocks under the GEM registration system reached 375 billion yuan.

There are 7 companies with a total market value of more than 10 billion yuan.

Among them, Anke Innovation has the highest total market value with 56.45 billion yuan; followed by Steady Medical, reaching 52.15 billion yuan; and the third is Kangtai Medicine, with a total market value of 46.81 billion yuan.

Judging from the transaction situation, the average turnover rate of the first 18 stocks under the GEM registration system was 59.2% on the first day of listing on August 24. As of September 24, the average turnover rate of 33 stocks had stabilized at 34. %, the transaction gradually stabilized.

The expansion of registered stocks has also increased the overall market turnover of the ChiNext. According to Wind data, from August 24 to September 24, the average daily turnover of ChiNext reached 267.152 billion yuan, accounting for the proportion of the total turnover of A shares. From about 25% to more than 30%.

Relaxing the limit on price increases and increasing activity brings fluctuations in individual stocks

Dong Dengxin, director of the Institute of Financial Securities at Wuhan University of Science and Technology, told the Beijing News that the operation of the ChiNext in the past month can be said to have been smooth and smooth.

This indicates that new progress has been made in the expansion of the Growth Enterprise Market. On the other hand, it also proves that the pilot registration system of the Science and Technology Innovation Board is relatively successful. Therefore, the Growth Enterprise Market is faster and more effective in copying the experience of the Science and Technology Innovation Board.

Dong Dengxin said that the most significant change brought by the registration system to the Growth Enterprise Market is the active trading and the significant increase in trading volume.

Before the implementation of the registration system, the daily turnover of the Growth Enterprise Market accounted for less than 20% of the A shares. After the implementation of the registration system, this proportion increased to 30%.

After the reform of the GEM registration system, it has brought a larger incremental capital and active investors to the market. The main reason is that the registration system reform has provided a greater limit on the stock market’s rise and fall of individual stocks, from 10%. Up to 20%, compared with the small and medium board and the main board, the stock stocks of the ChiNext show a huge advantage, which has attracted speculative funds to a large extent.

Coupled with the issuance of incremental stocks on the GEM, it has also increased its popularity.

With the increase and decrease limit of stock stocks simultaneously magnified to 20%, the ChiNext exhibited relatively large fluctuations in individual stock stocks.

"Tianshan Bio", "Yu Diamond", "Changfang Group" and other GEM stocks with small circulating market value, low prices and poor fundamentals, their stock prices rose rapidly in the short term, and the phenomenon of speculation was prominent. On September 8, the Shenzhen Stock Exchange gave three stocks Suspension verification.

Gui Haoming, chief market expert of Shenwan Hongyuan, said that the first month of the GEM registration system has achieved the expected goal. A group of companies listed in accordance with the new standards have been able to operate smoothly. Under the new trading system in the secondary market, although some The performance of the stock has exceeded the unexpected, but there is also a process of gradually stabilizing.

One month’s time to measure the results of the registration system is still too short. In particular, the GEM is carrying out stock reforms. The stock reforms are more complicated than the previous ones. The current phenomenon of individual stocks being hyped has also been adopted by relevant departments. With effective measures to contain them, how to balance and standardize the problems that arise in the development process requires a process.

When the registration system of the GEM was in operation for three weeks, on September 9th, the first broken issue of registered stocks appeared, and Fengshang Culture fell below the issue price, which aroused greater market attention.

Since then, on September 10, Meichang shares broke the issue and became the second break issue stock under the GEM registration system.

At present, the shares of Fengshang Culture and Meichang have returned to above the issue price. However, the closing price of Fengshang Culture on September 24 was 141.86 yuan per share, which was only 2.78% higher than the issue price of 138.02 yuan. It is still on the verge of breaking.

Dong Dengxin said that it is a normal phenomenon to break the issue. So far, no stock on the GEM has broken the issue on the day of listing. He thinks it is a pity.

In mature markets, such as the Hong Kong and US markets, the ratio of IPO breaks on the first day of listing is generally around 15%-30%, and the first day break is also a sign of mature markets.

The issuance of new shares under the registration system is risky, and the pricing may be high or low. Therefore, the discovery phenomenon is normal or even normal.

It is about to usher in the refinancing review of a giant with a market value of 100 billion yuan

At present, 374 companies have been accepted under the GEM registration system, of which 15 are in the state of acceptance, 134 are in the state of inquiries, 20 are in the listing committee meeting stage, 66 have entered the registration stage, and 137 have been suspended for review , 2 companies were terminated due to withdrawal of listing applications.

Among the 372 enterprises under review, the three provinces of Guangdong, Zhejiang, and Jiangsu have the largest number of enterprises from the place of registration. Among them, there are 82 enterprises in Guangdong, 57 and 56 enterprises in Zhejiang and Jiangsu respectively.

In addition, there are 27 and 24 companies in Beijing and Shanghai respectively.

From the perspective of sponsors, China Securities, CITIC Securities, Minsheng Securities, and Guosen Securities have the largest number of sponsors, with 30, 30, 25, and 24 sponsors respectively.

There are also a number of companies on the way to go public. At present, Shanke Intelligent, Amic, and Shanghai Kaixin have completed online and offline issuances, and Arowana and Panda Dairy are about to be issued. These companies are expected to be listed soon.

Among them, Arowana will become a giant on the ChiNext.

Arowana’s current issue price is 25.70 yuan per share, and the total amount of funds raised is estimated to be 13.933 billion yuan. After deducting the estimated issuance costs, the estimated net proceeds are approximately 13.693 billion yuan.

Arowana will become the largest IPO on the GEM.

Based on the issue price and the total equity after the issue, Arowana has not yet been listed, and its total market value has reached 139.3 billion yuan.

If sorted by the closing data on September 24, the total market value of Arowana ranks sixth among all stocks on the GEM, lower than Aier Ophthalmology and higher than Lens Technology.

At the same time, the GEM refinancing review is also progressing in an orderly manner. So far, 187 refinancing projects have been accepted, of which 23 have been registered and effective, and 34 are in the status of submitting registration.

On September 17, the registration application of Qianyuan Pharmaceutical’s fixed increase project was approved by the China Securities Regulatory Commission, becoming the first “small fast” fixed increase project approved after the implementation of the registration system on the Growth Enterprise Market. It was accepted on September 8 and September The registration took effect on the 17th, and the review process only took 9 days.

Gui Haoming said that the one-month operation of the ChiNext has both accumulated experience and certain lessons, which all take time to digest gradually. Reform has never been smooth sailing.

Therefore, the achievements made in the first month of the ChiNext reform are still commendable, and the greater challenges facing the ChiNext in the future are also hoped to be solved through continuous system improvement and strengthening of supervision.

Beijing News reporter Gu Zhijuan