Banca.CaixaBank and Bankia prepare an imminent merger

Operation: The Government, willing to hand over Bankia to CaixaBank for ten times less than its rescue cost

Reactions.Bankia and CaixaBank soar on the stock market

The phones didn't stop ringing last night.

On the table, a delicate and accelerated operation in the heat of the economic crisis.

CaixaBank and Bankia finalize their imminent merger.

Negotiations are still just that, they have the most complicated placet, that of the Government, which holds 62% of control of Bankia through the Frob.

And with these wickers, both entities did not take long to report the negotiation to the National Securities Market Commission (CNMV), as required by law.

The machine is running.

But what does the merger of these two banks mean for Spain?

To begin with, we are at the birth of what will be the largest entity in the country.

Both by number of assets, branches, and employees.

But let's go in parts.

Who will take the helm?

Although by size, CaixaBank is the dominant entity in this merger-absorption.

It will be, according to financial sources,

José Ignacio Goirigozarri who will exercise the presidency

of the same.

Until now, the president of Bankia has a very good image both in the eyes of the sector and the Government itself.

The CEO of the resulting entity will be the current CEO of CaixaBank,

Gonzalo Gortázar

.

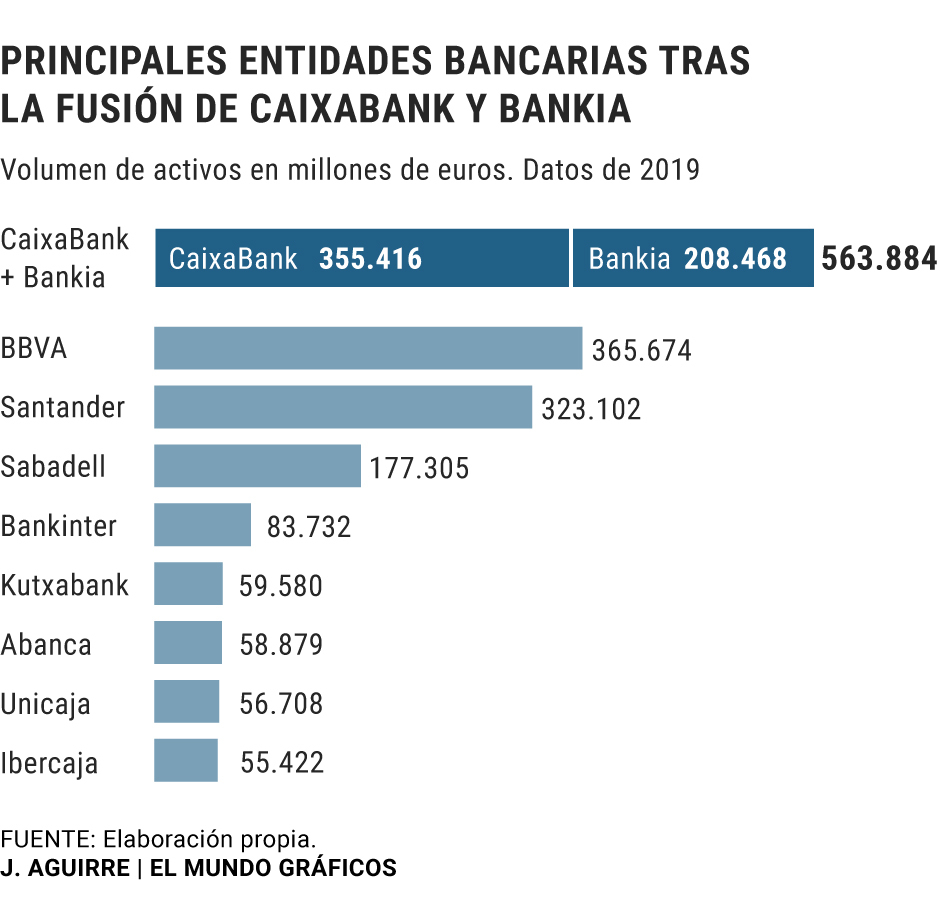

The largest bank by assets.

Until now, the largest Spanish bank, due to the volume of its assets, was BBVA.

CaixaBank followed.

And in third position was Banco Santander.

The creation of the new bank, whose name has yet to be defined, changes the podium.

Between CaixaBank and Bankia they will add assets

of over 600,000 million

.

The largest branch network

CaixaBank has a very extensive network of branches.

Specifically, it has 4,400 distributed throughout Spain.

And its weight is especially relevant in Catalonia or in areas such as Navarra, after the absorption of Banca Cívica in 2012. Bankia, for its part, has its greatest deployment in Madrid, with which the merger has a certain strategic sense at a geographical level.

Specifically, the entity chaired by Goirigolzarri currently has about 2,200 offices.

Between the two, 6,600.

Obviously, after the merger, both entities will have to analyze how many of these offices may be superfluous and will accelerate a process of closing branches that has been going on for years.

A recent report by the British bank Barclays recommended

closing around 10% of the branches

that still operate in our country, about 1,500.

Only in this way, the bank maintained, Spanish entities could increase their profit by 5% before 2022.

The largest bank in employees, too

And if the new Spanish banking colossus would be the bank with the most branches, it will also be the one with the most employees in the country.

CaixaBank comes to this operation with

35,600 workers

.

Bankia does the same with

16,000

.

In total, 51,000.

And, again, as will happen with the offices, experts are waiting for a restructuring process after the merger to study synergies and clean up possible duplications.

Faced with the drums of possible dismissals, the general secretaries of CCOO, Unai Sordo, and UGT, Pepe Álvarez, have rushed this Friday to request

"non-traumatic measures" for the

Caixabank and Bankia staff.

Also the Madrid president, Isabel Díaz Ayuso, has spoken in this regard:

"Everything that is or could be loss of employment worries us

.

"

According to the criteria of The Trust Project

Know more

Spain

Black Cards

economy

Restarting Digitization, cuts and mortgage war in banking to overcome the impact of the coronavirus

Previous tests, applications and all possible teleworking: this is the return of the Ibex companies

Jordi Sevilla returns to LLYC after his abrupt departure from REE and Román Escolano goes to the EIB

See links of interest

Last News

Programming

English translator

Work calendar

Daily horoscope

Santander League Standings

League schedule

Movies TV

2019 cut notes

Topics

Stage 6: Le Teil - Mont Aigoual

Germany - Spain, live