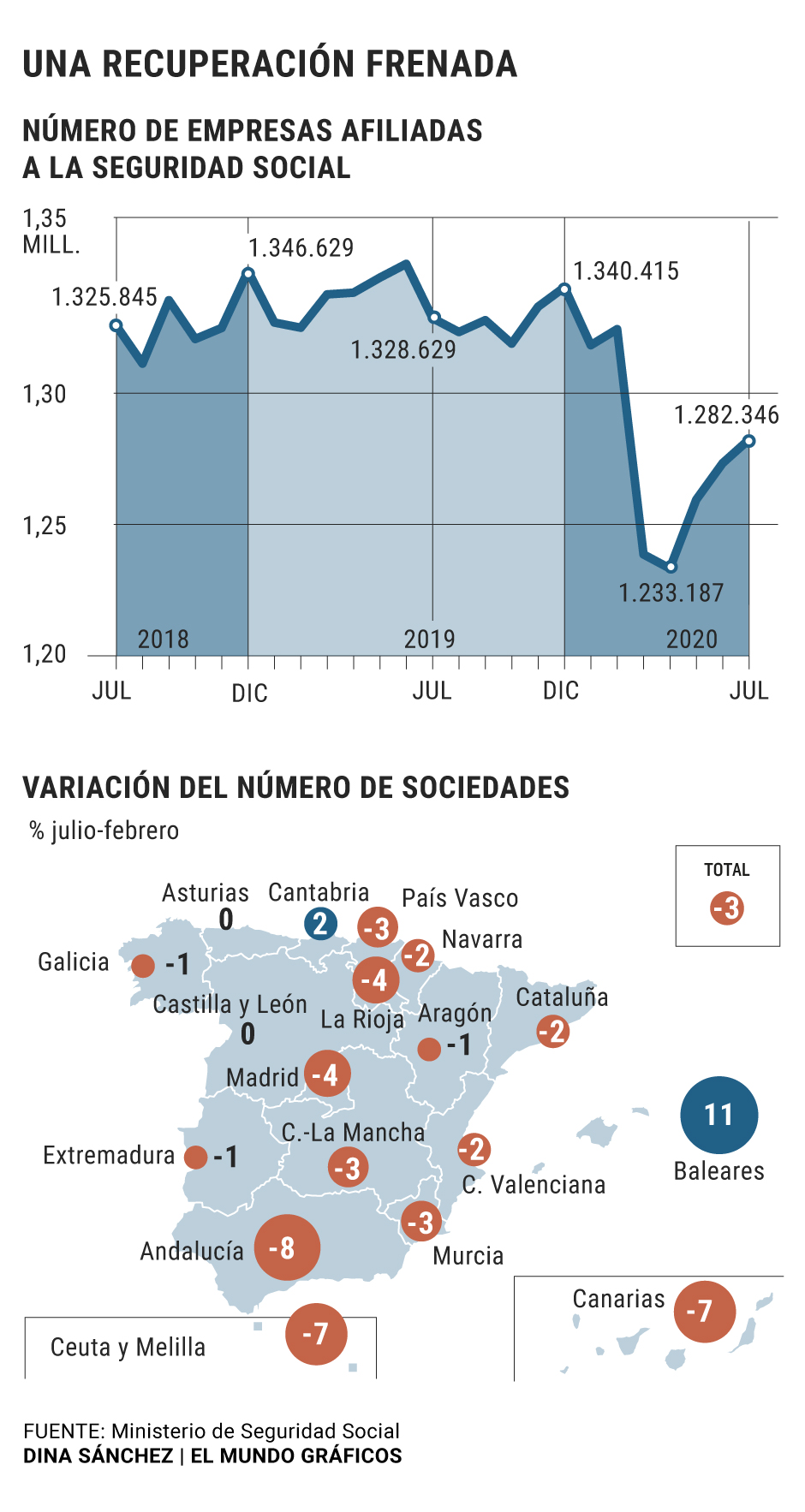

Four months after the coronavirus crisis broke out, the Spanish economy is still far from recovering the number of companies registered with Social Security prior to the outbreak of the pandemic. In fact, at the end of July, only 53% of the more than 91,000 that closed between the months of March and April had recovered due to the paralysis of economic activity.

Companies are, together with families, one of the great economic engines of a country. They create wealth and, therefore, the evolution of the registry of operating companies acts as a GDP thermometer, both at a general level and by different economic activities and regions.

From the data published by the Ministry of Social Security, it appears that business creation began to recover in May in line with the gradual return of activity. During that month alone, a total of 26,000 companies were registered in the system . However, the improvement was slowed and entered a downward dynamic in June and July with the start-up of 13,000 and 9,000 companies, respectively.

The recovery of business activity has advanced at different rates depending on the sectors and the different regions of the country. Activity in different businesses such as commerce or agriculture has accelerated and the balances for the creation of new companies - that is, those established minus those liquidated - were already at higher levels than those of the same month of the previous year, according to statistics of the INE. On the contrary, entrepreneurship in the hotel industry and real estate continued to show double-digit declines in June as two markets were particularly hit by the pandemic. The first, due to the hardening of health protocols, and the second due to uncertainty and loss of income that penalize investment.

The tourist break in the months of April and May and the weakness that the summer season is showing have also hampered business regeneration in some of the territories most exposed to this sector. While the data for companies registered with Social Security in the country as a whole was 3% lower in July than before the pandemic, in autonomous regions such as Andalusia, the Canary Islands or the cities of Ceuta and Melilla, the drop exceeded 7%. That is, more than double.

The historical trend shows that the greatest creation or activation of companies is concentrated between the months of March and June, is reduced during the summer months due to holidays and the stoppage of sectors such as education, and returns strongly in October. This 2020, however, is being totally atypical after the collapse of March and April, and the great unknown is now to know how the registry will evolve in the coming months.

Economists, managers and insolvency administrators foresee a strong increase in the number of bankruptcies in the last months of the year, when the financial and legal support measures approved by the Government during the state of alarm to guarantee the survival of companies impacted by the lockdown.

"The State should review the existing bankruptcy regulations and the regulation of ICO guarantees to adapt them to the current situation and provide business restructuring and liquidation processes with the greatest possible agility and flexibility," states Fedea in a recent report . The 'think tank' fears that financial institutions will prematurely execute the State guarantee of the 100,000 million euros granted to SMEs and large companies since last April in the face of an "expected avalanche of bankruptcies and business restructurings", therefore that recommends reviewing the bankruptcy regulations, consolidating the public debt and renouncing the collection privileges that the Administration has in these procedures.

The end of the state of alarm was the starting gun for bankruptcy proceedings. During the month of June alone, bankruptcy proceedings tripled with respect to May levels and already exceeded the figures of just a year ago. The figure continued to grow in July to 463 processes, 21% more.

This increase was still produced under the 'shield' with which the Government endowed the companies in the decree of the state of alarm that prevents creditors from forcing the competition of a company to try to recover the debt. The blockade is in effect until three months after the end of the extraordinary period of confinement, that is, until September. Therefore, the bankruptcies that are taking place are voluntary and it is the company that uses this mechanism to try to continue operating despite acknowledging its insolvency situation.

According to the criteria of The Trust Project

Know more- Social Security

- Spain

- GDP

- Melilla

- INE

- Ceuta

- Canary Islands

- Andalusia

- economy

Macroeconomics Retail sales recover in June and rise 17.8%

EmploymentCOVID-19: The greatest natural catastrophe leaves the labor market at a minimum pending the Government's economic recovery plan

Data from the economic alarm: the tourist slowdown threatens eight sectors with five million workers

See links of interest

- Last News

- Programming

- English translator

- Work calendar

- Daily horoscope

- Santander League Standings

- League schedule

- Movies TV

- 2019 cut notes

- Topics

- Austrian Grand Prix

- Spanish Grand Prix, live

- Almeria - Girona

- Sevilla - Manchester United, live

- Real Zaragoza - Elche