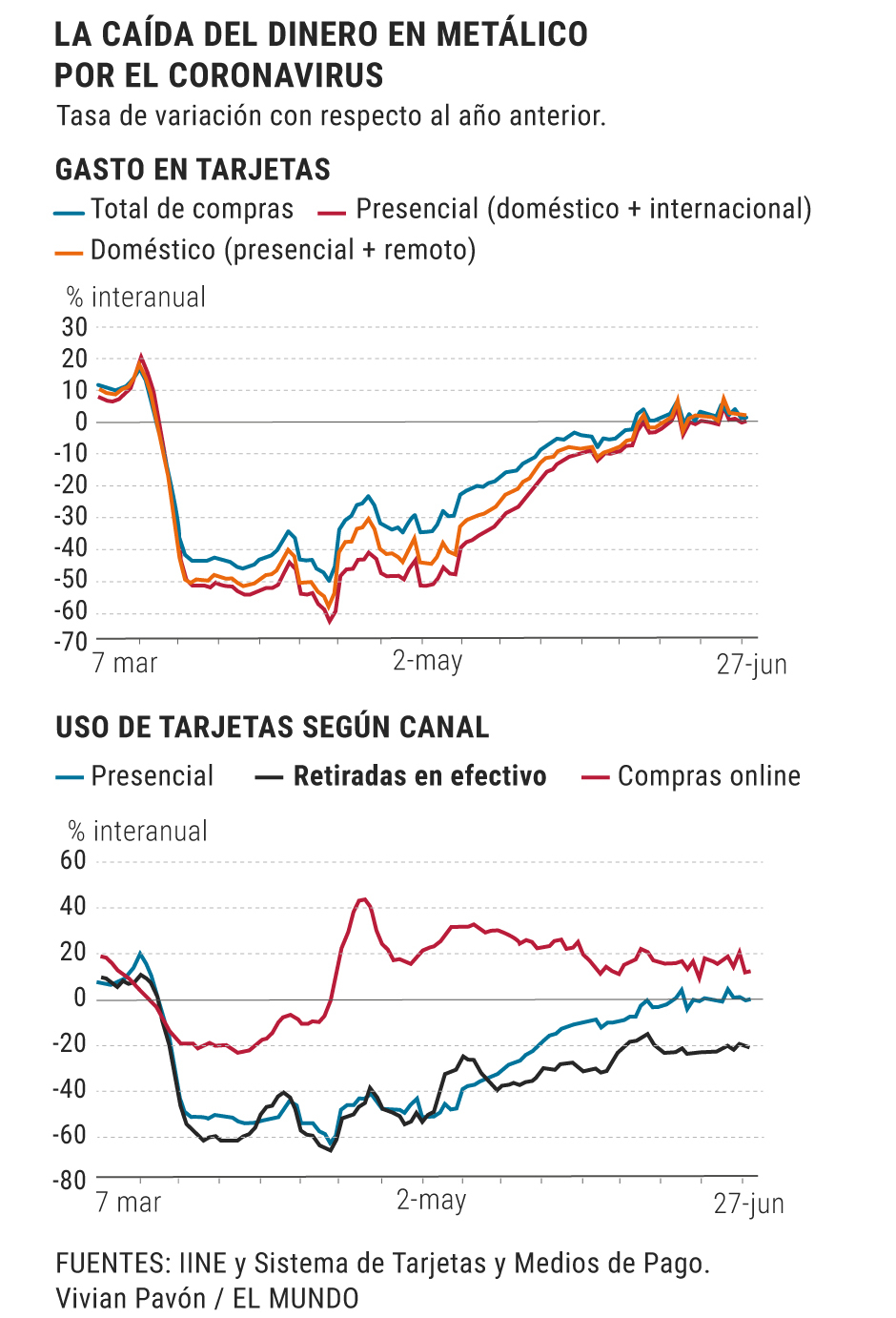

The coronavirus crisis has led to a huge technological disruption for much of society. From one day to the next, thousands of confined households made online shopping their main source of food and all kinds of products. Credit cards, whose use is already at pre-pandemic levels, won, and the great loser has been cash. The withdrawal of banknotes at ATMs still registered falls of between 15% and 20% in June compared to the same month of 2019, according to data provided to this newspaper by different financial entities and the Bank of Spain.

The lower use of physical money is one more indicator that the economy is still a long way from recovering the levels of activity prior to the outbreak of the health pandemic, last March. The decrease in its use has been influenced by several factors: the loss of income due to the crisis and lower spending due to the fear of an economic downturn by the groups most loyal to cash -especially the elderly-, the fear of a contagion of the virus through banknotes - denied by the European Central Bank (ECB) itself - and, in line with the latter, the promotion by companies and health authorities of technological payment mechanisms by card or mobile to limit contacts between people.

The result is a historical drop in its use, which in the months of greatest confinement such as April exceeded 60%. This collapse was coupled with a greater use of cards, initially intended primarily for online purchases. But as of May, it is observed how the payment terminals of the shops began to reactivate in parallel to the de-escalation of the homes until reaching, already in June, consumption levels similar to and even higher than those of 2019. Cash withdrawals ATMs also showed a rapid improvement in May, but in June they stabilized around this 20 or 15% drop, depending on the customer profile of each entity.

“The positive effect of the beginning of the de-escalation was only produced in POS payments, while cash withdrawals at ATMs have continued to show very pronounced year-on-year setbacks. This behavior, which could be due to the uncertainty about a hypothetical perception of contagion risk associated with cash handling, suggests that an eventual calibration of the drop in consumption in the second quarter made exclusively from the use of cards at POS terminals would perhaps be overestimating the improvement in this spending component ”, explains the Bank of Spain in a recent analysis of the evolution of household consumption during the months of confinement. That is to say, that we use the cards more does not mean that we spend more than a year ago.

Apart from the slowdown in economic activity, these data reflect strong progress in the digitization of financial services driven by the crisis. Banks had to keep part of their branch network open due to legal obligation during the state of alarm, although they made an effort to reduce customer traffic by boosting their remote attention services. For pensioners, one of the groups most linked to the use of cash, the entities even advanced the payment of the subsidy to avoid passing through the window.

The coronavirus, like all crises, has opened transformation opportunities for the country's large banks, and one of them has to do with less use of cash. On the one hand, financial groups reduce logistical and labor costs linked to the management of coins and banknotes, and on the other they benefit from the increase in commissions coupled with the promotion of electronic money.

“Digitization frees people from tedious tasks to focus on managing and advising clients. Technology is a lever, but the important thing is people and their cultural transformation ", explains Carlos Torres, Bankia's Deputy General Director of Transformation and Digital Strategy. At the end of June, the company had a 15% drop in cash withdrawals at ATMs, below other groups such as Santander where it exceeded 20%.

The big question now is whether Spanish families will return to cash and its use will at some point return to pre-covid levels. The latest survey of means of payment from the Bank of Spain, referring to the year 2018, indicated that cash continued to be the preferred method of payment among young and old, especially in rural areas.

But the pandemic has meant a radical change in the form of payment. Fear of contacts has triggered the use of contactless technology, which allows payment without any contact between buyer and seller. According to a Mastercard report , nine out of 10 purchases made between April and May have been made using this technology, predominantly using cards but also using mobile phones or other smart devices such as watches and bracelets. According to the payments firm, "more than half of the population (53%) say that their use of cash has decreased during the Covid-19 crisis."

According to the criteria of The Trust Project

Know more- Carlos Torres

- Santander

- New normal

Savings and ConsumptionING joins Bizum to boost mobile payments

EconomyThe bank beats the registrars the great mortgage lawsuit of 45 million for its megasede in Madrid

European Central Bank Guindos predicts bank mergers in the eurozone "in the coming weeks"

See links of interest

- Last News

- Programming

- English translator

- Work calendar

- Daily horoscope

- Santander League Standings

- League schedule

- Movies TV

- 2019 cut notes

- Topics

- F1, live: 70th Anniversary GP