"Increase in non-payment" Support measures are progressing, but severe funding continues July 22 17:33

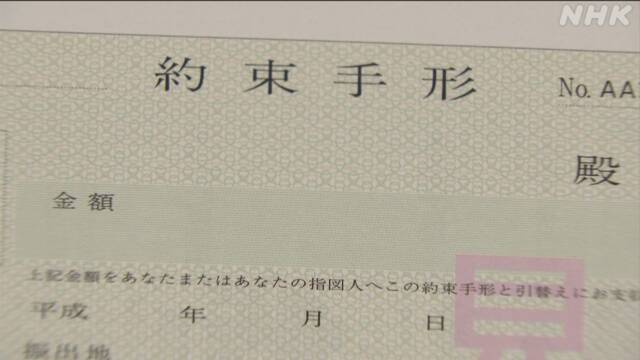

The number of transactions that resulted in the failure to prepare funds by the promised date due to the transaction of bills used for payments between companies increased by 18% last month compared to the same month last year. It can be seen that, despite the progress of support measures such as these, strict financing continues.

If a bill that promises postpayment of the payment is issued twice in half a year and fails to be settled by the due date, the transaction with financial institutions is usually suspended and it becomes difficult to continue the business.

According to the Japan Bankers Association, the number of bills that were unpaid last month was 1030, an increase of 18% from the same month last year, and the total amount of unpaid bills increased by 46% to 1.7 billion yen.

The number of non-deliverable notes declined temporarily in May due to the government's cash flow support measures such as virtually no interest and unsecured loans, but it has turned to an increase again.

The number of bank suspensions has dropped significantly, as the National Bankers Association demands that transactions not be immediately suspended in the event that the bills fail to be delivered due to a drop in sales due to the new coronavirus.

However, due to the increase in non-payment last month, it can be seen that the company has a difficult cash flow.