At this point in time of any other summer before 2020, some of you probably would have asked for a small credit to take a dream vacation trip or a brand new car. Statistics say that the months leading up to the summer are the ones with the most requests for loans, above even Christmas. But the coronavirus is capable of destroying the most deeply-rooted traditions and in this case it has also done so.

The economic uncertainty generated in households by the pandemic has caused many families to give up all these plans this year and withdraw when it comes to asking for financing to face them. In fact, only 14.20% of Spaniards intend to ask for a loan in the remainder of the year, compared to 85.80% who do not consider it.

It is one of the most striking conclusions of the I Consumer Loans Barometer prepared by Asufin , the Association of Financial Users, to test the consequences of Covid-19 on the financial behavior of families in Spain.

The doubts and fears that the economic situation will worsen in the coming months means that many of them not only increase their savings and reduce consumption, but also avoid debt. The change has been drastic . Not surprisingly, the consumer credit segment is one of the fastest growing in recent years among financial institutions, both due to the interest of consumers in acquiring certain products and services financed, as well as the interest of their own entities, which obtain their best margins from them in a context of zero and negative rates.

Now the situation has turned around and 10.90% of those surveyed who initially planned to apply for financing assure that they finally will not , while 6.70% have been forced to resort to it when experiencing a reduction in income from the current situation.

The barometer also asks respondents about the destination of the loan and almost a third (30.9%) answered that they would use it to cover money needs (30.90%) above the most classic reason at this time of year: the purchase of the vehicle (25.30%). "If we add the three segments most linked to consumption, that is, car purchase, reform and vacation trips, they reach 41.90%. In turn, financial destinations such as having money or refinancing debts add up to practically the same 41 , 10% ", indicates the survey.

The consumer segment is the one that most concentrates the fall in the intention to request loans. Travel and holidays are the most punished games and almost half of those who were going to ask for financing for this purpose (46.20%) will not. It is followed by the purchase of vehicles -about 30% admit that they will not ask for the expected loan-, which can translate into a decrease in sales in this key sector.

Similarly, loans for construction and renovation is expected to fall by 15%, while remaining fairly stable, with declines of just 3%, the segment of studies .

The report, which has done interviews with 1,845 people between 5 and 18 June 2020, also puts the focus on the impact on the car market, which is expected to replicate the descents of the loans. Asufin has asked the respondents if the aid announced by the State for the purchase of a vehicle through subsidies would change their decision to purchase a car financed, and the result has been that only 17.30% of the respondents did. They would rethink, which is an indication of the low efficiency of measures of this type in a moment of uncertainty like the current one.

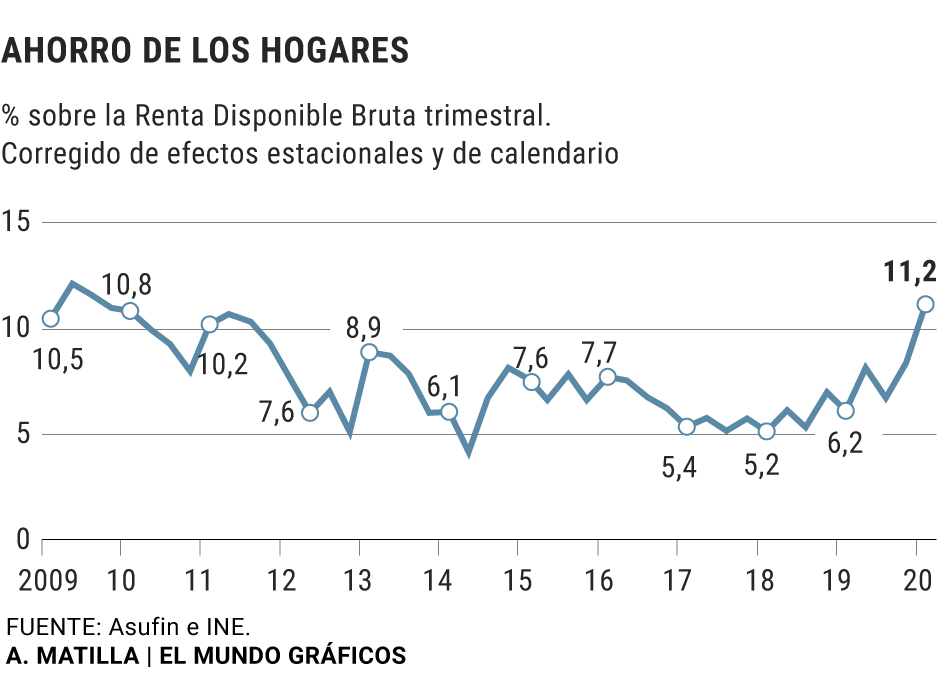

By contrast, Spaniards prefer to keep their money safe and keep it in anticipation of a worsening situation. Proof of this is the rise in the household savings rate in the first quarter of the year, despite the fact that only the last 15 days of March were directly affected by the confinement.

According to data from the INE (National Statistics Institute), the rate increased between January and March to 11.2% of the available rate, 2.8% more than the previous quarter, reaching levels of 2009, in full financial crisis.

According to the criteria of The Trust Project

Know more- economy

- Coronavirus

- Covid 19

- Descaled

Macroeconomics Boris Johnson announces a new deal in the Roosevelt style of € 274 billion

SpecialThe crisis accelerates changes in rural Spain and companies: "Better broadband than narrow road"

Housing New housing resists coronavirus with a rise of 0.8% but confidence in the sector falls

See links of interest

- Last News

- Programming

- English translator

- Work calendar

- Daily horoscope

- Santander League Ranking

- League calendar

- TV Movies

- Cut notes 2019

- Themes

- Wolverhampton Wanderers - Everton

- Espanyol - Eibar

- Formula 1 Styrian Grand Prix

- Aston Villa - Crystal Palace

- Levante - Athletic Club