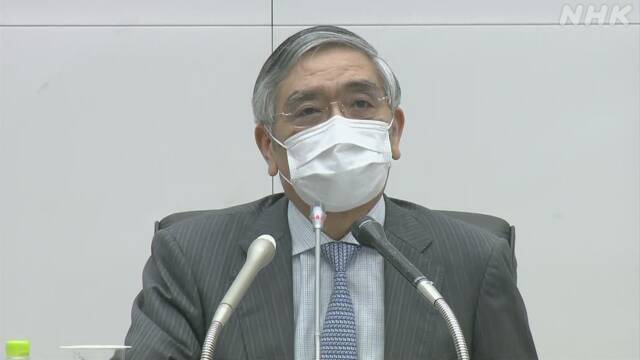

BOJ Governor Kuroda “Large-scale monetary easing, at least until next year” June 17, 5:39

The BOJ's Governor Kuroda has indicated that large-scale monetary easing measures that will support the economic downturn affected by the new coronavirus will continue until at least the next fiscal year. The central bank of the United States also shows that it will maintain the zero interest rate policy until next year, and the unusual low interest rate policy around the world is likely to last.

The Bank of Japan decided to maintain the current large-scale monetary easing policy at the monetary policy meeting held until the 16th, and increased the financing support for companies affected by the new coronavirus to 110 trillion yen.

Governor Kuroda emphasized the idea of expanding financial support as well as taking extra measures if necessary as the impact at the press conference may be prolonged.

On the other hand, when asked about when the unusual monetary easing measures could be completed, Governor Kuroda said, "From the perspective of prices, it seems quite far from raising interest rates in the next fiscal year and the next fiscal year," at least in the next fiscal year. Monetary easing continued, and Mr. Kuroda pointed out that raising interest rates during his term was difficult.

Even in the world's most infected United States, the Federal Reserve suggests that it will maintain a zero interest rate policy until next year.

With the fear of the “second wave” spreading again, the unusual low interest rate policy launched by central banks around the world to support the depressed economy is likely to last.