- Coronavirus. The Bank of Spain increases the collapse of the economy to a maximum of 15% and anticipates three years of crisis

- Coronavirus. Two decades lost in debt reduction: AIReF warns that only the "consensus" will save the accounts

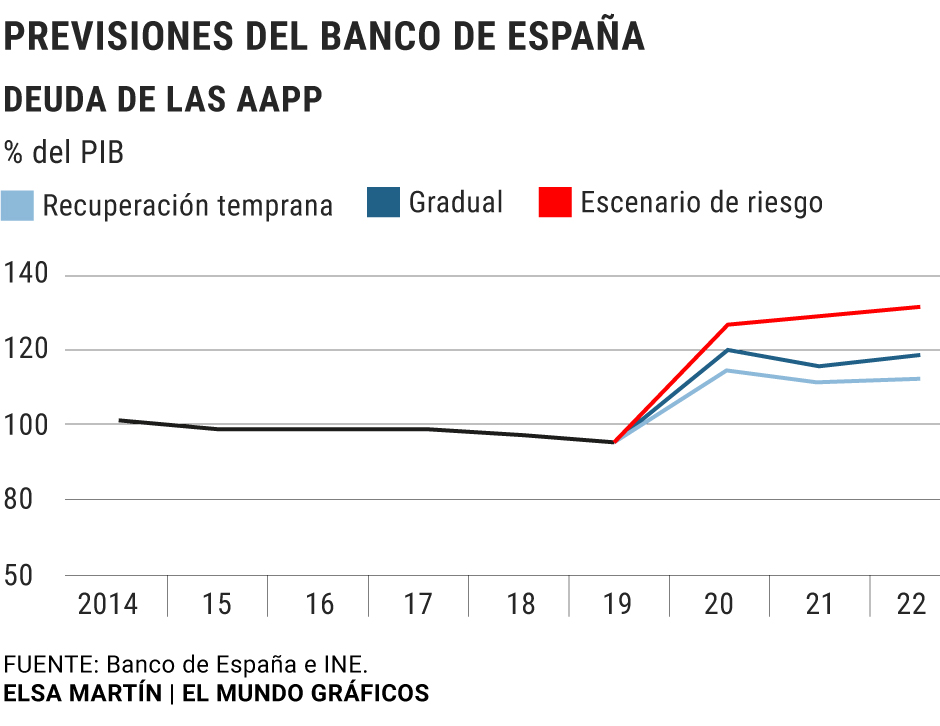

The economic crisis derived from the coronavirus pandemic is going to hit Spain with special intensity. And it will do so for the "longest and most intense" confinement of the population; increased dependence on tourism; or the "highest weight of SMEs". But also, because the fiscal response is being "less than the average" of the European Union, a situation that has its origin in the lack of budgetary discipline shown by the governments of Mariano Rajoy and Pedro Sánchez and whose best example is, without a doubt , the blushing deficit increase that the Socialist Executive incurred last year .

The warning - or rather confirmation - was made yesterday by the Bank of Spain, which has repeatedly insisted on this point in recent years. The deficit and debt reductions registered in the boom years were exclusively due to the economic cycle itself and to the fall in interest rates, as the organisation's director general for Economics and Statistics, Óscar Arce, underlined yesterday.

And making a greater effort in this regard was essential so that precisely what is happening did not happen: that in the event of an eventual crisis, the country had room for action and could follow the path set by countries such as Germany in terms of unlimited liquidity for companies, tax holidays and even tax breaks.

What the BdE probably never suspected when making its ignored warnings is that what has ended up materializing is the most acute recession in peacetime, which in Spain will cause a fall in Gross Domestic Product (GDP) in 2020 « more intense than in the euro area as a whole ”and with“ differences of around three percentage points, depending on the scenario ”.

Those scenarios are the ones that Arce presented this Monday within the new macroeconomic projections 2020-2022, a document that contains a noticeable deterioration in the estimates and which shows that, in any case, the country will not recover the levels pre-crisis until 2023. For this year, the minimum recession is 9% as long as there is an "early recovery". Therefore, the least negative estimate that the BdE made in April disappears, which contemplated a 6.6% drop and that the governor, Pablo Hernández de Cos, already advanced last month in Congress that had been totally out of date . Outweighed by the force of the crisis.

If the recovery is "gradual", the slump would be 11.6%, and if everything that could go wrong does go wrong, the BdE anticipates that the slump would go up to 15% . This is what the regulator calls the "risk scenario", and which has been designed as part of a joint exercise by the Eurosystem and by the European Central Bank (ECB).

“A very slow recovery scenario has been built, characterized by intense episodes of new infections, which require additional strict confinements, and by the presence of financial channels, which amplify the real disturbance and cause its effects to have a degree of persistence that is significantly more high ”, points out in the report published yesterday.

Given this explanation, it could be assumed that it is a remote possibility, an almost impossible scenario. And yes, it seems complicated, but if you look at what was added by the head of Economics and Statistics during the presentation that made the conclusion is another. “The risks are clearly oriented to the downside, that is, it is not at all ruled out that the path is less favorable, that the fall in GDP may be greater than those contemplated in these two scenarios [referring to the first two]. We do not see a smaller fall than that described in the best scenario and, on the other hand, falls above 11% cannot be ruled out, ”said Arce.

The document also gives figures to the spectacular impact that the state of alarm is having in the current quarter, and shows that the fall of "unprecedented magnitude" in the first three months pales in light of what lies ahead. "Despite the fact that confinement has gradually begun to relax since the beginning of May, the drop in output of the Spanish economy will be significantly higher, reaching a quarter-on-quarter rate of -16% in the scenario of rapid recovery and a -21.8% in the gradual recovery ”, he points out.

The unemployment data is equally alarming, with unemployment that in the worst case scenario would go up to an alarming 24% , which would mean returning to levels not observed since 2014. This maximum, in addition, would occur in 2021 despite economic recovery, something that also happens in the most positive scenario. In that case, the figures would be 18.1% average unemployment this year and 18.4% next year. And the reason is found in what Arce described as an "ERTE factor", that is, in the absence of this temporary employment mechanism, the unemployment rate will rise in 2021.

In accordance with the criteria of The Trust Project

Know more- Crisis

- Coronavirus

- Covid 19

Covid-19 Hospitality and shops in Peñíscola are ready for phase 1

ExclusiveThe Government will give up to 1,015 euros a month to one million vulnerable families

StoriesThe Pawnbrokers Boom: "We Will Be One of the Few Businesses That Work After the Crisis"

Close links of interest

- Last News

- Programming

- English translator

- Work calendar

- Daily horoscope

- Santander League Ranking

- League calendar

- TV Movies

- Masters 2019

- Cut notes 2019

- Themes