- Coronavirus. The Bank of Spain already warns of a long crisis and requires politicians to rise to the "magnitude of the challenge"

- Coronavirus. Two decades lost in debt reduction: AIReF warns that only the "consensus" will save the accounts

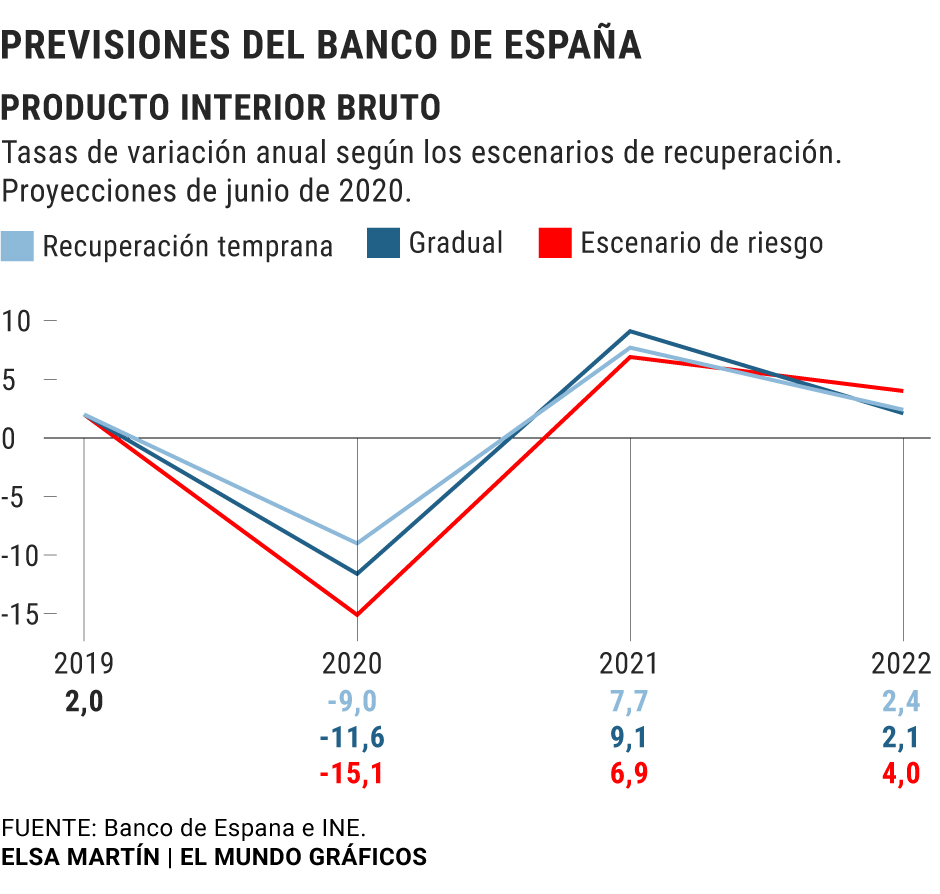

The economic crisis that Spain will suffer as a result of the Covid pandemic will be long, with a recovery from previous levels that will not come before 2023 and with a fall in Gross Domestic Product (GDP) that this year could be up to a fifteen%. It is the scenario that the Bank of Spain (BdE) draws in the forecasts that it has published this Monday and that yields even worse figures than those set out in its previous document.

This deterioration of the context was already advanced by the organism's governor, Pablo Hernández de Cos, during the appearance that he carried out in the Congress of Deputies, and the estimates that the BdE has developed confirm that the previous less negative scenario has disappeared. Thus, the minimum fall will be 9% in what the BdE qualifies as early recovery.

On the other hand, if there is a gradual recovery, the drop will be 11.6%, while if all the risks to the downside materialize, that is, if everything that can go worse effectively does, the collapse would reach that 15% . And, in any case, "the reduction in GDP in Spain in 2020 would be more intense than in the euro area as a whole" with "differences of around 3 pp, depending on the scenario," the agency explains.

"The risks are clearly oriented downward, that is, it is not at all ruled out that the path is less favorable, that the fall in GDP may be greater than those contemplated in these two scenarios," explain sources of the general direction. Statistics, referring to the first two scenarios. "We do not see a smaller fall than that described in the best scenario and, on the other hand, falls above 11% cannot be ruled out, " they add.

This situation is what would lead to the third scenario that, explained by the Bank of Spain, has been developed as part of a joint exercise by the Eurosystem and by the European Central Bank (ECB). "A 'very slow recovery' scenario has been built, characterized by intense episodes of new infections, which require additional strict confinements , and by the presence of financial channels, which amplify the real disturbance and cause its effects to have a degree of persistence noticeably higher, "explains the document.

In accordance with the criteria of The Trust Project

Know more- Crisis

- Bank of Spain

- Covid 19

- Coronavirus

According to Banco de España Economic reconstruction will require a structural adjustment of 6,000 million a year in the next decade

Coronavirus Public debt shot up by 22,500 million in March despite the fact that the crisis only affected half a month

Covid-19 Hospitality and shops in Peñíscola are ready for phase 1

Close links of interest

- Last News

- Programming

- English translator

- Work calendar

- Daily horoscope

- Santander League Ranking

- League calendar

- TV Movies

- Masters 2019

- Cut notes 2019

- Themes

- SV Werder Bremen - VfL Wolfsburg

- 1. FC Union Berlin - FC Schalke 04

- FC Augsburg - 1. FC Köln

- Rio Ave - Paços de Ferreira