"Sustainable benefit" This is also adjusted for the founder's business operator May 22 8:26

k10012440021_202005220647_202005220703.mp4

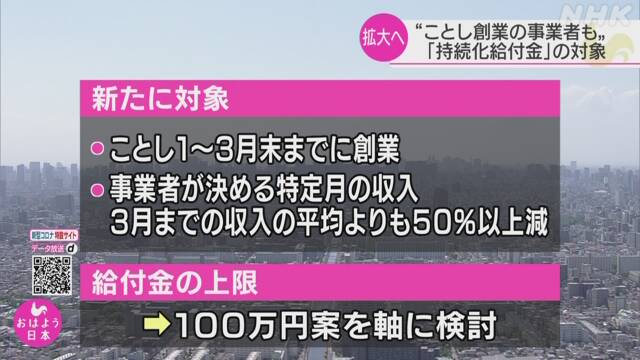

Regarding the "sustainable benefit" that provides cash to businesses whose sales have dropped significantly due to the effect of the new coronavirus, the government has started to adjust to include payments for businesses that have just started. .

The requirement for the application of “sustainable benefit” is that the sales have decreased by 50% or more compared to last year due to the influence of the new coronavirus, but this time the business just founded is Since it is not possible to make a comparison, it is out of the scope of payment.

However, the government began to make adjustments to include it in the target of payment, as voices were calling for support from businesses shortly after its foundation.

The new target is for businesses that are founded from January to the end of March and whose income for a specific month determined by the business has decreased by 50% or more from the average income up to March. Discussions are underway around the idea that the upper limit of gold will be 1 million yen.

Also, regarding benefits, if a sole proprietorship such as a freelance company has recorded the main income as "Miscellaneous income" at the time of final tax return, it is not covered by the payment, but this is also included Final adjustments are being made in the direction.