On Tuesday, May 12, the world cryptocurrency market is showing uncertain dynamics. During the bidding, the price of bitcoin grew by 2%, to 8.8 thousand per coin, after which it slightly decreased - to 8.7 thousand.

Other digital assets showed a similar swing. So, for example, in the first half of the day, Ethereum grew in price by 2.3% (up to $ 190), bitcoin cache - by 1.3% (up to $ 236), ripple - by 1.5% (up to $ 0.198). After this, the values were also slightly adjusted. Such data leads the portal Coinmarketcap.

Investors ambiguously perceived the change in the rules of bitcoin mining that happened on the eve - halving. Traditionally, the event takes place every four years and is one of the key to the dynamics of the global cryptocurrency market.

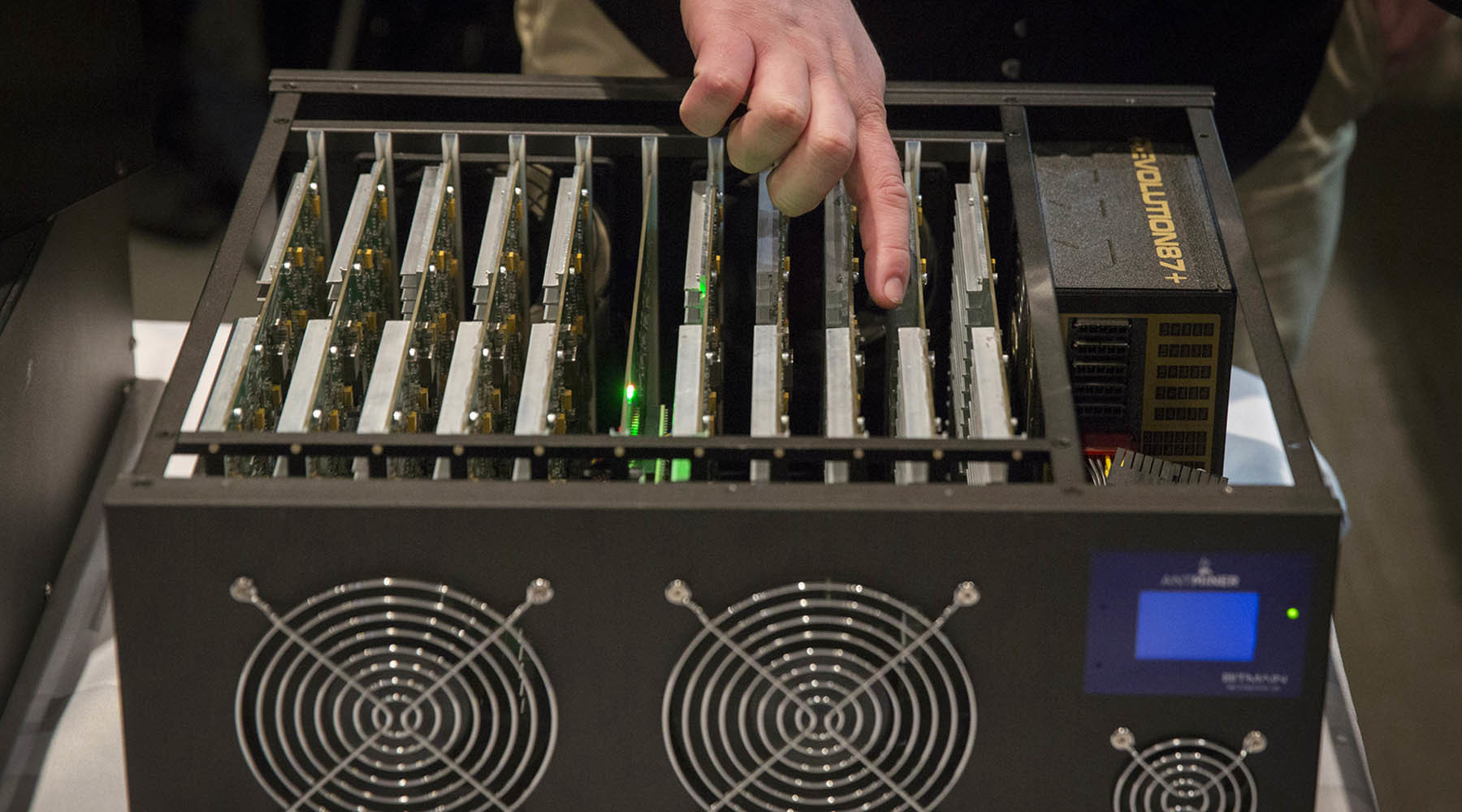

Bitcoin exists on the basis of blockchain technology - a single database that contains information about all completed transactions. The issue of new crypto coins occurs due to mining - solving complex mathematical problems and the emergence of a new block in the blockchain network. Each such block is an array of data, where information about all operations carried out after the creation of the previous block appears. For solving the problem, miners receive a reward in the form of bitcoins.

Every year, the search for such blocks becomes more complicated and requires more and more computing power, and the reward for mining is reduced. So, in 2009 it amounted to 50 bitcoins per block, in 2012 it decreased to 25, and in 2016 to 12.5. On May 11, 2020, the remuneration of miners was halved again and reached 6.25 bitcoins.

As explained to RT by the head of the analytical research department of the Higher School of Financial Management Mikhail Kogan, now the production of new bitcoins is slower. At the same time, the demand for electronic coins still continues to increase at the same pace. According to the analyst, such a situation can lead to a significant increase in the cost of the main cryptocurrency in the long term.

“Halving the miners' rewards for each block mined is a key event around the first cryptocurrency, as it means reducing the issue of coins, while their number is algorithmically limited to 21 million. In other words, the rate of increase in supply will decrease, while demand will inevitably grow,” Kogan explained.

- Reuters

- © Lucas Jackson

Note that a few days before the change in the rules for bitcoin mining, its value in the moment rose to $ 10 thousand per coin. As Yuri Mazur, head of the CEX.IO Broker data analysis department, noted in an interview with RT, investors were waiting for a reduction in the mining reward and began to buy large amounts of cryptocurrency in advance. Therefore, immediately after the halving, the volume of purchases of bitcoins slightly decreased.

Against this background, according to the analyst, in the near future, the cost of bitcoin can briefly decrease to $ 6-7 thousand per coin. Meanwhile, according to RT, EXANTE managing partner Alexei Kiriyenko,in the coming months, quotes may resume growth and renew new highs before the end of the year.

“Reaching the mark of $ 20 thousand for bitcoin is more than possible. So, some time after the halving, the so-called syndrome of lost profit may appear among traders. In fear of not buying bitcoin at competitive prices, players will begin to massively invest in cryptocurrency, ”Kiriyenko explained.

In general, according to analysts, today the global cryptocurrency market has managed to fully recover after the March collapse. Then the cost of bitcoin updated the annual minimum and at the moment it dropped to $ 4.1 thousand. The collapse of the exchange rate occurred as a result of panic in the global stock market. Investors massively sold risky assets, including cryptocurrencies, against the backdrop of a threat to the global economy of the coronavirus pandemic.

Nevertheless, already at the end of March the situation in the markets stabilized. Players reacted positively to central bank measures to support the global economy. For example, the US Federal Reserve System and the European Central Bank (ECB) have launched a quantitative easing program. Regulators began to print additional money and inject funds into the financial systems of their countries. According to analysts, such a policy contributes to the growth of stock markets and at the same time strengthens investor interest in cryptocurrencies.

“The actions of the Fed and the ECB affect the rate of bitcoin and cryptocurrencies. On the one hand, new money is pouring into the economy, which is distributed between financial assets, and, of course, part of these funds comes to the cryptocurrency market. On the other hand, by printing money, the Fed and other central banks only spur demand for electronic coins, strengthening investor confidence that the regulation of the money supply in the crypto market is more equitable, ”concluded Yuri Mazur.