The Government has lowered its prospects for collection with the Google rate around 19.33%, of the 1.2 billion euros estimated in the previous legislature to 968 million, according to the Minister of Finance and spokesman for the Executive , María Jesús Montero. The Tax on Certain Digital Services (IDSD) continues, although the settlement will not take place until the end of the year, pending the conclusion of a global agreement and, in passing, to shelter from possible reprisals from the US.

Where do government accounts come from?

The Executive is finally left with the most optimistic interpretation made by the Independent Authority of Fiscal Responsibility (AIReF), which calculated between 546 and 968 million the potential of the application of this new tax. In any case, the data considerably reduces the collection expectations of the Government led by Pedro Sánchez.

AIReF's calculations were based on the 546 million that would correspond to Spain, given the size of its market , according to the accounts previously made by the European Union (EU), which provided for a community injection with a joint of 5,000 million euros per year for this concept. However, the community proposal did not succeed and the international implementation of the tax has been subject to the negotiations currently taking place within the Organization for Economic Cooperation and Development (OECD). To that figure, AIRef added another 240 million due to the reduction of the minimum billing threshold, a bar that, instead of the 5 million provided by the EU, Spain has dropped to 3 million billing. In addition, intra-group operations that would be computed in this country, unlike in Europe, would inject another 182 million. The collection would therefore be estimated at 968 million (546 plus 240 plus 182 million) .

What do you think from Google to Facebook of this rate?

Actually, it is a tax, not a fee. Large corporations exercise intense lobbying , focused on Brussels. In their public statements, these companies ensure that they will comply with the legislation that is in force, but in the private sphere they recognize that, like the rest of the companies, they do everything in their power to reduce the taxes to be paid. In France, it is customary to call the tax GAFA , in reference to Google, Apple, Facebook and Amazon, but in Spain it has been baptized as Google . In this company, the Californian giant of internet searches, they do not see that name with bad eyes , because it would indicate that the tax is directed against some companies, however much Minister Montero speaks of a "non-discriminatory" character.

Are they only against the internet giants?

Criticisms at a Google rate are in the mouth of almost the entire digital economic sector, represented through associations such as Ametic or Adigital, from which it is considered that the tax "will result in a strong loss of competitiveness in Spanish companies , producing the fragmentation of the Digital Single Market, the paralysis of investment in our country and isolating Spain from the global digital context. "

Directly, the tax should only affect companies with a turnover of more than 750 million euros worldwide and 3 million euros of income in Spain, thresholds that, according to the Government, "avoid an impact on SMEs." Spanish and European start-ups associations have shown against, however.

Fundación Civismo, lobby of liberal ideology, quantifies the negative impact of the Google rate at 178 million for the sector only and a total of 302.6 million euros for the Spanish GDP , all this only in its first year of application. According to this foundation, such a tax "will cause our country to lose investment appeal, and will encourage these companies to establish their headquarters outside our borders ." As Minister Montero has acknowledged, there is " the shadow on whether it will affect end users ", a consequence of which various associations and even some companies have repeatedly warned, for example the French branch of the e-commerce giant Amazon .

Why is it suspended?

France has frozen the application of the Google rate , in view of the reaction of the US went through the imposition of tariffs on Gallic products. Spain, without wanting to paralyze a measure that was already on the table in the previous legislature, has chosen to establish that for this first year the liquidation is never carried out before December 20 , and by means of a single declaration of the income of the affected companies . The objective is that these statements have a quarterly frequency, but for now the Executive awaits the global agreement of the OECD and is covered by possible reprisals from the US, the country of origin of the majority of large technology corporations, from Microsoft to Netflix.

What happened to the European agreement?

In Europe, some countries have blocked the imposition of a digital tax, contrary to the criteria of others such as France and Spain. This is the case in Ireland, where many of the continental headquarters of technology companies, such as Facebook or Google, are located as a result of its lax fiscal regime. Other nations in northern Europe, such as Denmark, Finland and Sweden (where Spotify comes from, for example, have also been against the imposition of the tax.

Therefore, the European debate eventually moved to the OECD. In this organization it is estimated that a global agreement for the imposition of a digital rate would report an annual collection of approximately 100,000 million dollars a year, that is, around 92,000 million euros . This data represents 4% of the worldwide corporate tax collection.

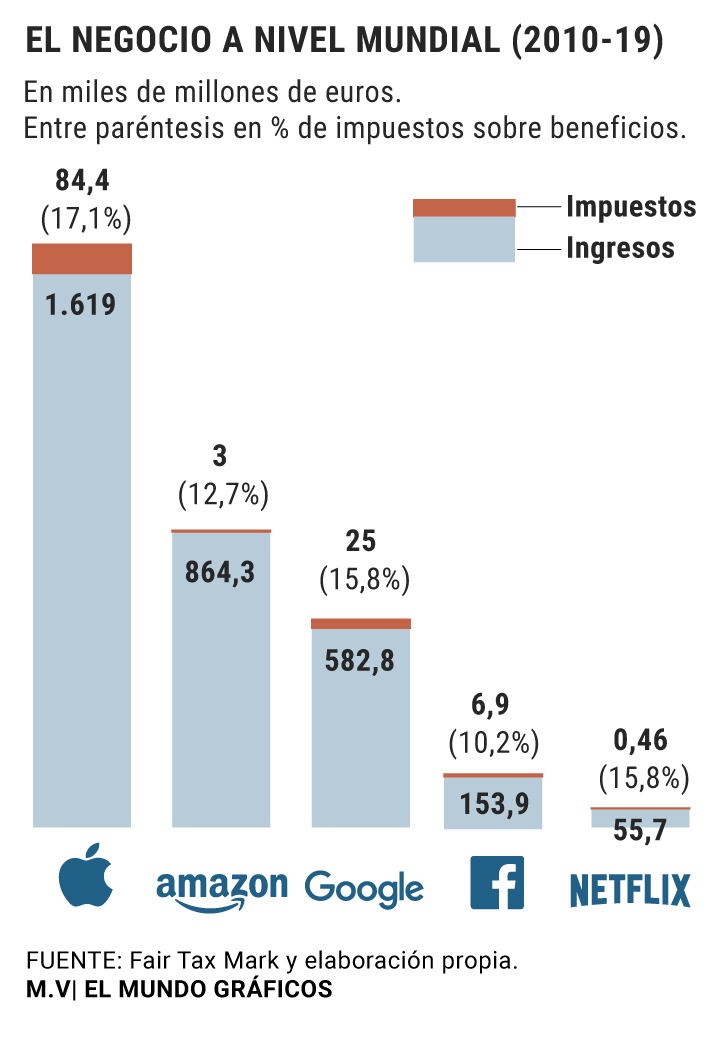

The tax on digital activities is often related to that of companies, since it is outlined as a formula that covers the amounts that large companies in the online sector stop paying by taking advantage of tax breaks in countries such as Holland or Ireland, where they manage to reduce Tax charges at minimum expression. According to a Fair Tax Mark report, there is precisely a gap of more than 90.1 billion euros in the decade between taxes paid for Big Tech calls and those that those companies should have assumed (Amazon, Facebook, Google, Netflix, Apple and Microsoft)

According to the criteria of The Trust Project

Know more- Europe

- Spain

- Ireland

- GDP

- Waterhouse Price

- Spotify

- Sweden

- European Union

- Netflix

- Microsoft

- Maria Jesus Montero

- Holland

- France

- Finland

- Denmark

- economy

- Taxes

- Business

- Pedro Sanchez

Politics Pablo Iglesias promises a guaranteed minimum income and universal

Taxation Agreement in the OECD to negotiate a tax on digital companies

EntrepreneursPlamen Russev, founder of Webit: "Our thunder is already rumbling more than those of Zeus"