In the midst of the crisis in the public pension system and in the face of increasing public doubts about whether it will receive a subsidy after retirement, the bank took advantage of 2019 to relaunch its offer of retirement plans and raise the managed funds by 4.1% . The total amounts to 3.5 billion euros between new deposits and the revaluation of the portfolio in a single year, three times more than the income obtained in the whole of 2018.

The fear of Spanish society not to receive public subsidy after retirement increased considerably in 2019 coinciding with the emptying of the so-called pension piggy bank and the disagreement between the main political formations on the reform required by the system. According to a recent study by BBVA, 86% of respondents are concerned about the sustainability of the system and more than half believe that what they enter will be insufficient to live without problems when their work activity ceases.

In this scenario, financial institutions have seen a growing business opportunity that sustains their income statement just when they need it most, due to the current context of negative interest rates in Europe and the steady decline in their credit portfolios due to atony in The demand for mortgages.

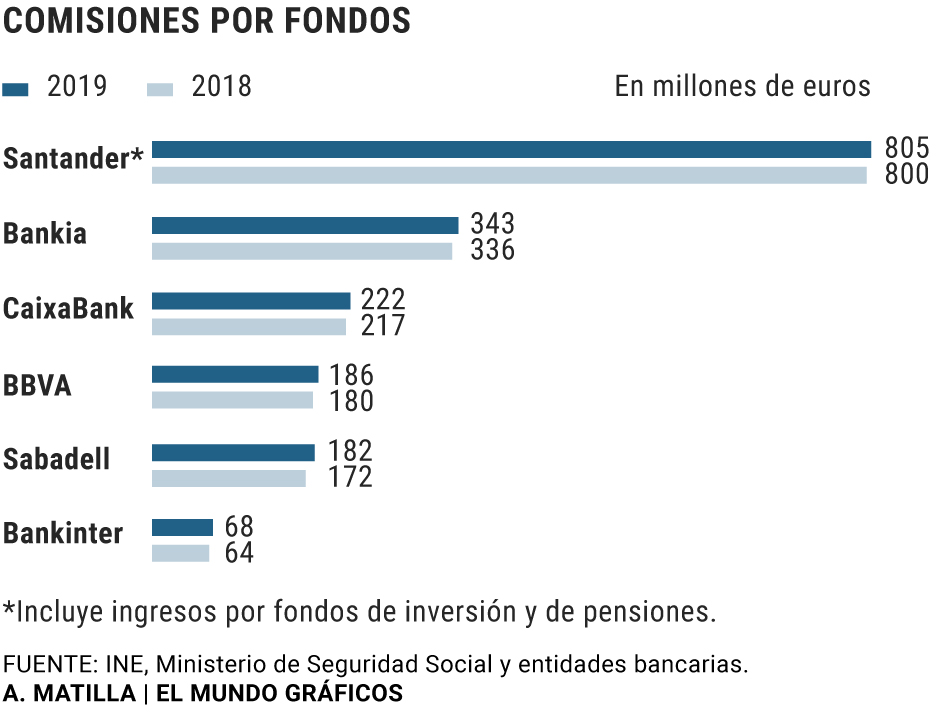

Pension funds constitute a very attractive business for the sector by taking part of their liquidity out of balance and avoiding the cost of their clients' savings due to the negative Euribor rate. For this reason, entities are focusing a large part of their commercial activity on attracting customers in alternative off-balance-sheet businesses such as investment, pension or insurance funds, all of which generate attractive commissions for the entities. In 2019, management revenues of these funds increased by 2% exceeding 1,805 million euros.

The decline of its traditional credit granting activity has unleashed a huge struggle between entities to gain market share in these products. The sector as a whole, led by the banks, registered net subscriptions to pension funds worth 798 million euros in 2019, compared to the net reimbursements of 202 million the previous year, according to Inverco statistics.

All groups managed to raise their assets in managed funds with the sole exception of Sabadell, which reduced its portfolio by 227 million euros with a 6.3% reduction.

The group chaired by Josep Oliú is aware that this has been one of the great weaknesses of his latest income statement and it has been set as a priority objective to reverse this trend in 2020 after his agreement with the manager Amundi.

On the opposite side, BBVA highlighted that it raised its pension fund portfolio by 1,405 million euros, while CaixaBank continues to lead the sector with 33,732 million euros in managed retirement funds.

The hiring of retirement plans was also favored by the improvement of stock markets. The Ibex, to which many of these products are linked, closed the year with a rise of 11.2%. This good trading moment encouraged the purchase of funds linked to equity markets and, on the other hand, placed the average profitability of the year at 8.8%, its historical maximum according to data from the employer Inverco.

On the other hand, banks have also pointed to these products as a way for their clients to avoid hardening the commission policy or achieve savings in contracting other products. In the case of Santander, for example, the signing of a mortgage entails reductions in the interest rate if a pension fund is contracted.

The increase in pension plans occurred despite the uncertainty that hangs over the sector due to the possible changes that the Government can apply to these instruments. Podemos, which forms a coalition in power with the PSOE, contemplated in its program the elimination of the tax benefits included in these plans as reductions on the basis of personal income tax in the contribution and in the rescue. However, this proposal does not appear in the government agreement signed by both coalitions last December.

In fact, all banks agree to highlight in their retirement plan campaigns the potential "tax savings" as a claim for their new clients. However, several entities took advantage of the greater social sensitivity in 2019 for the future pension by reformulating their commercial offer.

The war in the fundraising sector leaves bonuses of up to 5% for the transfer of money from other entities and includes different gifts for opening a retirement plan ranging from Amazon checks to 32-inch televisions.

According to the criteria of The Trust Project

Know more- Europe

- Santander

- We can

- PSOE

Companies Economic and labor uncertainty plunges the confidence of SMEs to their worst level in four years

InterviewJoan Baldoví: "The PSOE has eight months to present another financing model"

EconomySanchez promises in Davos to reduce the deficit with Podemos and slows down the 'Google Rate' after the French fiasco