- Portability.MásMóvil and Digi fat at the expense of Orange, Telefónica and Vodafone

- From January to September.The brake on revenue growth 'telco'

- Deflation. The 'telecos' market, "unsustainable"

- Buy Cellnex's paradoxical boom

Telecommunications close 2019 in a paradoxical stock market scenario. Cellnex, a neutral infrastructure operator, has concluded the year with the best performance of the entire Ibex, almost doubling its value (+ 94%). On the contrary, Telefónica, the sector's leading multinational in Spain, has starred in the fourth most pronounced decline in the selective (-10%). Although the Ibex has advanced 11.8% in 2019, its best year since 2013, the company leads by José María Álvarez-Pallete has not finished taking advantage of that momentum. In Europe, the picture is similar, with the price of telecommunications at the tail of all sectors of economic activity.

Telecos , as explained to EL MUNDO Andrés Aragoneses, an analyst in the Department of content development, products and services at Self Bank, “were already severely punished in the dotcom crisis of the beginning of the century by the market, price levels that in many cases They have not come to overcome again. Business expectations, somewhat flat, do not inspire confidence in an area that has failed to meet the expectations of the investor in recent years despite the rise of mobile telephony ».

«This year has been very complicated for large telephone companies. This is due to the rise of low-cost companies, such as MásMóvil, Yoigo [of the same group] or Digi in Spain (...) As for the terms of recovery, we could see certain rebounds, but in my opinion 2020 will be very similar to 2019, since it is a sector in decline ”, Diego Morín, an analyst at IG Spain, explains to this newspaper.

For the definitive take-off of the Ibex, it is "necessary that both the banking and telephone sectors maintain a certain positive behavior and leave the complicated situation they are in," eToro analysts recently pointed out. However, as financial institutions are conditioned by the negative interest rates endorsed by the European Central Bank - a policy that hinders the profitability of that sector -, telecommunications companies have found that many of their traditional services report some limited income , see the almost null price of a call or text message. Google (Gmail) or Facebook (WhatsApp) communications seem to have won the game.

Telecos also face pharaonic investments, in terms of spectrum as well as infrastructure, unavoidable disbursements for the development of 5G. Folded into the core of their business, operators have been forced to part with assets such as their towers, while other companies manage to strengthen their facilities for the aforementioned deployment of future mobile communications.

Meanwhile, Cellnex dominates the Ibex

That is the case of Cellnex, which announced last Thursday its irruption in the eighth European market, through the purchase of 800 million of the Portuguese Omtel. This last company belonged to the former Portugal Telecom, MEO, which today pays for the use of infrastructure that once was theirs but had to sell, such is the need for telecommunications operators

«Cellnex is a company that has managed to position itself in the market thanks to certain acquisitions, as was the case of Arqiva and the most recent, of Omtel», recalls Morín, of IG: «In addition, the Spanish company has enough margin to finance the buy with the available box, which guarantees a greater potential for growth in the market ». Aragoneses adds from Self Bank that the Cellnex business is "a highly valued asset" and that the company "is not part of the more retail business of other operators that offer fiber or mobile lines, a business branch in the middle of a price war " .

From IG it was recently highlighted how «Telefónica, which traditionally had a great attraction for national investors, has been trying for years to win the market favor without luck and the last changes announced at strategic and organizational level have not impressed much, but at least they seem like a step in the right direction that could pay off in 2020 ».

The multinational has prepared for the future with a reorganization of its divisions, a retreat in the less profitable territories of Latin America and a reconversion of the workforce through a voluntary leave plan. The problem covers the entire Spanish telco market, as is the result of the results of the first nine months of the year: Telefónica, even with its vicissitudes, managed to improve its revenues compared to the same period of the previous year, rather than its rivals Orange and Vodafone failed.

European telecommunications

But this is not a question of the Ibex, which has been strengthened in 2019, but of telecommunications in the region, which are worse in the stock markets throughout the continent. As if that were not enough, the European Commission has been reluctant to authorize any business merger that contributes to the consolidation of that sector in low hours.

«If we combine somewhat flat expectations, an increase in players such as MásMóvil and a high leverage, it can be justified in some part that the operators will be left behind in the stock exchanges in 2019. In fact, if we take into account the classification by sectors of the Stoxx 600 , the telecommunications were in last place , with a revaluation of 0.05%, well below the + 23% that the index was revalued ”, emphasizes Aragoneses from Self Bank.

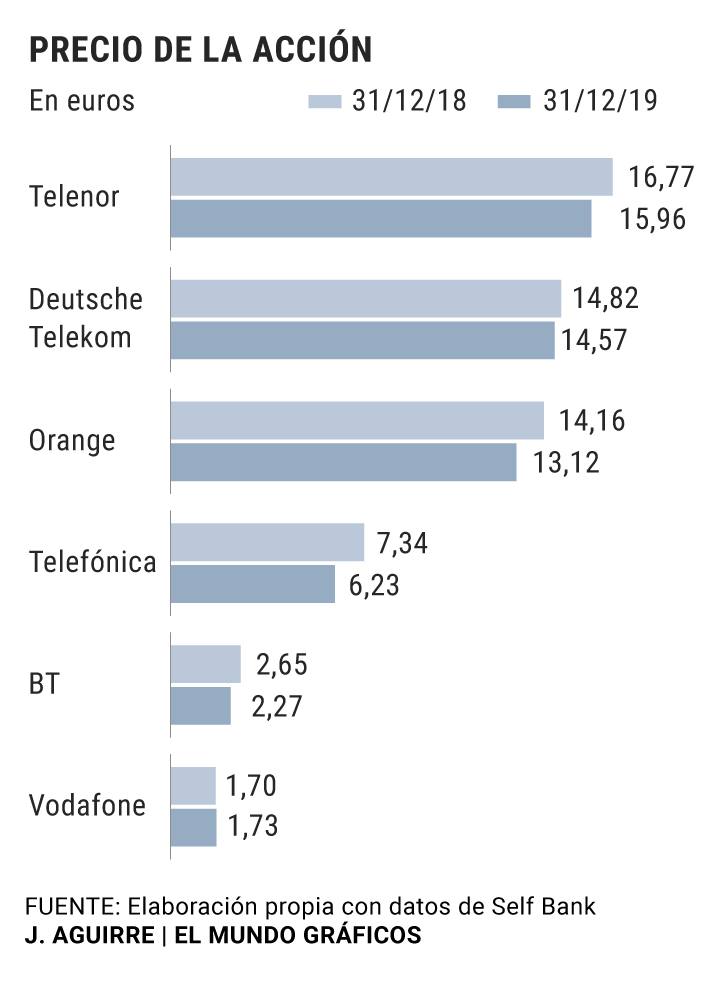

This has been evidenced by the large operators in the region. Deutsche Telekom , incumbent operator in Germany, French Orange , Norwegian giant Telenor , or British groups Vodafone and BT have also reduced their capitalization in 2019. Meanwhile, the two US giants, AT&T and Verizon, have progressed on the stock market this year. , not to mention the homeless revaluation of the great American technology companies.

According to the criteria of The Trust Project

Know more- Telefonica

Telecommunications This is Meinrad Spenger and the Austrian recipe with which he directs MásMóvil

EmpresasMediapro, the producer of Jaume Roures, buys the one from Buenafuente, El Terrat

InterviewRen Zhengfei, founder of Huawei: "The 5G network in Spain will be the best in Europe"