- Study: The rent already eats 40% of the salary of families in Madrid, Catalonia and the Canary Islands

- Limit prices. What is done outside of Spain?

Moderation, stabilization, normalization ... there are several terms that experts use to venture where things will go in 2020 when talking about housing in Spain. After almost a vigorous five years in the market, the next fiscal year presents a key to the transition towards a more adjusted and balanced scenario in which the economic slowdown and the political issue will determine the intensity of the adjustment. It will be, experts say, a year starring the rental, and it will also be an exercise in which the first price drops could begin to be recorded after years of double-digit promotions.

All eyes point to Barcelona ; here the first increases after the real estate crisis of 2008 began to be noticed and this is also where analysts begin to glimpse the first symptoms of exhaustion. Behind her could come more.

"A striking case is that of Catalonia and more specifically that of the city of Barcelona, which is the first region that is beginning to show signs of exhaustion. And in 2017, the rental price was increasing at a rate of almost 20 % began to grow at a slower pace until 1.2% year-on-year growth in February 2018. In the case of Barcelona, since March 2017 the price of rental housing does not grow above 10% and in 2019 , the variations have moved between 1% and 5%. The road of contraction of prices that Catalonia has started, and more specifically Barcelona, we may see it in other cities and communities during 2020, "says Ismael Kardoudi , director of Studies and Training of the real estate portal Fotocasa .

The analysis should not be understood in an alarmist way by the most strenuous or triumphant by the tenants, who have been seeing their incomes grow almost unassumingly for some time.

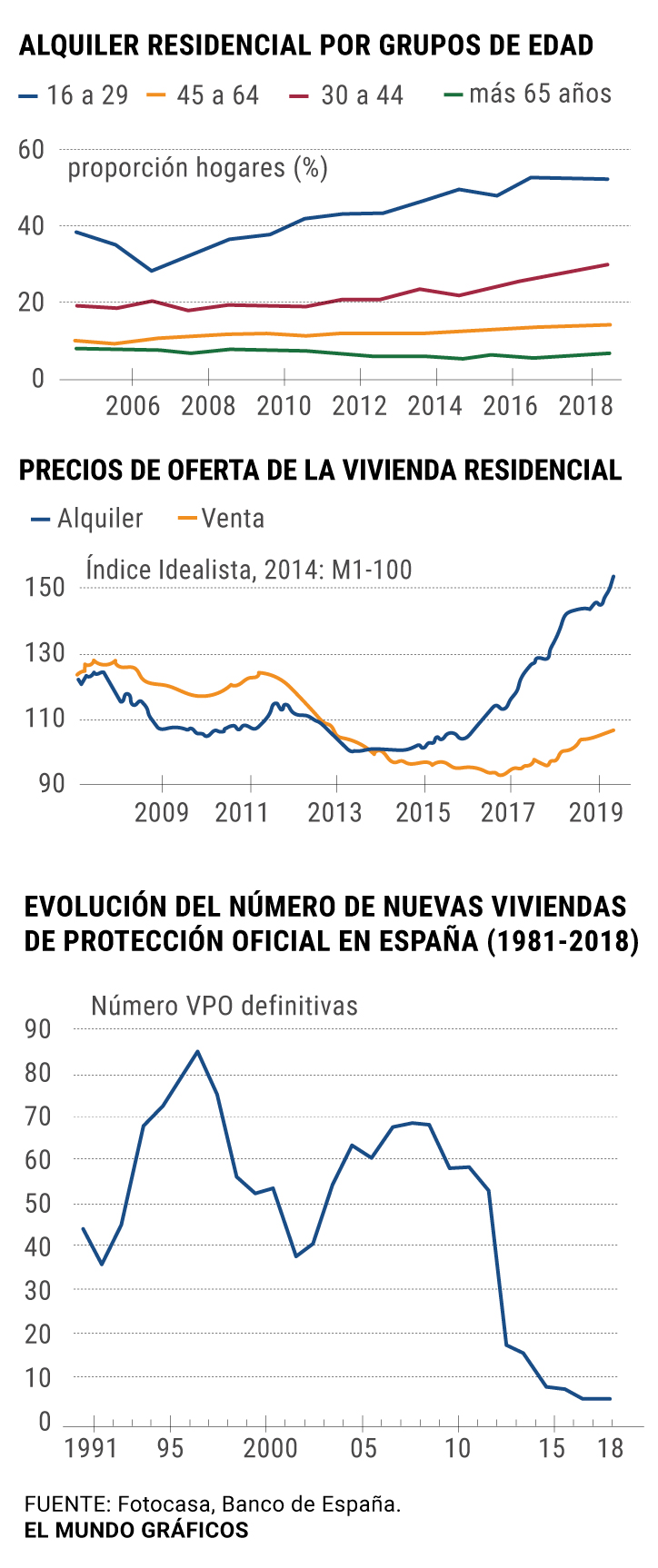

The low salaries, the greater restrictions of the entities to grant mortgage loans or the labor mobility towards the big urban centers have impelled the demand of lease in such a way that the supply has remained scarce. This imbalance has aggravated the problem of accessibility to housing, especially among the youngest, and has also caused a vertiginous rise in prices; in the last five years and according to the data of the Bank of Spain, they have shot 50% on average, although the increases vary and have been greater in cities such as Madrid, Malaga, San Sebastian or Barcelona.

"By 2020 we can estimate, given projections of official and private organizations, growth at a national level of between 2% and 3%, subject to a rational economic and political evolution, both internal and external," replies Samuel Population , director National Residential and Land consulting firm CBRE Spain.

Evolution will not be homogeneous, as it has not been until now. "From Fotocasa we consider that prices, both for sale and for rent, will continue to moderate and that, although it will be done at different speeds, the markets that are already beginning to show signs of exhaustion, such as Catalan, will begin a moderation path. However, tensions will continue in some big cities like Madrid, "says Ismael Kardoudi.

Risks

The evolution of the market, both for rent and for sale, will depend on several factors that have already had an impact in 2019: the foreseeable outcome of Brexit or the global economic slowdown have an international dimension, but there are also relevant risks within our borders.

On the one hand, the end of the digestion of the Mortgage Law , which entered into force last June and has affected the number of purchases and mortgages granted in the final tranche of 2019. Looking ahead to 2020, from Pisos.com they believe that these indicators will recover and reach a certain cruising speed. Specifically, they expect transactions to be around 530,000 purchases at the end of next year, while mortgages could rise 4% compared to 2019, to reach 360,000 loans granted. Regarding visas for new construction, the 120,000 will be exceeded for the first time since 2008, which will increase the residential supply to meet the demand.

The other internal risk is political instability and the formation of the new Government. All actors in the real estate sector agree that the regulatory changes that occurred in 2019 paralyzed part of the market activity and now look with concern and concern at the proposal to limit rental prices.

It is one of the flagship measures of the PSOE and Unidos Podemos Government agreement, although its application in large cities such as Paris has not yielded the expected results so far and despite the fact that experts have long been warning of the possible consequences. "The intervention of the free market by the Administration could discourage the attraction of investors that boost the supply of rent and new construction," acknowledges Samuel Population.

From the Negotiating Agency of the Rental they consider that such measures are "ineffective in solving the needs of access to housing" and could aggravate tensions. "In all the countries where the rental price has been intervened, income has not dropped and high prices have been maintained," explains José Ramón Zurdo , general director of the firm. Lefty also warns that a "black market could be promoted because the owners do not settle for [the lowest income] and go to the underground economy to compensate for economic differences."

Tax guarantees and incentives

But not all are risks in the market. There are also challenges and the main one for the coming months is to increase the supply of available housing, both for sale and for rent. Many companies see it as an opportunity, as with socimis (listed investment companies that focus on the acquisition of assets for rent). In Spain there are 22 firms specialized in the management of residential rental housing and "all have important growth plans for 2020 in a market characterized by the lack of sufficient product. It is expected that a part of that growth will materialize in 2020 through the build to rent , that is, agreements with the main real estate developers for the construction of new housing for rent.This increase in the rental housing stock will help to balance supply and demand in the market and, in this way, to the moderation of prices, "explains Javier Basagoiti, president of the Asocimi association.

"Time and resources" is what it takes to expand the residential park, according to Ismael Kardoudi. "This is an issue that virtually all political parties have collected in their electoral programs. In this sense, the search for synergies with the private sector should be a preferred option."

Also from Altamira they emphasize the need for public-private collaboration. "The challenges for next year will be to adapt production to the demand of each area, the need for financing, both for the acquisition of finalist land from developers and private buyers of new construction, and the lack of labor in construction , which does not contribute to cost reduction, "they comment from the servicer to EL MUNDO .

"Everything goes through an increase of the offer and guarantees to the owners in the markets where this is required," adds Samuel Population, of CBRE.

Legal guarantees and tax incentives are two of the most common recipes among experts to alleviate the gap between supply and demand.

Not forgetting tax incentives . "It is necessary to act immediately on the existing housing that is in private hands and that does not go out to the rental market. To incentivize these owners, the new Government can rely on tax tools (relief for such income, reductions in municipal taxes such as the IBI, etc.) and providing support and security in situations of non-payment or possible damage to the properties ", they collect from Fotocasa.

The rise of 'build to rent'

Spain has been and continues to be and a brick country. The returns offered by the housing market here do not go unnoticed by smallholders - who continue to choose mostly to buy a house when they want to invest their savings - or to large investors. Therefore, more and more companies are raising their commitment to build to rent , that is, build homes to exploit them exclusively on a rental basis.

From promoters and construction companies to socimis (listed investment companies that focus on the acquisition of assets for rent) in recent months have targeted this kind of residential fever .

Javier Basagoiti , president of the Asocimi association (which brings together more than twenty companies in the field) explains where things can go this year. In the Spanish Stock Exchange, 22 socimis specialized in residential housing management are listed and "all have important growth plans for 2020 in a market characterized by a lack of sufficient product. It is expected that a part of that growth will materialize this year through the build to rent , that is, agreements with the main real estate developers for the construction of new housing for rent, "he says.

"This increase in the rental housing stock will help to balance supply and demand in the market and, by that means, to moderate prices," adds Basagoiti.

According to the Build to Rent study published this week by the Appraisal Company together with Urban Data Analytics (uDA), Madrid and Zaragoza are the provinces that present the lowest investment risk when building a promotion to rent it, compared to Asturias and Teruel , which present a high real estate risk.

The type of housing recommended in promotions directed to the rent are houses of approximately 55 meters in the province of Barcelona -where there is a slight real estate risk-; Two bedroom apartments in Seville and the province of Salamanca, where ideally apartments are approximately 120 square meters.

According to the criteria of The Trust Project

Know more- living place

- economy

- Rental

BarcelonaColau opens file of 90,000 euros to Idealista and a realtor for racist discrimination

HousingThe Basque Government reserves 4 out of 10 protected rental housing for young people

Economy The tourist housing business decreases due to greater regulation