The State plans to recover a maximum of 27% of the 58,871 million public money injected directly into the savings banks, according to a new report from the Banking Ordinance Restructuring Fund (Frob). The Frob has made an unprecedented effort of transparency taking stock of ten years of rescue ensuring that it has already recovered 5,917 million and estimating that it can still recover 9,729 million more. The public institution chaired by Jaime Ponce admits that he has not yet recovered one euro from Bankia, but estimates that, in accounting theory, he can still get 9,560 million from this entity and another 169 million . This is a hypothetical accounting value based on the 2018 accounts, because the market value of the Frob's stake in the bank headed by José Ignacio Goirigolzarri is much lower. Just 3.6 billion.

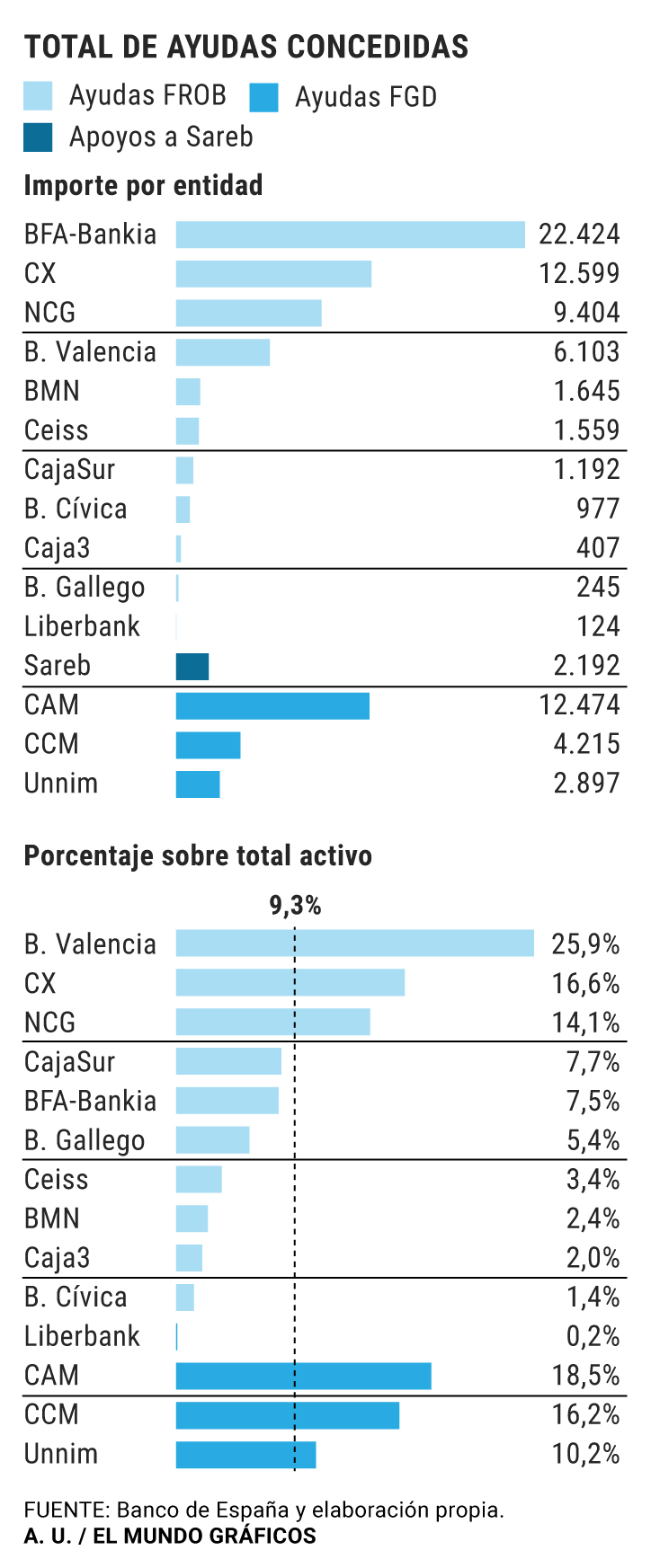

Another fact that the report shows is that, although in absolute figures, Bankia was the entity that received the most public aid to reach 22,424 million, it was only the eighth in the blacklist of the rescue in proportional terms . The effort of the different public aid instruments to cover the hole of Banco de Valencia, the most rescued, and the Savings Bank of the Mediterranean (CAM) was greater. In both cases, the rescue amounted to 25.9% and 18.5% of its assets. It is followed by the Catalunya Caixa (CX) list, which had to cover 16.6% of its balance sheet. In contrast, the aid injected into Bankia accounted for 7.5% of the assets it managed. Even Caja Castilla-la Mancha, with 16.2% doubled the effort required by Bankia, although, where appropriate, like the CAM and the Catalan Unnim savings banks, it was implemented through the Deposit Guarantee Fund and not directly with the Frob, which is 100% state-owned.

The Catalan financial entity that presided over Narcís Serra received 12,599 million euros , NovaCaixaGalicia, 9,404 and Banco de Valencia, 6,103. The three outnumber the bailout in Bankia.

Ponce justifies the publication of the report, according to an official statement, to "describe in a systematic and clear way the performance of the FROB during this decade." He has also pointed out that “his vocation is to bequeathed to the following generations a document that serves as a source to go to to verify two simple ideas: the seriousness of the effects of the banking crises on the whole of society and the essential that it will always be to have the best public institutions to face them » .

The effort made by the State in the rescue of the financial sector reached 38.8% of the deposits that were in Spain a decade ago and entities that had 36.6% of employees, according to the document.

According to the criteria of The Trust Project

Know more- Black Cards

Economy The Bank of Spain increases the bailout to the bank to 65,725 million and gives up another 300 million in Bankia

Courts The Bank of Spain gave Deloitte access to thousands of emails from an opposite witness to the auditor in Bankia

Rescue The Court of Auditors certifies that the Frob has not recovered a single euro of the 22,400 million injected into Bankia