If repealing the 2013 pension reform and shielding the revaluation with the CPI is the workhorse of millions of pensioners, the same does not happen with the reform that preceded it in 2011. In 2020 the isolated effects of this reform will generate in the calculation of the initial pension a reduction of 22 euros compared to 2019, according to estimates from the University of Valencia, one of the most recognized centers in this area. If a longer reference is taken over time and compared to the pre-reform system introduced by José Luis Rodríguez Zapatero, the difference rises to 1,072 euros per year. Not surprisingly, last year one in three new retirees anticipated retirement or sought the formula to benefit from the previous system.

The 22 euros difference in the initial pension of 2020 is basically due to the fact that next year a new stage of the transitional period of implementation of the reform comes into effect, already in its equator. This is the application of the percentages to be attributed to the years quoted for the pension. The casuísitica for the calculation of a pension is very wide depending on the working life or the contribution base, for example, but the isolated effect of the reform for a person who retires in 2020 at 65 years with 35 years of contributions would be those 22 euros compared to 2019 or 6.1% less if 2012 is taken as a reference . The drops reach 10% in the case of early retirement at 63 years.

Law 27/2011 was the last of the Government of José Luis Rodríguez Zapater o. It was published in August of that year but did not take effect until two later. He did it with a series of elements that, according to the latest report on the situation and perspectives of the Security of the Institute of Spanish Actuaries, act as "a machinery" capable of "cutting back the generosity of the system" and doing so with "mute". «It may seem that they will not have an effect on generosity; but they will have it, ”say the actuaries.

The report points out that during the first years of the reform - approved in the crudest part of the crisis - the changes are of a "tenuous" nature and that later they will be deployed in all their breadth, in reference to the amount of the initial pensions of The new retirees. The reform is planned to work in this direction in the 2013-2027 period, when it will be fully in force. It acts on two axes: the retirement age and contribution periods on the one hand and, on the other, new percentages applied to those contribution years.

As for the percentages applied to the years quoted, next year a first cut will be activated and will continue towards a second phase in 2023. With regard to the retirement age, to retire in 2027 with 100% of the pension , may be done at 65 years if 3 years and three months are quoted more than in 2012, that is, 38 and a half years of contribution . For shorter periods, the right to 100% of the benefit goes up two years, up to 67 years of age. In 2020, the transitional period of the reform will reach its equator and the contribution years required to reach 100% will be 37 compared to 35 in 2012.

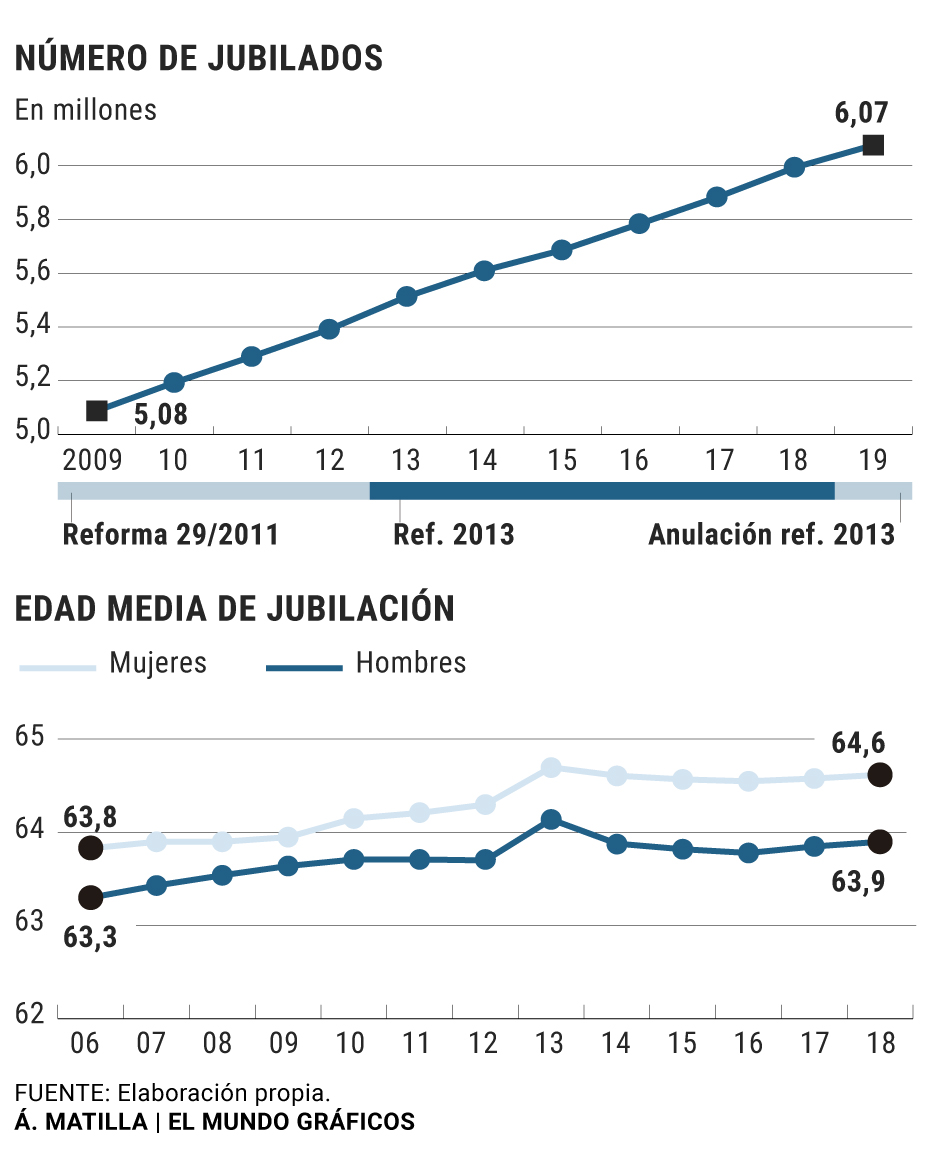

Although when it was approved there were two years of mattress for the entry into force and 16 until its full operation, the effects of the 2011 reform are already visible. It is checked by the pensioners themselves at the time of accessing retirement and seeking the most advantageous benefit. And also Social Security. "The number of pensions that are recognized according to the 2011 legislation is still high," the document explains, adding that due to the changes introduced by the Government through decrees in December last year, the number of people does not fall that fall under the calculation system prior to the reform.

Early retirements escape the system

Until September 2018, 89,641 people agreed to retirement using the exceptions contemplated by the law and avoiding the reform, according to the financial economic report of the draft Social Security budgets of 2019. Virtually half of the early retirements and 19, 1% of ordinary pensions are made in accordance with the previous legislation, which guarantees more generous initial pensions. They account for 36% of the 246,057 that did so in total until the end of the third quarter. The 156,416 retirees who did so with the reformed system to rebuild the financial sustainability of the system obtained worse conditions.

The University of Valencia takes as reference an initial retirement pension of 1,400 euros for a 65-year-old person who is retiring this year with 35 years of contributions with the reformed regulatory framework. A retiree under the same conditions in 2012 would have had an initial pension of 1,468 euros, that is, 68 euros more per month and 952 euros more per year, since 14 payments are collected. With the entry into force in 2020 of one of the elements mentioned by the actuaries, the table of percentages for the calculation of the regulatory base, the difference with the previous system is accentuated and goes to 1,076 euros less. The "machinery" is gradual and will be fully in force in 2027. At that time, an initial pension for a profile such as the one indicated will be up to 2,212 euros lower than it would have been with the system that is still rightfully received, More than a third of retirees.

Pensioners focus their protests on the revaluation of benefits while omitting this system of generosity cuts , perhaps because of the greater visibility of the decision to link them to the CPI and the lower tables of the calculation of the regulatory base of Law 27 / 2011 It is also influenced by the fact that it was proposed by the Government and supported by Congress and social agents. A third reason is that those who receive pensions today are the most sensitive to the generosity of the system and its changes. More than those who are in the quotation phase.

Eight years after its approval, the 2011 reform has cut the generosity of the system in the calculation of its initial pensions, which are higher than in 2012 but could be even more so with the previous parameters. It was a last minute reform. The last one of the Government of José Luis Rodríguez Zapatero before calling elections in July 2011. Imposed by the bodies that supervised the Spanish economy and accepted by social agents, was published in August in the BOE, with higher retirement ages and bases shorter regulators to make the system more sustainable.

According to the criteria of The Trust Project

Know more- José Luis Rodríguez Zapatero

- Social Security

- Pensions

SOCIAL SECURITY The Government plans to raise pension spending by at least 18,000 million with the 'piggy bank' at minimum

Basque Country Pensioners warn the future government: "Neither promises nor delays"

Basque Country5,000 Basque retirees pressure Parliament to push for a law that guarantees pensions