At the beginning of the trading session on the Moscow Exchange on December 2, the dollar rose by 0.18% to 64.4 rubles, and the euro - by 0.2%, to 71 rubles. However, by the middle of the day, the values fell to 64.2 and 70.8 rubles, respectively.

The official exchange rate of the Central Bank on December 3 was 64.41 rubles per dollar and 70.97 rubles per euro.

Until the end of the month, the attention of foreign exchange market players will be riveted to the development of trade relations between the United States and China. About this in an interview with RT said financial analyst at BCS Premier Sergey Deineka.

In October, Washington and Beijing again intensified negotiations to conclude a trade agreement and end the tariff war. In November, US President Donald Trump announced the possibility of signing the first part of the agreement in the near future. Meanwhile, the American president threatened China with a new increase in duties in the event of another failure of the transaction.

Traditionally, during the growth of geopolitical tensions in the world, investors begin to sell risky assets. As noted by Sergey Deineka, such a development of events may put some pressure on the Russian currency. However, even if the trade war intensifies, the ruble will continue to be more attractive than the currencies of developing countries.

“If the decision on the“ first phase ”of the trade transaction is postponed to 2020, and the United States raises tariffs on Chinese goods from December 15, then the currencies of developing countries can end the year on a minor note. At the same time, the ruble compares favorably with risk counterparts due to strong macroeconomic factors of Russia - a large volume of reserves and low public debt, ”the expert noted.

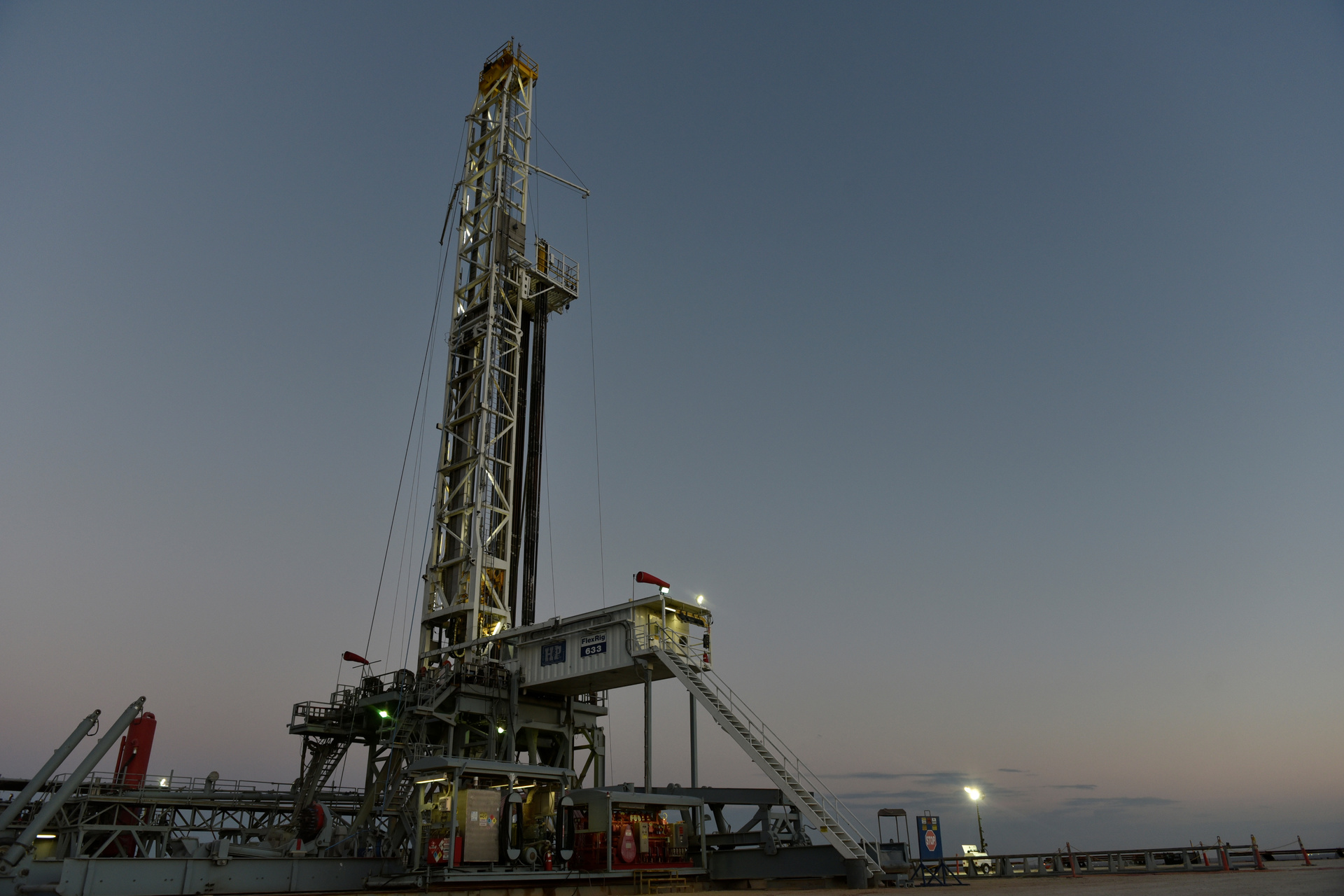

Oil unrest

According to RT analysts surveyed, before the end of the year, the dynamics of the ruble will to some extent also depend on changes in oil prices. In recent days, the cost of energy Brent benchmark brand fluctuates in the range of $ 60-64 per barrel. As expected, the key factor for the quotes will be the outcome of the summit of the countries that signed the OPEC + agreement. The event is scheduled for December 5 in Vienna.

If participants in a deal to freeze oil production decide to further reduce hydrocarbon production, commodity quotes could rise and thereby support the ruble. This was stated in an interview with RT by the chief strategist of UNIVER Capital Dmitry Alexandrov.

“So far, the ruble has supported investors' expectations that the countries participating in the OPEC + agreement will reduce oil production by 400 thousand barrels per day,” the expert noted.

At the same time, Aleksandrov admits a decrease in oil prices in the event of worsening relations between China and the United States. If Washington is unable to agree with Beijing, the trade war will intensify, and global demand for energy raw materials will decrease markedly. According to the analyst, such a development can weaken the national currency.

- Reuters

- © Nick Oxford

At the same time, the influence of commodity quotes on the ruble will be limited by the budget rule, which stipulates that during the rise in oil prices the Ministry of Finance buys foreign currency and thereby puts pressure on the ruble. Moreover, in the event of a collapse in the energy market, the ministry ceases operations - and pressure on the ruble weakens. As a result of such actions, the dependence of the national currency on oil prices is reduced.

Recently, the effect of the fiscal rule has already weakened the relationship between the ruble and oil, so players in the foreign exchange market have become less likely to react to changes in commodity prices. This was stated in an interview with RT by the head of the CAFT analyst group Mark Goichmann.

“The ruble is dependent on oil prices, but to a lesser extent than in previous years. For example, in recent days, oil has fallen in price by 3.5%, and the ruble against the dollar - only by 0.8%, ”said Goikhman.

Seasonal fluctuations

In general, before the end of the year, the ruble will be supported by a record inflow of investments in Russian debt securities. According to the Central Bank, since the beginning of 2019, the total volume of the federal loan bond market (OFZ) has increased by almost 1.53 trillion rubles and for the first time since the observation amounted to 8.86 trillion. At the same time, the amount of foreign investments increased by more than 1 trillion rubles and also reached a historic maximum of 2.84 trillion. In general, foreign investors account for almost a third (32%) of all OFZ purchases.

“The interest of foreign investors in government bonds, which give higher returns than developed markets, remains a positive driver for the ruble, along with a budget surplus, growing international reserves and a declining external debt of Russia,” said Mark Goikhman.

However, in December seasonal factors may affect the ruble. According to Goikhman, the demand for foreign currency has traditionally increased in Russia in the last month of the year, and the ruble is starting to weaken.

“The growing demand for foreign currency is associated with New Year’s imports and Russian travel abroad. In addition, in previous months there were delays in spending budget funds on national projects launched in 2019. Therefore, in December, larger-scale financing of national goals is planned, which will increase the supply of rubles in the market and lower the national currency rate, ”the expert noted.

In addition, pressure on the ruble may be exerted by payments of Russia on foreign debt. According to Dmitry Alexandrov, at the end of the year, financial authorities sell rubles and buy foreign currency on them to fulfill the country's obligations.

However, the experts surveyed do not expect sharp fluctuations in the national currency in December. According to Sergei Deineka, over the next month, the dollar will remain in the range of 64.5–66 rubles, and the euro - near 71–72 rubles. A similar assessment is shared by Mark Goichmann.

“It can be assumed that although December will be a month of ruble depreciation, this dynamics will not be exceptionally strong. The maximum level for the dollar will be the border of 65-66 rubles, ”concluded Goikhman.