Telefónica takes air in the stock market. On Wednesday, José María Álvarez-Pallete announced an action plan to drastically reorganize the Spanish multinational. "We feel that there is a model that has been exhausted. This generates a five or ten year value, although we do not know how the market will react in the short term," the company's chief executive acknowledged the measure. Yesterday, the answer was known: Telefónica improved 1.17%, by starring in one of the biggest increases in the Ibex during the session.

The company has retreated in Latin America, to the point of splitting a segregated company open to investors for that area, and will focus on the markets of Spain, Germany, the United Kingdom and Brazil, as part of a deep remodeling that is completed with the creation of a technological unit (Telefónica Tech) and another for infrastructure (Telefónica Infra).

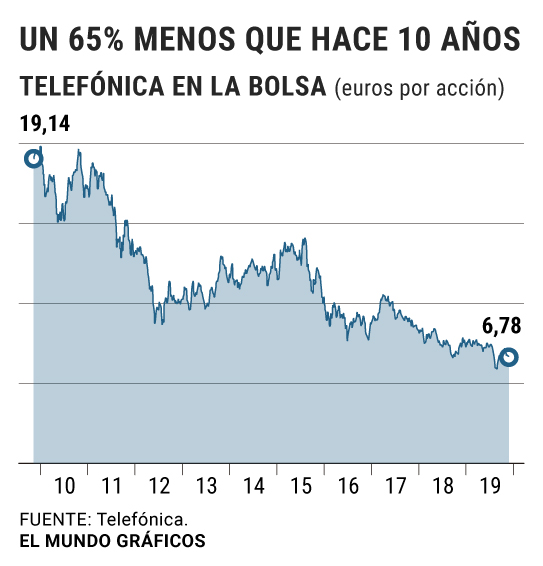

The telecommunications company has made this decision at a time of stock market failures, beyond the importance for the business for the future. Telefónica's share has lost two thirds of its value (more than 65%) in the last 10 years , with a minimum last August, when the title fell below 6 euros, something that had not happened in 22 years, although that is why the shareholder has not been paid with dividends. Yesterday, the reception in the parquet was dominated by optimism.

Need for a revulsive

" A change was very much needed , due to the decrease in the share price," Bank of America said yesterday in its analysis of the reorganization. "Although we applaud the company's long-term vision and social responsibility, its short-term share price is more exposed to growing competition and exposure in three of four of the nuclear markets," he warned. According to Bank of America, "Telefónica is under competitive pressure in its operations for Spain, the United Kingdom and Germany" and "obvious strategic movements" are not distinguished to further reduce costs or investments in capital goods (capex), which are fundamental in the telecommunications sector.

In Credit Suisse, they stated that the reconfiguration will "soften several sources of concern among Telefónica's investors, such as its high indebtedness, its complex structure and lack of growth," common to the telco sector throughout the continent.

"The proposal does not imply any draft revolution with respect to what has been pointed out in recent months, investors do reward today [for yesterday] the company's intentions to segregate those markets in which the growth potential of their traditional business Voice and data has been significantly reduced in recent years, "said IG analysts. In their opinion, "the decision to establish a firewall between these less mature markets and those on which the heart of the business" of the company "is based seems right in the eyes of the market."

According to the criteria of The Trust Project

Know more- Spain

- United Kingdom

- Germany

- Brazil

- José María Álvarez-Pallete

- economy

Telecommunications Telephony: 40,000 casualties in the company since 2000

CompaniesBotín signs investment banker Luis Isasi to preside over Santander Spain

International The United Kingdom of Brexit is the European country that invests most in Spain