There are only 40 days left until 2019 to end, and although it may seem impossible to undertake any savings project, according to the recommendations of the Technicians of the Ministry of Finance (Gestha) it is just this final stretch of the year the "ideal time" to plan the declaration of the rent and save up to 4,300 euros.

But in this plan there are those who start with an advantage, for taxpayers with higher incomes and assets , the savings would scale up to almost 60,000 euros for those who receive income over 600,000 a year. While people with annual returns below 21,000 euros may lower their bill by about 1,600 euros.

So what can be done to pay less to the Treasury before the end of the year? Here are some tax tips to implement:

Pension plan

In the last months of the year, contributions to pension plans should be made, although the limit amount was reduced from 10,000 to 8,000 euros, provided that it does not exceed 30% of income from work and economic activities.

In any case, the tax advantage is reflected in the general basis of the tax, not the savings. It is advisable to invest another 6,234 euros on average to reach the limit of these contributions guarantees an additional tax saving of about 1,870 euros on average, varying this additional savings according to income and the autonomous community of residence.

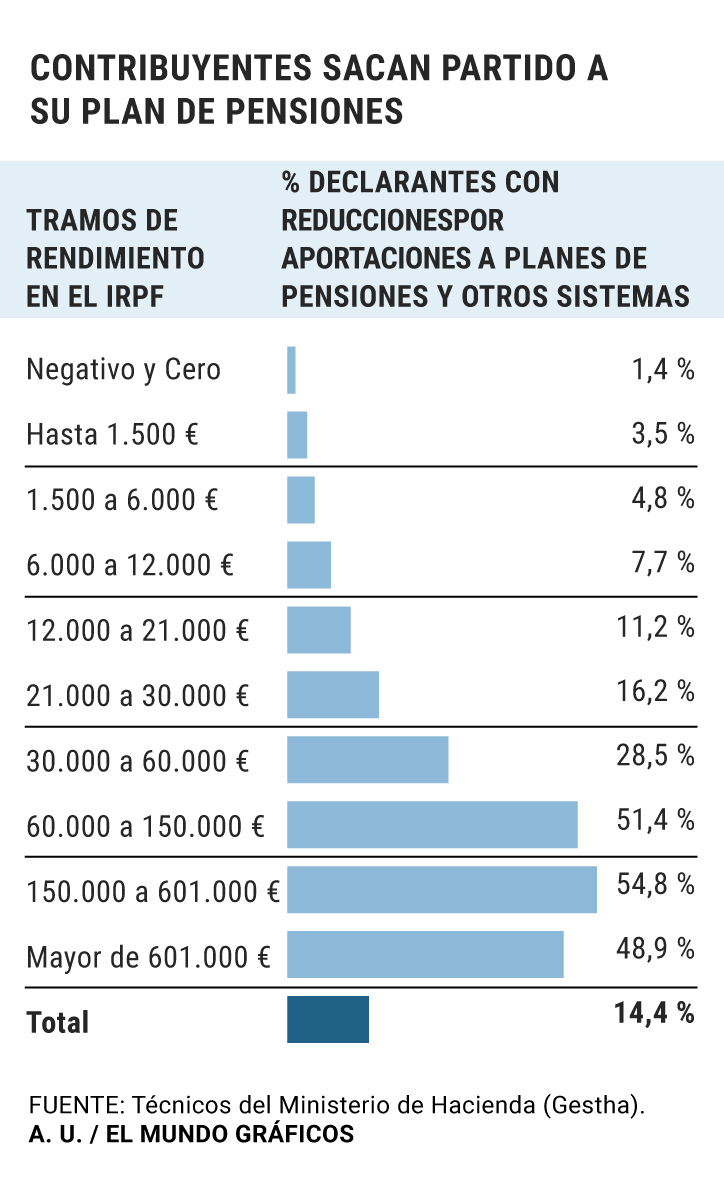

The IRPF statistics show that this advantage is used, especially, by taxpayers who enter more than 60,000 euros, which represent 3.9% of the total, whose savings account for 45% of the contribution to the Pension Plan.

If you bought a home

Those who bought their usual home or made any payment for its construction before January 1, 2013 will continue to enjoy their right to relief, provided they have had deductions for that home in 2012 or previous years.

In this way, these taxpayers can deduct up to 15% of the amounts invested, with an investment limit of 9,040 euros. Given this ceiling, it may be interesting to make an additional payment - of 4,753 euros on average - to amortize the mortgage before the end of the year to reduce the tax bill by 713 euros. Of course, there are exceptions such as Navarra or the Basque Country, which has its own personal income tax.

In the case of young people up to 30 years and large families 23% with the maximum limit of 1,955 euros (25% in municipalities of Álava with less than 4,000 inhabitants with a limit of 2,346 euros).

If you sold it

For those who sold their house this year, the profits obtained will be taxed in the next income statement, depending on their amount, between 19% and 23%, in the Provinces of the Basque Country between 20% and 25%, and in Navarra between 20% and 26%. However, if the amount is totally or partially reinvested in another habitual dwelling, it will be possible to neutralize this payment.

Over 65 years

The profits obtained by the sale of the habitual residence the citizens over 65 years or by severe dependents or of big dependents are exempt.

In Navarra, the exemption of the profit is conditioned to the fact that its disposition serves to assist the economic needs of old age and dependency, and in the Basque Country it is limited only to those over 65 for the first 400,000 euros of profit. And in these last territorial territories for a single transmission.

Compensate losses with profits

Being a stock market investor can not only bring profits, but also handicaps. Therefore, the end of the year is a good time to make accounts and compensate the losses generated by an investment fund, shares or financial derivatives with the capital gains obtained.

Plan the sale of shares

Although not all taxpayers are obliged to declare, since they have work income lower than some amounts, it is also required not to exceed certain limits of income other than work, such as: Full income from movable capital and capital gains subject to withholding, with the joint limit of 1,600 euros per year.

If you work abroad

The yields that have been obtained by the works carried out for companies based abroad are exempt from taxation with a maximum limit of 60,100 euros per year, which is reduced to 30,000 euros in Navarra.

This exemption may only be applied in the territory in which the work is carried out, a tax of an identical or analogous nature to that of the personal income tax is applied and it is not a country or territory legally classified as a tax haven. In addition, this exemption is only for temporary displacements, since if the taxpayer is resident in another country, he would no longer be taxed in Spain.

For solidarity

Union dues and expenses of up to 300 euros in legal defense against the employer, as well as those of professional associations on a mandatory basis (these also Navarra with a limit of 500 euros) are entitled to reduction or deduction.

It is also possible to deduct 10% for donations to other foundations and associations declared of public utility not covered by Law 49/2002 .

The technicians also highlight that there is ample margin to increase donations, an average of 2,035 euros allows an additional deduction of 678 euros, singularly "interesting" for those who earn more than 600,000 euros that could increase their donations by 48,902 euros.

Attention, Entrepreneurs

Good news for the entrepreneur's third grade friends and family as they receive a tax reward.

The IRPF law established from September 29, 2013 an incentive in favor of business angels or people interested in contributing capital to start an activity.

The deduction is 30% in the state IRPF share of the investment made when subscribing the shares or shares of the company, being the maximum basis of the deduction of 60,000 euros per year.

According to the criteria of The Trust Project

Know more- Personal income tax

- Navarre

- Basque Country

- Alava

- Spain

Meteorology The worst storm of autumn comes with 37 provinces warned by snow, wind, waves or rain

Basque CountryThe judge leaves EA without leadership by suspending Eba Blanco's election for ignoring the Guarantees Commission

10-N The new victory of the PNV aggravates the crisis of the Basque PP